Foreign Direct Investment (FDI) and the Economy of China

Arora and Vamvakidis (2010) inform that starting from the late 1970’s China has been achieving incredibly high level of GDP with an increase of 9% in average.

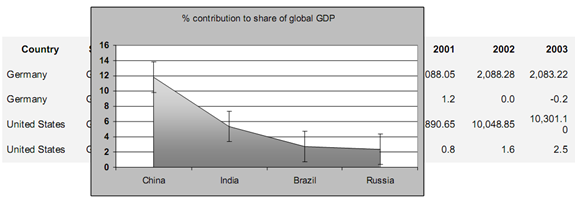

China has been the biggest contributor to the global GDP that has accounted for more than half the combination of GDP contributions by India, Brazil, and Russia which is illustrated in Table 1 below:

Source: International Monetary Fund

China current strong position is also supported by the fact that it’s GDP has ranked No.4 in the world with USD 3.52 trillion, or 8% of the total world in 2007 which is a great accomplishment taking into account the fact that in 1978 it was only 1% (The Foreign Economic Research Institute, 2009).

Today China is seen as an attractive destination in terms of investing funds and outsourcing operations. Although the country does not offer the cheapest labor costs with one USD per hour (Biz China 2007), many other factors contribute China to be attractive to investors and thus attracts huge amount of FDI inflows

The Factors Contributing to FDI inflow to China

There are many factors proposed that contribute to the FDI inflow into China several of them being the most important. Increasing workforce within the country as a result of the migration of large numbers of inland farmers to the mainland of China for purposes of employment is seen one of the main reasons for the increase of the FDI. Justin and Fox (2007) inform about proposition of USD 20 billion investment by western companies that has contributed to the reduction to the level of unemployment to 6% in 2007.

The number of population is seen as another important factor to the inflow of FDI in China due to the fact that large number of population of 1.3 billion with 800 million of which being an active workforce, domestic market huge for the consumption of the products and services produced in China as a result of FDI.

Moreover, together with consistently growing GDP the level of earnings among population is increasing as well which results higher consumption of products and services. Although, FDI in China mainly relate in Mainland China, nevertheless, more rural parts of the country benefit from its impact as well in the form of reduced prices for the domestic products as a result of higher competition, and, consequently the number of consumption of products and services increase.

Positive impacts of FDI on Chinese Economy

Conventional growth models, as well as numerous empirical studies indicate to the significant positive correlation between FDI and economic growth. For instance, an empirical study by Barro (1995) involved running a regression of per capita GDP growth on the investment/GDP ratio which resulted on a positive impact of investment on the growth of GDP. The study was undertaken on the basis of data obtained from 100 countries and found that 0.2-0.4 increase in GDP was achieved as a result of 10 per cent increase in investment ratio.

Another research undertaken by Zhang (2006) found the positive impact of FDI on host country’s economy. The study was taken further by Fahian (2010) who found a two way positive impact of FDI on the economy of host country.

Cheung and Lin (2003) focused their study on the overrun impacts of FDI on Chinese economy and established a positive relationship between them. The positive effect of FDI on the economy of a country is discussed on the work by Tseng and Zebregs (2002) as well.

The contribution of FDI for productivity and income growth in host country has been stressed by numerous empirical studies. The most notable researches in that aspect include the works by Barro (2005), Zhang (2006) and others. Many authors agree that in cases where FDI in any specific country is accompanied by unusually high rate of economic growth within that country, other factors apart from the positive impact of FDI may have played their positive role on the economic growth within the country as well.

Interestingly, there are research findings that find no positive correlation between FDI and economic growth in cases where the least developed countries are involved. This opinion is supported by OECD Report (2009) and the research undertaken by Fahrian (2010) that was tested in the case of Sri Lanka.

Developing countries, on the other hand, were found to benefit significantly from the inflow of FDI mainly because of presence of developing infrastructure, education and technology which is further boosted by the inflow of FDI.

The positive impacts of FDI on the economies of host countries were summarized by Zhang (2006) on the following points:

- FDI aids capital formation and employment augmentation.

- Manufacturing exports may be promoted by FDI

- Valuable skills, knowledge and resources are brought

As it was mentioned by Zhang (2006), FDI is likely to be an engine of host economic growth as inward FDI enhances:

- Capital formation and employment augmentation

- FDI may promote manufacturing exports

- FDI may bring host country special resources such as management know-how, skilled labour access to international production networks and established brand names

- FDI results in technology transfers and spillover effects as mentioned by Markusen and Venables, 1999, UNCTAD.

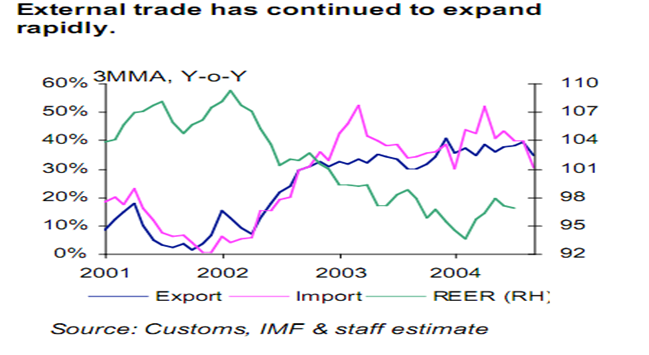

In the case of China, the most significant contribution of FDI has been the expanding China’s manufacturing exports which further and consistently have been enhancing the GDP growth over many years as shown in the below table.

Source: Chinese Bureau of Statistics, 2004

TheChina’s export has risen as the 26th with $18 billion and 47% in the world in 1980 to 3rd with $792 billion and 93% of the exports and manufactured goods (IMF, 2008).

Moreover, as stated by Zhang (2006) FDI tends to have brought extra gains toChinain facilitating its transition towards a market system that started in the late 1970 which promoted income growth.

The gains mentioned above helped the country to stimulate the move towards a more market orientation by introducing a market-oriented institutional framework; contributing to changes in the ownership structure towards privatization by promoting competition and facilitating the reform of state-owned enterprises and facilitating the integration ofChinainto the world economy.

Negative effects of FDI on host country

Even if there is common consensus about the existence of positive relationship between FDI and the economic growth, there are still evidences and empirical analysis provided by several researchers such as Fahrian (2010) who stated about drawbacks of FDI on host economy, Athukorala (2003) who found no relationship between FDI and the economic growth in the host country economy and Tseng and Zebregs (2002) who evaluated the pitfalls of the FDI in the host country economy.

Sun (2002) indicates that FDI does not only positively correlate with economic growth of any given country, but it also results in negative effects on the host country’s economic growth. The negative effects are a reaction to the distortions and inefficiencies in the domestic markets mainly due to distorting domestic stability of business cycle.

Another drawback of the FDI inflow into the economy of the host country has been analyzed by Athukorala (2003) who stated that the inflow of FDI does not necessarily correlate with the economic growth of the underdeveloped economy, but, underdeveloped economy may even lose the possible sources of future scarce resources to FDI enterprises.

Moreover, this evidence is further backed by Fahrian (2010) who stated that FDI inflow does not necessarily positively correlate with the economic growth of the host country as he empirically analyzed this in the case of Bangladesh and concluded that FDI does not actually bring economic growth in the host country, but the economic growth in the host country attracts the FDI inflow into the country economy.

Moreover, the research by Tseng and Zebregs (2002) state further drawbacks of FDI on host country economy through the complexity of tax system and intensified competition opportunities for the domestic investment.

Furthermore, according to The Marxist and dependency theory as stated by Zhang (2006), FDI by multinational corporations (MNCs) is usually used as one of the mechanisms of exploitation and gaining controls over developing countries by western industrialized countries.

And here are the following suggestions about detrimental effects of FDI on Chinese economy:

- FDI may actually lower the domestic savings and investment thus causing the domestic companies to be less competitive

- FDI may reduceChina’s foreign exchange earnings on both current and capital accounts

- The contributions of foreign-invested enterprises public revenue may be considerably less than it should be as a result of transfer pricing and variety of investment allowance provided by the Chinese government as stated by Zhang (2006)

- The management know-how brought into the country by multinational corporations may in fact inhibit the developing the local sources of these scarce skills and resources due to the foreign dominance in the Chinese markets.

- Multinational corporations may suppress domestic firms and use their advantage in technology to drive out the local competitors, indicating that the future tendency for the domestic companies is uncertain

- Multinational corporations exacerbate the inequality among population increasing the gap between the poor and the rich

- The management know-how and technology

References

- Arora, V., and A. Vamvakidis, 2005a, “The Implications of South African Economic Growth for the Rest of Africa,” South African Journal of Economics, 73(2), June, pp. 229-42.

- Athukorala, AW, 2003, “The Impact of Foreign Direct Investment for Economic Growth: A Case Study in Sri Lanka”, 9th International Conference on Sri Lanka Studies

- Barro, R., and X. Sala-í-Martin, 2004, Economic Growth, second edition. (New York: McGraw Hill)

- Tseng, W &Zebregs, H, 2002, “Foreign Direct Investment in China: Some Lessons for Other Countries”, IMF Policy Discussion Paper

- Zhang, KH, 2006, “Foreign Direct Investment and Economic Growth in China: A Panel Data Study for 1992-2004”, UIBE