Profit levels in short run and long run perfect competition

Perfect competition can be defined as a situation “in an industry when that industry is made up of many small firms producing homogeneous products, when there is no impediment to the entry or exit of firms, and when full information is available” (Baumon and Blinder, 2011, p.200).

Market structure can be specified as perfect competition if the following conditions or assumptions are met:

Firstly, there are many supplies in the market and each supplier has an insignificant market share. In other words, no single supplier is in the position of impacting price through manipulations with its supply of products.

Secondly, there are no major differences between products offered by suppliers and these products can be consumed as substitution for each-other. To be more specific, even when there are certain differences between products in the same industry, they are identical in consumer perception.

Thirdly, consumers are fully aware about costs charged by all suppliers. This situation has implications in a way that a certain supplier decides to increase its prices; the levels of its revenues will decline because of consumers switching to other suppliers.

Fourthly, the level of access to various resources is equal for all suppliers. Moreover, all participants in the industry can benefit from breakthroughs and other positive changes in the industry in an equal manner.

Fifthly, industry entry and exit barriers for suppliers are insignificant. In other words, new suppliers can join competition at any time with implications on the levels of profits of existing suppliers.

Sixthly, there is no divergence between private costs and social costs, as well as, benefits due to the absence of externality in manufacturing and consumption.

Six main assumptions associated with perfect competition market structure discussed above have certain implications on profit maximisation attempts of businesses.

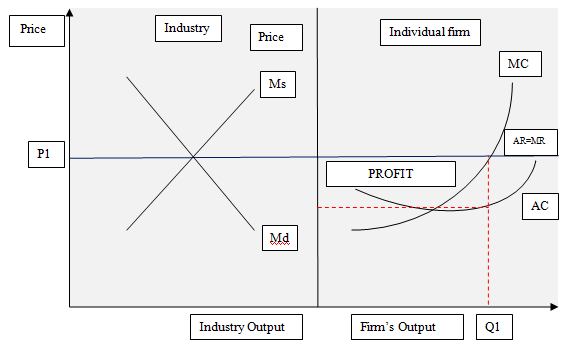

Outcome of interaction between supply and demand results in market equilibrium in the short run, and this situation can be specified as short-run perfect competition (See Figure 1).

In short-run perfect competition profit of an individual firm can be maximised in a situation when marginal revenues (MR) equals to marginal cost (MC). Accordingly, in Table 1 above maximum levels of profit can be generated by a firm by producing Q1 quantity for the price of P1.

Moreover, as it is illustrated in Table 1, the firm is able to generate abnormal or supernormal profit in the short run for the duration of period when P1 price stays higher than the level of average cost (AC).

It can be further elaborated that the difference between abnormal and normal profit relates to relationship between average total cost and average market price, and abnormal profit can only be generated when average revenue is greater than average total cost.

However, it is important to note that the possibility to generate supernormal profits is not available for all businesses. Specifically, certain businesses that have higher level of average costs would not be able to generate supernormal profits.

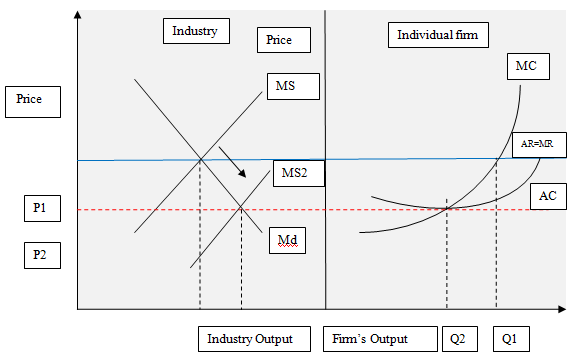

Large numbers of firms generating abnormal profits is going to trigger more output from existing firms and motivate new businesses to enter the same industry. This inevitable scenario is going to cause the price to decline from P1 to P2, assuming that the level of demand remains constant. Consequently, the opportunities of generating supernormal profits are going to be eliminated, and firms will be left with only normal profits (Figure 2).

It is important to note that a set of market entry barriers such as capital and knowledge requirements, scarcity of unique resources, technological factors etc. may have positive implications for businesses already operating in the industry in terms of being able to generate abnormal profit for the duration of prolonged period of time.

In other words, due to market entry barriers, new competitors may not be able to enter the industry, therefore granting firms with the possibility of generating abnormal profit for long duration of time. Abnormal profits generated by pharmaceutical and oil companies due to market entry barriers can be mentioned to illustrate this point.

References

Baumol, W. & Blinder, A. (2011) “Microeconomics: Principles and Policy” 12th edition