Finance

Total inward and outward FDI flows Inward FDI – Since after the economic reformation of China, the country moved towards more market oriented economy, it has received a very large part of international direct investment flows.China has become the second largest host country to FDI in the world afterUnited States, and the largest FDI recipient among the developing countries. In fact, as stated by OECD report (2000), for period of twenty years, actual amount of FDI inflows from 1979 to 1999 totaled to 306 billion US dollar, which is equal to 10 percent of direct investments worldwide and around 30 percent of investment amount for all the developing countries. Furthermore,China consistently continued to receive a large share of direct investments in developing countries in the first decade of 21st century. This argument backed up with figures published by OECD (2005) with the inward FDI into mainland China rising to amount of $55billion in 2004 from $47 billion in 2003. However, there is significant concern among experts in China about possible overheating of the investment cycle as much of this investments accounted toHong Kongbased investors. Outward FDI – While China continues to be largest FDI recipient, it is also gaining importance in world stage as outward investor as well. Many large companies operating in China appear to developing into truly international corporate networks through investments. Moreover, Chinese enterprises are increasingly trying to do “strategic” investments abroad, not least to gain access to raw material. However, the process has been uneven. Figures released by China’s State Administration for Foreign Exchange (OECD Observer, 2005) shows that net outward FDI declined from a peak of $6,9 billion in 2001 to £152,3 million in 2003, then slightly recovered to $1,8 billion in 2004. Nevertheless, OECD figures suggest that these figures may understate the position. …

China’s economic transformation towards more market oriented economy has been one of the most dramatic economic developments of recent decades. Between the period of 1979-2009, China’s growth rate averaged 9% per annum and its integration into the world trading system has been crucial (IMF, 2010). Between the period of 1979 to 2005 its share in world trade has increased from less than 1% to 6, 4%. After three decades of spectacular growth,China even beat Japan to become world’s second largest economy behind the US (Barboza, 2010). Thanks to its open economy, the ration of foreign trade to GDP increased from 12 per cent to 34 per cent (OECD, 2005). According to study of Zhang (2006) and many others, the significant growth in China’s foreign trade in the past two decades has strong relationship with the inflow of FDI as it has been core at the core of China’s foreign trade expansion. Furthermore, this was backed by the OECD report (2000) that FDI has been decisive factor in China’s involvement in the international segmentation of the production process known as globalization. Following the large amount of FDI in manufacturing field, exports and imports as a share of GDP rose from negligible amounts to nearly 25 percent in 2000. The average tariff rate fell from 50 percent in the early 1980s to about 15 percent in 2000, less than half of that India as China exempts so many goods entirely from custom duties. Moreover, a significant share of imported goods are illegally imported, the tariff collection rate as a percent of total value of imports has been much lower. As a result, the tariff revenue as a percent of total imports is only 3 percent in China, compared with 23 percent inIndia. As matter of fact, the net FDI inflows into China…

By John Dudovskiy

Category: Finance

FDI was recognized by Chinese authorities to be one of the important success factors for transformation from the centrally planned economy to the market economy from the very beginning of the transformation process. At the same time, authorities were unwilling to significantly reduce the level of the state control over the economy. According to Tseng and Zebregs (2002) ‘ideological obstacles’ had to be overcome by authorities, as well as traditional stereotypes that related FDI to imperial colonialism that needed to be avoided. It is a common opinion that due to the fact that these stereotypes have been around for several generations the inflow of FDI into China was increased at a reduced speed compared to its actual potential. Long (2002) mentions such legislations as Law of the People’s Republic of China upon Foreign Wholly Owned Enterprises, Law of the People’s Republic of China upon Sino-Foreign Joint Ventures, Law of the People’s Republic of China upon Sino-Foreign Cooperative Enterprises, and the Guiding Directory on Industries open to Foreign Investment that have been devised to regulate the activities related to the foreign direct investment in China. Tseng and Zebregs (2002) claim that rules and regulations imposed by the government regulate investment activities that involve the use of scarce resources, projects that are take place in designated areas, projects that present hazard to environment or national safety, and productions that compete with the state monopoly. It is also known that rules and regulations were promoted in China that favor liberalization in many aspects, including in economic activities in order for the China to get membership of World Trade Organization (WTO). These rules and regulations include compliance to non-discriminatory treatment of foreign and domestic businesses, compliance to the universal rules on intellectual rights and others. This opinion is supported by Long (2005), who informs…

By John Dudovskiy

Category: Finance

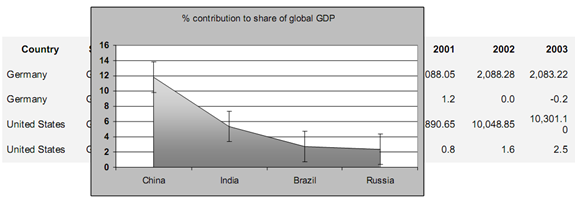

Arora and Vamvakidis (2010) inform that starting from the late 1970’s China has been achieving incredibly high level of GDP with an increase of 9% in average. China has been the biggest contributor to the global GDP that has accounted for more than half the combination of GDP contributions by India, Brazil, and Russia which is illustrated in Table 1 below: Source: International Monetary Fund China current strong position is also supported by the fact that it’s GDP has ranked No.4 in the world with USD 3.52 trillion, or 8% of the total world in 2007 which is a great accomplishment taking into account the fact that in 1978 it was only 1% (The Foreign Economic Research Institute, 2009). Today China is seen as an attractive destination in terms of investing funds and outsourcing operations. Although the country does not offer the cheapest labor costs with one USD per hour (Biz China 2007), many other factors contribute China to be attractive to investors and thus attracts huge amount of FDI inflows The Factors Contributing to FDI inflow to China There are many factors proposed that contribute to the FDI inflow into China several of them being the most important. Increasing workforce within the country as a result of the migration of large numbers of inland farmers to the mainland of China for purposes of employment is seen one of the main reasons for the increase of the FDI. Justin and Fox (2007) inform about proposition of USD 20 billion investment by western companies that has contributed to the reduction to the level of unemployment to 6% in 2007. The number of population is seen as another important factor to the inflow of FDI in China due to the fact that large number of population of 1.3 billion with 800…

By John Dudovskiy

Category: Finance

Scott and Wang (2006) state that there are several sources of finance available for SMEs in China. However, types of finance that are both available and obtainable differ for SMEs in different life cycle of the enterprises. They mentioned the following sources of finance available for SMEs in China: 1. Personal savings This form of financing is usually preferred if it is available as it does not require any interest payments in a fixed nature. Therefore, due to difficulties in finding and obtaining loan at the start-up stage, most owners of the small enterprises usually invest their own savings. 2. Loan from immediate friends and relatives This is another source of finance for SMEs in China as majority SMEs are organized and opened with the help of this type of financing. Due to strong family culture in China, the access to this type of financing is easier than it can be found in EU or theUS. 3. Trade credits Zhuo (2001) stated that trade credits is one of the financing sources for SMEs in China as it gives them the privilege of paying back to their suppliers later. This is also considered to be a good form of financing methods as small and medium sized enterprises usually struggle with cash at the early stage of their business operations. However, getting a trade credit also requires SMEs to provide healthy and strong cash flow statements, where in many cases it is impossible. 4. Bank loans Banks loans are crucial sources if financing any business in most countries due to the length and lower interest rates than the equity. However, obtaining a bank loan is another obstacle in financing SMEs in China. This is due to the fact that most of the banks are state-owned commercial banks that…

By John Dudovskiy

Category: Finance

The capital structure model was promoted by Modigliani and Miller (also known as MM) (1958) which indicated that the value of the company is unchanged by the alternative mix of capital structure, namely the structure of the capital is irrelevant to the value of the firm assuming that no tax and all profit are apportioned as dividends. However, Gray et al (2007) stated that such a perfect capital market does not exist in real life. Jensen and Meckling’s (1976) (cited in Gregory et al, 2005) agency theory provides insight into the financial management of capital structure where it states that a contract is made where a principal (owner) hires and agent (directors) to run the company on their behalf by delegating the responsibilities and pays them for it. However, in the case of SMEs, majority directors of the businesses are owners of them too. Cassar and Holmes (2003) mentioned about the pecking order model by (Myers, 1984), which suggests that firms have a particular preference order to finance their businesses. He indicated that due to the information asymmetry between the firm and the potential investors, the agents (managers) know more about the firm, its potential value and future prospects than the new investors. Therefore, managers know what form of financing is available to the business at any given stage. From this point of view managers usually try to obtain the financing that they think is obtainable for them. This sometimes leads to a situation where managers have not tried other available sources of financing as they assumed that the source of finance they obtained has been the best and only choice for them. Many researchers have researched the capital structure decision form the perspectives of small firms (Gregory et al, 2005, Cassar and Holmes, 2003, Coleman, 1998, Berger and Udell,…

By John Dudovskiy

Category: Finance

Banking profitability. Ramlall (2009, p.2) divides the determinant factors of banking profitability into two groups: 1. External factors. They can be divided into further two categories: macroeconomic environment and market/industry characteristics. 2. Internal factors that is characteristics which are bank-specific. Dividing banking profitability in such groups is an efficient way of studying the issue, because it differentiates the factors affecting it according to its characteristics. According to Anthanasoglu (2005) studies dealing with internal profitability determinants employ such variables as size, capital, risk management and expenses management. However, the authors fail to mention external profitability determinants in greater details as compared to the internal factors, despite the fact that external factors are important as well. 1. Mergers as a Measure to Increase Banking Profitability A study undertaken by Akhvein et al (1997) was focused on examining the efficiency and price effects of mergers by the use of frontier profit function. The result of their study indicated that merged banks enjoyed an average of 16 per cent increase on profit efficiency compared to other banks due to the range of factors including shifting outputs from securities to loans and improvements on higher value product range. While examining the effect on banking profitability and rate of return on capital on changes in interest rates, Hancock (1985), made three assumptions: 1. Banking profitability depend on interest rates for asset and liability items, which is not the same for one market interest rate. 2. Banking profitability depend on the user costs of all financial items, and user costs depend on service charges, service premium costs and deposit insurance premiums, as well as on interest rates. 3. The relative price changes between financial and non-financial items is taken into account. Berg et al. (1993) concluded Swedish banks being generally more efficient than Norwegian and Finnish banks. 2.…

By John Dudovskiy

Category: Finance

Banking profitability. One of the fundamental functions of any bank is its profitability. There is no doubt that recent global financial crisis negatively affected on the profitability of many banks around the globe. Some of them are starting to recover due to efficient measures from bank management and help from their governments. However, many European banks are still struggling to regain strong position in marketplace which they used to hold only a few years ago. And many of them are still not too far from the verge of bankruptcy. The problem of assessing the profit efficiency of banking industry is of paramount importance for local governments and economic theorists. Therefore, the important point is if government is striving to assist for the performance of banks to be improved, it is crucial to know how far a bank is able to increase its profit by increasing its efficiency, not using new resources for the purpose. The study on profitability of banks is especially important at this point of time. As in summer of 2012, the lowest point of global economic crises is past; however the banks and financial system in many countries and in many industries are still vulnerable to various shocks. The main important point is that problems within banking system are going to affect all other businesses as well. Because businesses have a close relationship with banks and most of them are financed by banks. This fact makes it necessary to study all the causes of the recent economic crisis in detail, giving extra attention to its affect to banks and to work on making banks less vulnerable to such external shocks. Studies into banking profitability Kumbhakar and KnoxLovell (2000, p.8) inform that Christensen, Jorgensen and Lau were the first researchers to estimate a flexible profit function in…

By John Dudovskiy

Category: Finance