Acquisition of Germanwings by Lufthansa German airlines: motives, strategic and organisational fit

1. Introduction

Mergers, acquisitions and formation of alliances are commonplace in global airline industry and they are fuelled by the search of competitive advantages in order to achieve long-term growth. However, the implementation of mergers, acquisitions and formation of strategic alliances in practice can be associated with a set of complex challenges that might include differences in organisational culture, clash of personalities within top level management, lack or absence of strategic fit between the two companies and others.

Lufthansa Group is a global airline company that employs more than 120,000 workforces that have contributed to generate 713 million EURO through serving 100.6 million passengers during the year of 2011 alone (Annual Report, 2011).

Germanwings is a budget airline company that employs 1355 members of staff and served 7.52 million customers in 2011 offering flights to more than 90 destinations with 33 Airbus A 319 airplanes (Facts and Figures, 2013, online). Germanwings is wholly owned by Lufthansa since 2009.

This report investigates a range of business issues related to the acquisition of Germanwings by Lufthansa German Airlines in 2009. The report starts with analysis of motives for choosing acquisition method among other alternatives by Lufthansa. This is followed by discussions of strategic and organisational fit between Lufthansa and Germanwings.

Moreover, this report addresses potential gains and risks faced by Lufthansa due to the acquisition of Germanwings. The report is concluded with assessing outcomes relative to expectations in relation to this specific airline acquisition.

2. The Motives for Choosing Acquisition Method by Lufthansa

Top level management of Lufthansa have selected the method of acquisition among other alternatives such as initiating a merger or forming a strategic alliance in relation to Germanwings due to the set of reasons that include less time required to complete the acquisition, increasing the market share, overcoming entry barrier in budget airline sector, and easiness of integration.

2.1 Short Time Required to Complete the Acquisition

Acquisition usually takes considerably less time as compared to mergers or strategic alliances. The main issue Lufthansa management had to deal with during the acquisition of Germanwings was to negotiate the price and the terms of payments, whereas in mergers and alliances negotiations needed also to cover the roles of each company after the merger or alliance, and a wide range of other issues.

Specifically, commenced in autumn of 2008, the process of negations and acquisition of Germanwings have taken only four months, completed by January 1, 2009 (Pper and Kupper, 2012). The selection of alternative strategy such as merger or alliance, would have taken much longer to be completed.

2.2 Willingness to Increase the Market Share

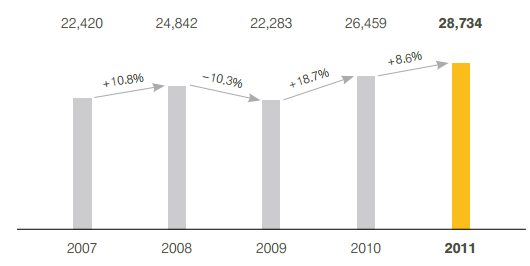

Acquisition of Germanwings has allowed Lufthansa to increase its market share to a significant extent that this has had a positive correlation with the level of revenues. Figure 1 illustrates the changes in Lufthansa revenues since Germanwings acquisition took place in January 1, 2009.

Figure 1 Development of Lufthansa revenue in EURO millions.

Source: Annual Review (2011)

Lufthansa management has attempted and achieved to a certain extent an increase in overall market share by pursuing new product development strategy through the acquisition of Germanwings. New product in this specific case, relates to no-frills budget airline services offered by Germanwings.

Specifically, as Figure 1 indicates, the levels of Lufthansa revenues have increased by 18.7 per cent after the acquisition of Germanwings, and the positive correlation between the levels of revenues and the market share is evident.

2.3 Overcoming Entry Barrier in Budget Airline Sector

Through its acquisition of Germanwings Lufthansa has been able to overcome entry barrier in budget airline sector. These barriers are perceived to be significant and they include legal barriers, infrastructure bottleneck, strategic barriers and absence of experience in low cost airline sector (Gro and Schroder, 2007).

Moreover, the acquisition of Germanwings has provided Lufthansa with necessary skills and competencies in order to be able to operate in a new segment of airline sector. Although, Lufthansa has been operating in airline business for several decades the company skills inventory lacked competencies and experiences in dealing with budget airline, and this gap has been eliminated with the acquisition of Germanwings.

2.4 Easiness of Integration

Integration of various business processes is perceived to be easier in acquisitions as compared to mergers and alliances mainly due to the lack or absence of arguments within top level management. In other words, in mergers and acquisitions strategic decision making is facilitated with the participation of both parties and this leaves room for negative impact of internal politics that might be caused by clash of personalities at top level.

The merger between two telecommunication companies Alcatel and Lucent to form Alcatel-Lucent in 2006 can be mentioned to illustrate this point. Specifically, personality clash between Lucent’s Patricia Russo appointed CEO of Alcatel-Lucent and board member Serge Tchuruk from Alcatel has had highly negative implications on the performance of merger company (Financial Times, 2008)

3. The Strategic and Organisational Fit between Lufthansa and Germanwings

The extent of strategic and organisational fit between Lufthansa and Germanwings plays an important role on the performance of Lufthansa Group upon the completion of acquisition.

Strategic fit can be explained as “the degree to which the activities of different sections of a business or businesses working together complement one another to achieve competitive advantage and business success” (Collins Dictionary, 2013).

Lufthansa has been traditionally positioned as a high-end brand targeting specific customer segment that is ready to pay premium fees for added values or perception of values associated with airline services. Germanwings, on the contrary, is a famous no-frills airline carrier that focuses on cost reduction through elimination of complimentary and additional products and services.

Therefore, from product and customer perspective it can be stated that there is a high level of strategic fit between Lufthansa and Germanwings. In other words, there is no direct competition between Lufthansa and Germanwings due to targeting different customer segments, and thus their strategy compliment each other, making a strong case for acquisition in order to increase the overall market share to contribute to the level of revenues.

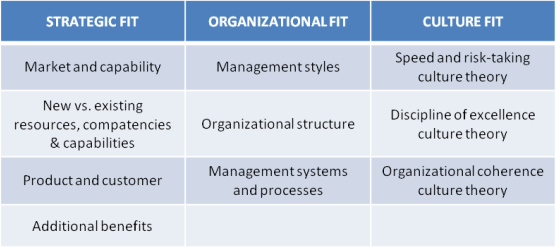

Figure 2 Components of strategic, organisational and culture fit between two firms

Source: Alekotte (2011)

Organisational fit, on the other hand, relates to “the complementarity of partner firm’s ‘soft’ organisational traits, such as goals, experiences, and behaviours that facilitates cooperation” (Peng, 2008, p.277). The major components of organisational fit can be specified as management styles, organisational structure, and management systems and processes (see Figure 2).

There are substantial differences between Lufthansa and Germanwings organisational structure and these differences mainly stem from the sizes of respective organisations. Being a large multinational airline company Lufthansa Group is led by Chairman of the Executive Board and CEO, currently Christopher Franz.

The following layer in management hierarchy comprises CEO Lufthansa German Airlines, Chief Officer Group Airlines, and Chief Financial Officer that report to Mr. Franz. Moreover, Lufthansa Group is further divided to 11 individual divisions each responsible for a specific aspect of business (Annual Report, 2011).

Germanwings organisational structure, on the other hand, with only 1,406 employees and 25 aircrafts before the acquisition was less complicated with fewer management hierarchies as compared to Lufthansa.

There are some differences in organisational culture between Lufthansa and Germanwings as well. Organisational culture in both companies is heavily impacted by its chosen business strategy. Specifically, in accordance to its chosen business strategy of differentiation, employees at Lufthansa are encouraged to be innovative in the search of new sources of competitive advantages.

On the contrary, Germanwings organisational culture values cost-saving and this is reflected on a wide range of organisational processes.

To summarise the point, the level of strategic fit between Lufthansa and Germanwings is adequate due to the complimentary nature of business strategies. The level of organisational and cultural fit between these two companies, on the other hand, is compromised.

4. The Potential Gains by Lufthansa

There are potential benefits to be gained by Lufthansa as a result of acquiring Germanwings and these benefits include increasing market share in the global airline industry, spreading risks though business diversification, and taking advantage of synergies.

4.1 Increasing Market Share in Global Airline Industry

The major potential gain associated with the acquisition of Germanwings by Lufthansa relates to the increase of the global market share to a significant extent. According to OAG Report (2011), the share of budget airline carriers in global airline industry is increasing steadily and has amount to about 26 per cent on August 2012. This market tendency is even starker in Asia Pacific and Middle East regions, where the share of no-frills airline has reached 29 per cent. Accordingly, entering this rapidly expanding market segment presents Lufthansa with the opportunities of increasing its market share significantly.

4.2 Spreading Risks by Business Diversification

Acquisition of Germanwings by Lufthansa makes a sound business case in terms of spreading risks by engaging in business diversification. The global economic and financial crisis of 2007-2011 exposed the high level of vulnerability of highly priced brands in a wide range of sectors to external economic shocks, including airline sector.

To put it simply, in times of economic challenges individual and corporate users of airline services may prefer to use budget airlines like EasyJet and Ryanair compared to expensive airline services offered by companies such as Lufthansa and Virgin Atlantic Airlines.

At the same time, continuing economic challenges within the European Union, the US and other parts of the world (Gali, 2012) may be interpreted as a triggering factor for the popularity of budget airlines to further increase.

From this viewpoint, by committing to the acquisition of Germanwings, Lufthansa has effectively spread its business risks associated with the decline of popularity of expensive airlines.

4.3 Taking Advantage of Synergies

Synergy is “the increase in performance of the combined firm over what the two firms are already expected or required to accomplish as independent firms” (Sirower, 1997, p.19). There is an attractive potential for Lufthansa to increase the levels of revenues of Lufthansa Group and achieve cost reduction through synergy in relation to its acquisition of Germanwings.

Synergy can be achieved to benefit Lufthansa Group through combining skills and capabilities within the two companies in order to increase the levels of operational efficiency and achieve higher level of cost reduction with economies of scale and other relevant measures.

5. Potential Risks Faced by Lufthansa

Lufthansa strategic level management have exposed the company to certain risks with the acquisition of Germanwings. The major risks include financial implications, compromising core competitive advantages of Lufthansa to a certain extent, and negative impact of differences in organisational culture between Lufthansa and Germanwings.

5.1 Financial Implications

One of the most significant risks associated with the acquisition of Germanwings by Lufthansa relates to the risks of financial resources invested in the project. In other words, Lufthansa has committed to significant financial investments with no guarantee about the success of outcome.

Lufthansa Group has been experiencing financial losses for the past several quarters in a row.

Specifically, during the first quarter of 2012 alone Lufthansa has reported a loss of EURO 381 million (GBP 500 million), a significant detrimental change in company performance compared to the loss of EURO 169 million during the first quarter of 2011(Deckstein, 2012).

Moreover, critics associate recent Lufthansa poor performance with ineffectiveness of strategic decision making during the last several decades, indirectly referring to the decision to acquire. Nevertheless, as it is the case with any type of financial investment, acquisition of Germanwings by Lufthansa is associated with the risks of not being able to generate desired output.

5.2 Compromising Lufthansa Core Competitive Advantages

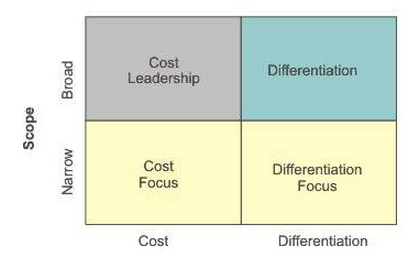

According to Porter’s Generic Strategies (1985) the sources of competitive advantage can be broadly divided into two categories: cost leadership and differentiation. In cost leadership firms strive to attract customers with competitive prices, whereas when following a differentiation strategy customers are attracted by additional value such as quality and/or additional product features and attributes that come for extra prices.

Moreover, according to their scope they can be further divided into cost focus and differentiation focus groups.

Figure 3 Porter’s Generic Strategies (1985)

According to this framework, traditional Lufthansa core competency has been closely associated a differentiation business strategy through offering a high quality service in premium prices. There is a justified risk that Lufthansa brand image and its quality value perception can be depreciated due to its association with a cheap airline carrier such as Germanwings.

5.3 Negative Impact of Differences in Organisational Culture

Organisational culture is a way of doing things within a specific organisational setting (Bhattacharyya, 2010) and differences in organisational culture between Lufthansa and Germanwings can have a highly negative impact on Germanwings performance after the acquisition is completed.

Components of organisational culture include group norms, company values, organisational philosophy, ‘unwritten rules’, embedded skills, mental models and others (Schein, 2010). Within this framework, differences in company values and mental models might have negative implications on the success of Lufthansa Group after the acquisition.

With the mission statement of putting the customer at the centre of attention and standing for superlative quality Lufthansa company values are closely associated with increasing the quality of customer experiences, even if it comes at extra financial expenses.

Mental model dominant at Germanwings, on the other hand, is closely associated with encouraging employees at all levels to identify and take advantage of cost saving opportunities so that the current competitive advantage of the company, cost leadership can be maintained.

This situation might have negative implications on the success of Lufthansa Group, because due to the fundamentally different organisational cultures between Lufthansa and Germanwings, the company can be left ‘on the middle road’ not being able to fully utilise none of the competitive advantages – product differentiation or cost advantage.

6. The outcomes relative to expectations

More than four years have passed since the acquisition of Germanwings was completed in January 1, 2009 and this timeframe is sufficient enough to be able to make some statements about the actual outcome of acquisition initiative relative to expectations.

Lufthansa expectations in relation to its acquisition of Germanwings are straightforward and they are directly related to primary objective of the organisation as a business entity, which is profit maximisation.

Lufthansa top level management has decided to avoid merging Germanwings and Lufthansa into a single private entity, rather, Germanwings has been kept as a separate brand within Lufthansa Group portfolio. This strategy has proved to be effective in a way that Lufthansa traditional core competitive advantages have not been compromised after the acquisition.

In other words, Lufthansa management has been able to avoid compromising the company brand image associated with high quality for premium prices through associating the brand with no-frills budget airline in the perception of its customers.

At the same time, Germanwings revenues during 2011 has totalled to EURO 687 million, an increase of 9 per cent compared to the level of revenues generated in 2010. Importantly, this revenue has been generated through carrying 7,522 thousands passengers, which is a decrease of 2.7 per cent from the previous year (Annual Report, 2011).

In summary, Germanwings acquisition initiative has proved to be strategically affective move for Lufthansa so far, with the latter company systematically increasing the levels of its market share through this acquisition. Increasing level of revenues of Germanwings amid significant challenges and decline in global airline industry can be mentioned to justify this point.

Lufthansa top level management has recently announced a major re-branding and restructuring initiatives in relation to its Germanwings arm. According to the official company website “on 1 July 2013, the ‘new Germanwings’ will launch a completely new brand and product concept allowing all passengers to enjoy ‘a la carte flying’” (About Germanwings, 2013, online).

7. Conclusions

Engagement in mergers and acquisitions and formation of strategic alliances have emerged as effective strategies in terms of increasing the level of market share and contributing to the level of revenues.

Lufthansa strategic level management have decided to choose acquisition strategy in relation to Germanwings partially because this specific strategy is associated with less time required to complete the acquisition, increasing the market share, overcoming entry barrier in budget airline sector, and easiness of integration.

At the same time this report has identified the level of strategic fit between Lufthansa and Germanwings as adequate, however the levels of organisational and cultural fit between these two companies were found to be compromised.

Moreover, a range of potential benefits to be gained by Lufthansa as a result of acquiring Germanwings have been found to include increasing market share in the global airline industry, spreading risks though business diversification, and taking advantage of synergies.

Likewise, this report has found a set of risks associated with the acquisition of Germanwings such as financial implications, compromising core competitive advantages of Lufthansa to a certain extent, and negative impact of differences in organisational culture between Lufthansa and Germanwings.

Nevertheless, the outcome relative to expectations associated with the acquisition of Germanwings by Lufthansa signals about the appropriateness of acquisition decision from strategic viewpoint.

In conclusion, Lufthansa management has selected strategically correct path by acquiring Germanwings in terms of increasing the company market share with potentially positive contribution to long-term growth prospects of Lufthansa Group.

However, it is important to note that this acquisition alone is not sufficient, and it is critically important for Lufthansa strategic level management to be subjecting various business processes within Lufthansa Group to critical evaluation in a regular manner, so that potential sources of competitive edges can be identified and utilised.

References

- Alekotte, P. (2011) “How to Select Optimal Acquisition Target” MBA Thesis, Aalto University Executive Education

- Annual Report (2011) Lufthansa

- Bhattacharyya, B.K. (2010) “Cross-Cultural Management” PHI

- “Can the new CEO end a culture of clash after a merger?” (2008) Financial Times, September 10, 2008 Issue

- Deckstein, D. (2012) “Cost-Cutting at Lufthansa: German National Carrier Undergoes Mass Restructuring” Der Spiegel, Issue 18, 2012

- Facts and Figures (2012) Germanwings, Available at: http://www.germanwings.com/downloads/Germanwings_Facts_and_Figures.pdf

- Gali, J. (2012) “Monetary Policy and Unemployment: A New Keynesian Perspective” CCBS Workshop

- Gro, S. & Schroder, A. (2007) “Handbook of Low Cost Airlines: Strategies, Business Processes and Market Environment” Erich Schmidt Verlag

- Porter, M.E. (1985) “Competitive Advantage: Creating and Sustaining Superior Performance” Free Press

- Pper, V.K. & Kupper, V. (2012) “Low-Cost Carrier Industry: A Focus on Germanwings Strategy” GRIN Verlag

- Schein, E.H. (2010) “Organisational Culture and Leadership” John Wiley & Sons

- Sirower, M.L. (1997) “The Synergy Trap: How Companies Lose the Acquisition Game” The Free Press

- Strategic Fit (2013) Collins Dictionary, Available at: http://www.collinsdictionary.com/dictionary/english/strategic-fit