Challenges faced by international monetary fund (IMF) and the ways of dealing with them

Abstract

The International Monetary Fund (IMF) as one of the leading global financial organisations that deals with the issues of securing financial stability, facilitation of international trade, promoting economic growth in a sustainable manner, and poverty reduction in a global scale.

There are mixed opinions about the role and performance of organisation in dealing with these issues. Some people perceive IMF to be an important organisation making valuable contribution to macroeconomic stability, whereas others blame the organisation for financial problems within specific countries and areas.

Nevertheless, nowadays IMF has to deal with a set of complex challenges in local and global scales. This paper attempts to critically evaluate a set of issues directly related to IMF performance. The paper has identified major challenges faced by IMF to include its governance structure, increasing level of politicisation, leadership challenges, performance evaluation difficulties, and dealing with social instability.

займы срочные в день обращения

Moreover, necessary changes have been proposed for IMF that should assist in dealing with the challenges the organisation is facing. These changes include reforming IMF governance, gaining focus on role and objectives, developing performance accountability frameworks, improving lending policy, and increasing the level of comprehensiveness in country analysis.

1. Introduction

The International Monetary Fund (IMF) is “an organization of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world” (About IMF, 2016).

IMF was set up during Bretton Woods Agreements in 1944 with only 44 countries and it is governed by a Managing Director and Chairman of the Executive Board, currently Christine Lagarde, who is assisted by the First Deputy and three other Deputy Managing Directors. The Articles of Agreement of IMF state that the Managing Director “shall be chief of the operating staff of the Fund and shall conduct, under the direction of the Executive Board, the ordinary business of the Fund.

Subject to the general control of the Executive Board, he shall be responsible for the organization, appointment, and dismissal of the staff of the Fund” (Management, 2016).

Today IMF is faced with a set of significant challenges at various levels that are partially caused by the increasing forces of globalisation, recent global economic crisis, increasing level of uncertainty in the global economy, emergence of new economic superpowers from East and a range of other reasons.

This paper analyses a range of issues related to IMF performance in short-term and long-term perspectives. Specifically, the current major challenges faced by IMF are discussed and the ways of dealing with these challenges are proposed.

2. Challenges Faced by IMF

IMF with its complex structure and wide range of aims and objectives faces a set of substantial challenges in various fronts that need to be addressed in a timely manner. The major challenges faced by IMF include its governance structure, increasing level of politicisation, leadership challenges, performance evaluation difficulties, and dealing with social instability. Detailed discussions of each of these challenges are provided further below.

2.1 Governance Structure

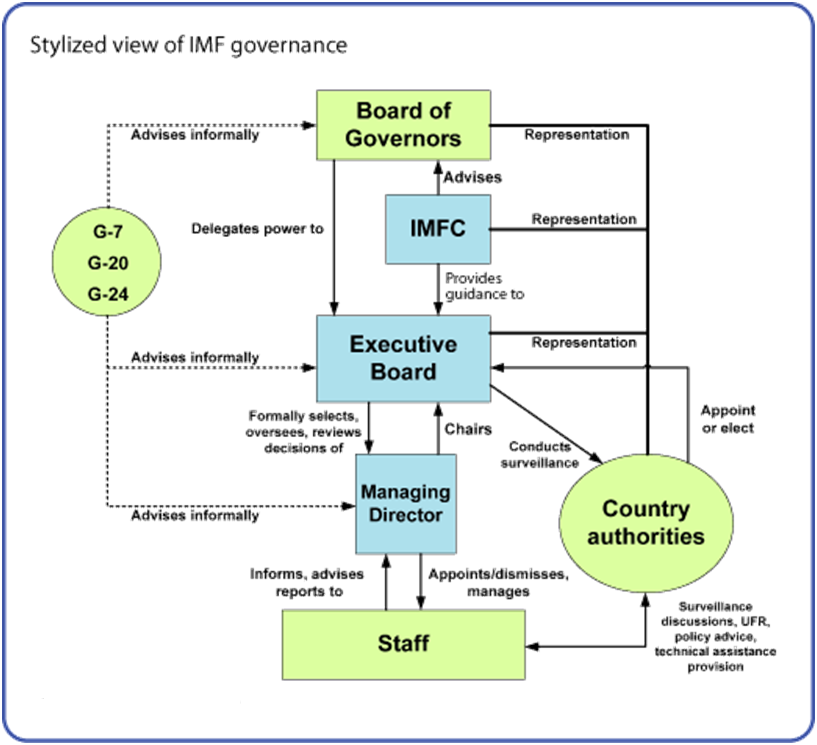

A major challenge faced by IMF is directly related to governance of the organisation in practical levels. It has been argued that international organisations such as IMF “face the problem of ‘multiple principals’ to a much larger extent than public and private enterprises. They are controlled by many governments – governments that often do not agree on what the organisation should do” (Martinez-Diaz and Lamdany, 2009, p.2).

In other words, there are often disagreements amongst governments in control of IMF in terms of the aims and objectives to be achieved by IMF and the manner in which they need to be achieved and this halts the performance of the organisation to a great extent.

IMF Governance Structure

Source: Martinez-Diaz (2008)

The major downsizes associated with IMF governance structure can be best evaluated by referring to four dimensions: effectiveness, efficiency, accountability, and voice (IEO, 2008).

2.1.1 Effectiveness

Effectiveness relates to IMF governance capacity for formulating appropriate aims and objectives and achieving them in a timely and effective manner. There are mixed opinions about the effectiveness of ‘fire fighter’ informal governance approach adopted by IMF management when a crisis occurs. Specifically, this approach involves a small network of G7 government senior officials to be formulating strategies to deal with the crisis in a private atmosphere (Caselli, 2012).

On one hand, the ‘fire fighter’ informal governance approach as been praised for the ability to deal with systematic crises in a timely and flexible manner. On the other hand, the main issues associated with this informal governance approach include the lack of transparency and difficulties associated with the allocation of responsibility for the results of the decision.

Nevertheless, it can be argued the disadvantages associated with this approach outweighs its benefits, therefore this approach to problem-solving is ought to be improved.

Moreover, is it is seen from the illustration above, the division of responsibilities between the Board, Management, and International Monetary and Financial Committee (IMFC) is not clear and these overlaps create substantial challenges in effective facilitation of IMF governance.

Disproportionately great influence of some powerful members of IMF, namely USA and Europe is an additional point of criticism for negatively impacting IMF effectiveness (Birdsall, 2012). The main rationale behind this specific criticism relates to the prevailing interest of these specific members above the core IMF aims and objectives.

Critics also point to IMF ineffective growth forecasts and their implications on the state of the global economy. Specifically, Financial Time’s Mackenzie (2012) convincingly argues that IMF global growth forecasts issued in autumn 2012 is based on a set of risky assumptions about China’s projected growth rate of 8.25 per cent in 2013, and Mackenzie (2012) specifies this fact as a key risk to the authenticity of IMF global forecast.

2.1.2 Efficiency

Efficiency involves IMF governance cost considerations and expenses management. This aspect of IMF governance has also been subjected to criticism and discontent among some country members and the public at large. According to estimations, “in 2007, the total Board budget was $59 million (73 million when including the budget for the Secretary’s Department). Between 1998 and 2006, the costs of running the Board oscillated between 5.9 and 6.4 per cent for the IMF net administrative figure” (IEO, 2008).

Critics argue that the current level of IMF performance can be maintained with fewer costs and they point to cost-saving potentials associated with the organisation of Board meetings, as well as, regular meetings involving member countries (Copelovitch, 2010).

2.1.3 Accountability

Accountability relates to the possibility for IMF shareholders and other stakeholders to judge the extent to which organisation’s aims and objectives are being achieved and accordingly set rewards, or punishments (IEO, 2008). The level and quality of accountability within IMF can be specified as one of the poorest aspects of organisational performance.

Concrete standards do not exist that could be used to evaluate IMF performance, and held the organisation accountable for its actions by members and other stakeholders. The challenges associated with IMF accountability partially arise from overlapping responsibilities of the Board and the Management.

2.1.4 Voice

Voice relates to IMF members’ ability to get their view to be taken into account during the decision-making. This specific aspect of IMF governance is found to be weak for a range of reasons that include the large size of multicountry constituencies within the Board, and ineffectiveness of current quota voting system (Dicken, 2010).

Furthermore, according to the survey conducted by Center for Global Development (CGD) involving 790 responses from 81 nations the current voting system has been disliked by 80 per cent of respondents in favour of more open voting process, and these finding signals about the need for the change in the system (Birdsall, 2011)

It is important to mention that acknowledging difficulties associated with IMF traditional governance structure wide-ranging governance reforms have been initiated in 2010 with the aims of granting adequate level of influence to smaller developing countries and to reflect the increasing importance of newly emerging market economies.

2.2 Increasing Level of Politicisation

Increasing level of politicisation of IMF can be specified as an additional issue that is proving to be obstruction in achievement of core aims and objectives of the organisation. It has been argued that “IMF lending is not a technocratic process; rather, the Fund is a highly political institution whose policies depend on the interests of not only its largest shareholders but also its bureaucrats, both of whom exercise partial incomplete control over IMF policymaking” (Copelovich, 2010, p.6).

To put it simply, rather than dealing with its aims and objectives in a direct and timely manner, IMF is being hostage to bureaucracy and geopolitical ambitions of specific countries.

The USA is considered to be the most powerful member of IMF with exclusive privileges that include powerful institutional linkages between the IMF, US Treasury Department and Congress, the ability to veto IMF decisions and modify its budget and quota (Breen, 2008), and there is a popular viewpoint that this position is taken advantage of by US government for political purposes.

Moreover, high level of politicisation of IMF is proving to have detrimental impact on the organisational image of IMF, especially amongst developing countries and newly emerging economic superpowers.

2.3 Leadership Challenges

According to Dunaway (2011) a substantial challenge faced by IMF Managing Director is to be decisive and courageous in terms of facing European leaders and communicating to them the current state of global economic situation and policy changes and other measures that need to be implemented in order to deal with these issues.

A recent article in Financial Times shifts attention to this issue by arguing that IMF has “challenged Berlin’s game plan for pulling the eurozone out of its crisis by advocating a series of short-term fixes that the German government has resisted” (Spiegel and Barker, 2012). Specifically, stance taken by IMF chief, Christine Lagarde has been praised for being courageous to challenge German chancellor Angela Merkel advocating the use of eurozone’s 500 billion EURO bailout fund to recapitalise banks directly rather than doing it through corresponding governments.

Nevertheless, the leadership challenge is greater for the current IMF Managing Director Christine Lagarde due the numerous scandals associated with the former head of organisation Dominique Strauss-Kahn. Specifically, Mr. Strauss-Kahn has been forced to quit as the head of the IMF after he was accused of rape attempt of a chambermaid at a New York hotel (Allen, 2012). Although this specific case against Strauss-Kahn has been subsequently suspended, additional accusations of similar nature emerged with negative implications on the image of IMF in general, and the bargaining power of the next Managing Director in dealing with heads of member states.

2.4 Performance Evaluation Difficulties

Another difficulty associated with IMF can be specified as challenges of evaluating its performance (Carbaugh, 2010). In other words, IMF aims to achieve a wide range of aims and objectives such as promoting international monetary cooperation and exchange stability, facilitating the expansion and balanced growth of international trade etc. and measuring IMF performance in contributing to the achievement of such a variety of aims presents substantial challenges in practical levels.

IMF established Independent Evaluation Office (IEO) in July 2001 and the office issues regular reports evaluating various aspects of IMF performance in an occasional manner. The most popular reports issued by IEO include Governance of the IMF: An Evaluation (2008) and IMF Performance in the Run-UP to the Financial and Economic Crisis: IMF Surveillance in 2004-07 (2011).

IEO conducts its evaluations on the basis of multiple surveys involving organisation’s governing documents, its historical record, and surveys involving monetary and fiscal authorities of member countries, members of Board, IMF senior level management, and external specialists (IEO, 2012).

However, although IEO is being positioned as ‘independent’ there is a great deal of doubt about the quality and the level of objectivity of IEO performance evaluations of IMF, taking into account that this evaluation office is governed and financed directly by IMF.

Therefore, due to the absence of specific set of performance criteria agreed by IMF stakeholders in general, members in particular, IMF performance evaluation in an objective manner remains a considerable challenge yet to be addressed.

2.5 Dealing with Social Instability

Justifiably the issue of global social instability has been specified as one of the most complex challenges faced by IMF by its Managing Director Christine Lagarde. This challenge relates to political upheavals in the Middle East and North Africa partially resulted by socially imbalanced growth. The negative impact of political situation and a range of other forces on the state of deteriorating national economies in these regions create additional challenges for IMF.

Moreover, it is important to note that, both, developing, as well as, highly developed economies is experiencing the issues of social instability. In developing countries these issues are expressed in the forms of increasing prices for commodity and high levels of unemployment, whereas developed countries are experiencing the issues of rising level of joblessness among young people and the difficulties associated with the protection of health and pension benefits amongst older people (Lagarde, 2011).

Thus, today IMF is faced with a complex task of securing financial stability, promoting high employment and sustainable economic growth amid harsh economic realties and uncertainties.

Furthermore, there is a growing among of discontent among IMF member countries in relation to huge financial resources the organisation has lent to the euro zone. This is mainly caused by spiralling debt issues in Greece and IMF’s role in dealing with the issue. According to Wall Street Journal despite the repeated pledges of IMF to European countries to ease the Greek debt burden “the German government has said repeatedly in recent weeks that it expects Greece to uphold the program it agreed to in early 2012 and that no extra German financial aid will be made available” (Dalton, 2012).

Therefore, IMF management is placed in a difficult position of having to accomplish its duties effectively, at the same time when acknowledging and addressing the concerns of all of member countries of the organisation.

3. Ways of dealing with IMF Challenges

The challenges faced by IMF specified above can be effectively dealt with by introducing a range of strategy modifications and improvements. One of the recent measures proposed in this regard by IMF Management relate to doubling the organisation’s lending power so that IMF would be better positioned to deal with threats to macro-economic stability. Commitments made by major member countries for the doubling of IMF fund include Japan contributing $60 billion, South Korea and UK contributing $15 billion each, and Sweden contributing $10 billion (IMF, 2016).

However, it is important to understand that the scope and scale of challenges faced by IMF cannot be dealt with only financial measures and more institutional and systematic changes are required. These necessary changes include but not limited to reforming IMF governance, gaining focus on role and objectives, developing performance accountability frameworks, improving lending policy, and increasing the level of comprehensiveness in country analysis.

3.1 Reforming IMF Governance

As it has been discussed above the current pattern of IMF governance based on quotas is associated with a set of significant inefficiencies. Namely, currently a country quota of an IMF member is used as the primary guidance to identify the level of its financial commitment to the organisation, the extent of its voting power on IMF decisions, and the level of bearing to the organisation’s financing.

The main issue associated with this approach include short-changing developing economies within the scope of IMF despite their growing impact and significance for global economic stability (Ahern and Fergusson, 2010).

Some reforms have been initiated during the 14th General Review of Quotas by IMF starting from 2010 that include doubling quotas, transfer of quota shares of more than 6 per cent from over-represented member countries to under-represented member countries, and allocation of more than 6 per cent of quota shares to rapidly emerging and developing market countries (IMF Quotas, 2012).

However the extent of these reforms is not sufficient enough in order to allow IMF to face the challenges of modern global economy in an appropriate manner. Specifically, even greater attention needs to be paid by IMF to newly emerging superpowers such as China, India, Brazil, and Turkey in terms of having their views counted in short-term and long-term decision-making.

To confirm this viewpoint “previous G24 analysis has shown that a population-based formula and increasing basic votes are effective ways of giving developing countries fairer representation” (Griffiths, 2010).

Neglecting this recommendation can have highly negative implications to IMF and compromise the level of its authority and popularity in the global arena. In other words, becoming more discontent with the role and performance of IMF and perceiving it to be a mere political tool for USA and European countries, newly emerging superpowers from Asian continent may decide to form an alternative international financial organisation that would threaten IMF influence and capabilities.

Spiralling national debt in the USA and deepening economic problems within the EU enhance the likelihood of this scenario if IMF refuses to accept increasing profile of newly emerging superpowers.

3.2 Gaining Focus on Role and Objectives

Consensus needs to be achieved amongst countries in terms of specifying role, and formulating specific aims and objectives for IMF in the twenty first century. Interestingly, it has been proposed that “IMF should not focus primarily on its low-income members and the challenges of global poverty. It should not focus exclusively on international financial crises affecting a small group of vulnerable emerging-market economies. Instead, it must be engaged with each of its members on the full range of their economic and financial policies” (Truman, 2006, p.1).

At the same time, there is an alternative viewpoint according to which “in an increasingly integrated world economy, the distribution of power within the Fund must adapt to reflect the growing weight of developing and emerging market countries in order to make the Fund more effective as an institution” (Kelkar et al., 2005, p.50).

Nevertheless, IMF role in the global economy needs to be clarified and its aims and objectives need to be formulated according to the SMART principle, where the abbreviation stands for specific, measurable, achievable, realistic and timely.

Moreover, the current overlap in roles and responsibilities of Board, Management, and IMFC has to be minimised to a great extent so that the achievement of aims and objectives can be facilitated in an efficient manner.

Additional advantages to be gained by specifying role, and formulating specific aims and objectives for IMF relates to the overall improvement of organisational image. Due to the not clearly specified aims and objectives of IMF, and worse due to the failure of the organisation to effectively communicate its aims and objectives the organisation is perceived as negative force by population of some developing countries and its impact on the country is being assessed as negative in a highly subjective and irrational manner.

Concentrating the attention on specifying role, and formulating specific aims and objectives for IMF, on the other hand, is going to have positive implications in terms of communicating its values and purposes for worldwide population, so that the organisation can protect itself from unjustified criticism.

Surprisingly, the official website of IMF contains no vision and mission statement that could be used as a general guidance for the organisation and this can be specified as a serious flaw. IMF management need to address this issue by formulating the organisation’s vision and mission statement based on specific values and the management has also to ensure that these values are shared by each employee working for IMF, and they need to be effectively communicated to organisational stakeholders as well.

Furthermore, IMF Managing Director should strive to eliminate the politicisation of the organisation using own power and improve its image as an international organisation. This can be achieved through adopting a tougher stance when dealing with the heads of member countries and preventing the IMF from being used as an instrument in order to implement own foreign policies by individual member countries.

According to its official website “the IMF is accountable to its 188 member governments, and is also scrutinised by multiple stakeholders, from political leaders and officials to, the media, civil society, academia, and its own internal watchdog” (Accountability, 2012).

However, there are no benchmarks, criteria or standards whatsoever against which IMF performance can be evaluated and thus specific individuals and groups within the party can be held accountable for the actions taken and results obtained.

Performance accountability frameworks need to be developed with the direct participation of the senior representatives and specialists of member countries and specific set of criteria need to be selected as the basis of the framework.

These criteria might include the extent of measures IMF has taken to prevent financial crises, the speed of response of financial crises if they occur, the level of adequacy of measures recommended and implemented in order to deal with the crisis, etc.

Moreover, the development of performance accountability frameworks and its facilitation in an effective manner for IMF involves clarification of the roles and responsibilities for organisation’s governance bodies and minimising overlaps between them.

Transparency principles need to be adopted as the key element of accountability for IMF with the organisation communicating the various aspects of its performance to its stakeholders and general public with the use of a range of communication channels such as internet publications, issuing bulletins and white papers, press-conferences, articles and magazines, and these communication channels need to be used in an integrated manner.

Another important measure within performance accountability framework relates to regular self-evaluation practices to be engaged by Board members. This specific initiative has been previously proposed by Independent Evaluation Office in 2008; however, the proposal has not been taken into account by IMF strategic management so far.

An effective implementation of regular self-evaluation practices for IMF Board members would provide highly valuable data in relation to the strengths and weaknesses of the Board, and also the overall initiative could be adopted as an effective learning process.

3.4 Improving Lending Policy

Justified criticism faced by IMF includes perceived inefficiencies associated with its lending facilities and the organisation being branded as too generous due to its sizable lending programs (Turner and Johnson, 2009). The current lending practice at IMF involves countries applying for loans to be able to meet certain conditions. These conditions relate to a wide range of aspects of a national economy including fiscal and monetary policy, exchange rate policy, the state of public sector reforms and the extent of trade liberalisation etc (Dicken, 2010).

Accordingly, IMF management is recommended to optimise its lending policy in dealing with its low-income members, so that the level of positive impact from its practices can be further increased.

The traditional IMF lending policy that analyses all countries from the same lens with disregard to cultural and country-specific differences has proved to be ineffective, and thus this practice needs to be improved. Improvement of IMF lending policy needs to be facilitated on the basis of dialogues and roundtables with the participation of member country senior level representatives.

3.5 Increasing the Level of Comprehensiveness in Country Analysis

The current country analysis practice in IMF is limited to analysing a specific set of economic variables and quantitative data such as gross debt, the level of GDP growth, debt-to-GDP ratio, rate of unemployment, national currency exchange rate etc. (Copelovitch, 2010).

At the same time, important qualitative data about the country such as overall political situation, social tendencies within the country, characteristics of the national culture etc. are not assessed during the country analysis process. Moreover, no tools, measurements and criteria have been developed by IMF that deals with these qualitative data in an appropriate manner.

This situation may negatively affect upon the quality of country analysis undertaken by IMF taking into account the direct impact of qualitative factor mentioned above upon the level of macro-economic stability within the country. Accordingly, IMF is recommended to develop effective tools, measurements and criteria that would have a sufficient provision for qualitative factors associated with a country along with quantitative economic variables to be used when conducting country analysis.

The development of these tools may require from IMF to attract external specialists, in which case the organisation needs to engage in close cooperation with member countries in terms of finding and recruiting highly qualified and experienced specialists.

4. Conclusions

The level of complexity in the global economy and the level of its sensitivity to various crises and economic disturbances in various parts of the world are increasing due to the increasing level of economic globalisation. Today an economic crisis in one of the major exporter and/or importer country such as USA, China, India, or Russia is going to have an inevitable negative impact upon the level of well-being of people and the state of economy in many other countries.

The global economic crisis of 2008-2011 that has been initially caused by housing price bubble in the US is a fresh and relevant example to confirm this point. This harsh macro-economic reality creates substantial challenges to IMF to achieve its objective of fostering global monetary cooperation, securing financial stability, facilitating international trade, promoting high employment and sustainable economic growth, and reducing poverty around the world in a timely and appropriate manner.

To put it simply, a set of aspects of IMF performance and strategy is failing to meet the challenges of the dynamic global economy and the organisation is lagging far behind in terms of introducing necessary reforms in a timely manner.

As it has been discussed above the most significant challenges faced by IMF include its governance structure, increasing level of politicisation, leadership challenges, performance evaluation difficulties, and dealing with social instability.

Accordingly, proactive approach needs to be adopted by IMF so that these challenges can be responded with a due level of effectiveness. Among a vast range of reforms the most urgent changes required to be implemented include reforming IMF governance, gaining focus on role and objectives, developing performance accountability frameworks, improving lending policy, and increasing the level of comprehensiveness in country analysis.

Moreover, IMF management need to be able appreciate the high level of dynamism of the modern global economic environment and adopt a proactive approach in terms of dealing with local and global economic issues.

References

- About IMF (2016) Available at: http://www.imf.org/external/about.htm

- Accountability (2016) IMF, Available at: http://www.imf.org/external/about/govaccount.htm

- Ahern, R.J. & Fergusson, I.F. (2010) “World Trade Organisation (WTO): Issues in the Debate on Continued U.S. Participation” DIANE Publishing

- Allen, P. (2012) “DSK’s long suffering wife Anne Sinclair finally leaves him as former IMF boss is kicked out of their Paris home” (2012) Mail Online, Available at: http://www.dailymail.co.uk/news/article-2166330/Dominique-Strauss-Kahns-long-suffering-wife-Anne-Sinclair-finally-leaves-him.html

- Birdsall, N. (2011) “IMF Leadership: OK for Now, but Fixing the Process Shouldn’t Wait” Center for Global Development, Available at: http://blogs.cgdev.org/globaldevelopment/2011/09/imf-leadership-ok-for-now-but-fixing-the-process-shouldn%E2%80%99t-wait.php

- Birdsall, N. (2012) “Failing IMF? Who Is Really to Blame?” Center for Global Development, Available at: http://blogs.cgdev.org/globaldevelopment/2012/07/flailing-imf-who-is-really-to-blame.php?utm_

- Breen, M. (2008) “The political economy of IMF conditionality” School of Politics and International Relations

- Carbaugh, R. (2010) “International Economics” Cengage Learning

- Caselli, M. (2012) “Trying to Measure Globalisation: Experiences, Critical Issues and Perspectives” Springer Publications

- Copelovitch, M.S. (2010) “The International Monetary Fund in the Global Economy: Banks, Bonds and Bailouts” Cambridge University Press

- Dalton, M. (2012) “IMF Pushes Europe to Ease Greek Burden” Wall Street Journal, August 6, 2012

- Dicken, P. (2010) “Global Shift: Mapping the Changing contour of the World Economy” 6th edition, Guilford Press

- Dunaway, S. (2011) “Three Challenges for New IMF Director” Available at: http://www.cfr.org/imf/three-challenges-new-imf-director/p25393

- “Governance of the IMF: An Evaluation” (2008) Independent Evaluation Office (IEO), IMF

- Griffiths, J. (2010) “IMF Governance Reform” Available at: http://www.brettonwoodsproject.org/art-566696 Accessed August 07, 2012

- IMF Quotas (2016) IMF, Available at: http://www.imf.org/external/np/exr/facts/quotas.htm

- Kelkar, V.L., Chaudhry, P.K., Vanduzer-Snow, M. & Bhaskar, V. (2005) “Reforming the International Monetary Fund: Towards Enhanced Accountability and Legitimacy” in Reforming the Governance of MIF and the World Bank, Anthem Press, Editor Buira, A.

- Lagarde, C. (2011) “Challenges and Opportunities for the World Economy and the IMF”, IMF

- Management (2016) Available at: http://www.imf.org/external/about/mgmt.htm

- Martinez-Diaz, L. & Lamdany, R. (2009) “Studies of IMF Governance: A Compendium” International Monetary Fund

- Mackenzie, K. (2012) “Prepare for probable disappointment, IMF” Financial Times, October 09, 2012

- Spiegel, P. & Barker, A. (2012) “IMF challenges Berlin’s crisis reponse” Financial Times, June 22, 2012

- Truman, E.M. (2006) “Reforming the IMF for the 21st Century” Peterson Institute

- Turner, C. & Johnson, D. (2009) “International Business: Themes and Issues in the Modern Global Economy” Taylor & Francis