SMEs in China: Overview

The definition of a small-medium enterprise (SME) is most commonly based on the number of employees that usually with fewer than 500 employees; In China, the definition of an SME is complex, which depends on the industry category and based on the number of employees, annual revenue and total assets, and this criteria on small and medium-sized enterprises are based on the SME Promotion Law of China (2003), which sets the guideline for classifying SME’s.

The definition of a small-medium enterprise (SME) is most commonly based on the number of employees that usually with fewer than 500 employees; In China, the definition of an SME is complex, which depends on the industry category and based on the number of employees, annual revenue and total assets, and this criteria on small and medium-sized enterprises are based on the SME Promotion Law of China (2003), which sets the guideline for classifying SME’s.

1. The relevant size of the SMEs is significantly smaller than the large and listed companies inChinadue to the size of their capital stock, credit allowance.According to Guo and Li (2007) ,the Structural characteristics of SMEs in China are:

However, in recent years, some SMEs have grown really large in size due to their continuous improvement and technological improvements.

2.>After the reformations of government legislations in 2005 for the favour of SMEs in China, nowadays, SMEs have been operating in different branches of businesses such as manufacturing, services, construction, transport and retailing. This support has helped the emergence of many more SMEs inChinawhich means there is even greater demand for financing all these SMEs.

3.> Small enterprises also make up huge proportion of SMEs in China which usually lack the degree of specialization and cooperation in the production areas. This is mainly due to the fact that there is lack of government legislations that supports and shows guidelines for SMEs inChina.

4.> The main market for SMEs is the domestic market of China which is due to the fact that SMEs can not cope with fierce competition in the international markets or does not have advantage over foreign-invested companies with high-tech. Due to shortage of funds, most SMEs operate mainly in labour-intensive small and medium industries as the technological progress is slow for them.

The private sector—a major driving force in economic expansion

Liu (2007) mentions about the increasing importance of SMEs in China as China’s private sector have become its main driver of economic growth. The statistics show that in 200, there were more than 40 million Small and Medium sized enterprises which accounted for more than 99.6% of the total number of enterprises in China. In terms of their contribution to the overall economic growth of the country, SMEs contributed as much as 59% of GDP and represented more than 65% of the imports and exports in the country. The tax revenue paid by the SMEs in the same year also accounted for more than 48% of the overall tax collected by the government.

One of the reasons for the growth of private output by SMEs has been due to the result of the higher productivity of most companies in the sector. The sharper incentives facing the private sector companies have resulted in them using les capital and labour than the stat-owned companies (Liu 2007).

Gray et al (2007) further stated that the aggregate productivity of private companies in the industrial sector has been estimated to be nearly twice as much as their counterparts in the state-owned companies. This also has led to increased profitability of private companies considerably and the rate of return on the assets employed by these companies was also twice as much as the companies which were controlled directly by the state.

As China is reliant on international trade, the economy of the country started to be more reliant on private sector companies as their contribution to exports has risen to two-thirds of all exports in 2005. Wu and Song (2008) further mentioned that even though more of these exports are achieved by foreign-invested companies, the shares of small and medium sized enterprises are also increasingly after they have been granted export licenses (OECD 2005).

Due to the key role that private sector plays in market oriented economy, Chinese government have realized and recognized the importance of the private sector for economic growth, job creation and its effects on the infrastructure, therefore, the government have started to reduce the barriers that limit its expansions and promote and support them in the same way as publicly-owned companies (OECD Report 2006).

Zhang et al (2005) pointed out the fact that even if the government has realized about the importance of private sector that hugely contributes to the economic growth of the country, and introducing new policies and legislations to support the companies in the private sector, there have not been enough emphasis on the support and promotion of SMEs in China. They further stated that even if SMEs are usually included in the benefits offered to private companies, they usually face obstacles in financing their businesses due to the lack of modern reformations in the banking industry of the country as most banks do not prefer issuing loan to SMEs as they assume that SMEs are riskier than other larger and more stable private companies.

Capital Structure theories and financial growth circle model

The capital structure model was promoted by Modigliani and Miller (also known as MM) (1958) which indicated that the value of the company is unchanged by the alternative mix of capital structure, namely the structure of the capital is irrelevant to the value of the firm assuming that no tax and all profit are apportioned as dividends. However, Gray et al (2007) stated that such a perfect capital market does not exist in real life.

Jensen and Meckling’s (1976) (cited in Gregory et al, 2005) agency theory provides insight into the financial management of capital structure where it states that a contract is made where a principal (owner) hires and agent (directors) to run the company on their behalf by delegating the responsibilities and pays them for it. However, in the case of SMEs, majority directors of the businesses are owners of them too.

Cassar and Holmes (2003) mentioned about the pecking order model by (Myers, 1984), which suggests that firms have a particular preference order to finance their businesses. He indicated that due to the information asymmetry between the firm and the potential investors, the agents (managers) know more about the firm, its potential value and future prospects than the new investors. Therefore, managers know what form of financing is available to the business at any given stage. From this point of view managers usually try to obtain the financing that they think is obtainable for them. This sometimes leads to a situation where managers have not tried other available sources of financing as they assumed that the source of finance they obtained has been the best and only choice for them.

Many researchers have researched the capital structure decision form the perspectives of small firms (Gregory et al, 2005, Cassar and Holmes, 2003, Coleman, 1998, Berger and Udell, 1996 and many others). This is due to the fact that problems related to financing normally arise predominantly in small businesses due to inadequate financial resources both in their start-up and growth stages.

One of the most famous models proposed was undertaken by Berger and Udell (1998) where they proposed that small businesses have a financial growth cycle in which financial needs and options change over time. They further stated that financial needs of the firm are also dependent on the size and age of their operations. When they are young and small, they usually rely on initial finance such as personal savings and borrowing from friends and family. When they reach to growth stage, they will get an access to intermediated finance which can be both in the form of equity and loan. When they get even bigger and older, they will gain an access to public equity and debt markets.

They further pointed out to the fact that the growth cycle is not always intended to fit all small firms.

Sources of Finance available to SMEs in China

Scott and Wang (2006) state that there are several sources of finance available for SMEs in China. However, types of finance that are both available and obtainable differ for SMEs in different life cycle of the enterprises. They mentioned the following sources of finance available for SMEs in China:

Personal savings

This form of financing is usually preferred if it is available as it does not require any interest payments in a fixed nature. Therefore, due to difficulties in finding and obtaining loan at the start-up stage, most owners of the small enterprises usually invest their own savings.

Loan from immediate friends and relatives

This is another source of finance for SMEs in China as majority SMEs are organized and opened with the help of this type of financing. Due to strong family culture inChina, the access to this type of financing is easier than it can be found in EU or theUS.

Trade credits

Zhuo (2001) stated that trade credits is one of the financing sources for SMEs in China as it gives them the privilege of paying back to their suppliers later. This is also considered to be a good form of financing methods as small and medium sized enterprises usually struggle with cash at the early stage of their business operations.

However, getting a trade credit also requires SMEs to provide healthy and strong cash flow statements, where in many cases it is impossible.

Bank loans

Banks loans are crucial sources if financing any business in most countries due to the length and lower interest rates than the equity. However, obtaining a bank loan is another obstacle in financing SMEs in China. This is due to the fact that most of the banks are state-owned commercial banks that hold most of the deposits and lending power in the country. Therefore, due to their relatively large and monopoly position, commercial banks usually prefer to lend money to large and listed companies as they are less risky than SMEs in terms defaulting the interest payments.

Moreover, commercial banks usually offer excessively large amounts of loan that is much more than the needs of SMEs, therefore, they are less interested in issuing loan to SMes due to economies of scale.

Furthermore, the credit ratings required to obtain a loan from these banks are really high, and in most cases SMEs credit ratings do not meet these high ratings requirements by state-owned banks (Fontes, 2005).

However, as mentioned by Wu and Song (2008), SMEs can access to different sources of finance based on their business life cycle. They further state that key financial resources for the start-ups are usually their personal savings or money borrowed from their immediate family and friends. This finding has been consistent with the western counties too as the findings of Bank of England (2003) data suggests that 60% of business owners used their personal savings as an initial source of finance. This is also compared to the findings of Research Commission of Chinese Private Business (2002) where the report identified that 65.5% of capital used to start the new business is originated from personal savings, 21% from bank loans and the remaining are originated from other sources of finance available to SMEs.

Small and Medium sized business financing in China

After the China constitution has found the private sector to be important part of the economy y the end of 1990, the government has gradually started lifting the barriers on the development of SMEs so that small businesses could develop quickly to add more value to the economic growth of the country (Chen, 2006).

Podpiera (2006) stated that instead of rewarding SMEs inChina, there is discrimination against in terms of access to external funding, historical political pecking order and underdeveloped capital markets which could have allocated financial resources to the least efficient small businesses rather than most efficient private firms.

Even though 3.3 million registered private companies which contributed to more than half of the GDP inChinawhich employed 47.1 million people in 2004 received only 10% of all banks loans (Wu and Song, 2008).

Cousin (2007) mentioned the sources of finance for all types of business, including for SMEs in China. He stated that the main sources of finance which are the banks are made up of 4 big SOCBs, 3 policy banks, 13 joint-stock commercial banks, 115 city commercial banks, 30,438 rural credit cooperatives and some other foreign banks.

OECD (2005) mentioned that the government directly and indirectly holds between 95-99% of the all banking deposits and assets. Due to close links between the government and banks, the government usually supports the banks by giving them a lot more freedom to operate, however, the influence of the government in the banking industry is still huge.

His findings lead to the conclusion that lending to SMEs by banks usually has political reasons rather than economic or financial disadvantages.

Wu and Song (2008) considered three aspects that affect on the financing of SMEs which are the government intervention or interference, the historical relationship between SMEs and the state-owned banks and the financial market environment. They stated that the interference by the government is usually carried out through scrutinizing banks to have very strict checks and ratings when issuing loans to private sector companies or firms as the government does not want the firms to default on their payments.

Moreover, the historical relationship between SMEs and the state-owned banks always have been negative, as the state-owned banks always restricted the ways of issuing loans to the SMEs considering them as risky businesses that may not pay as much interest payments to the banks as other large or listed companies due to their relatively small size.

The financial and capital markets as mentioned by Wu and Song (2008) is another aspect that affects the financing of SMEs in China due to lack of sufficient funds available in the financial market, lack of risk management practices, too high liquidity levels required by available lenders or selective nature of the lenders as most of them only accept very limited fixed assets such as land and building when issuing a loan.

The obstacles in financing SMEs in China

Mu (2002) stated that SME financing is an issue everyone in the world, however, it is even much harder to finance SMEs in China due to several reasons. Even though after the government found out the huge positive impact of private sector companies and lifting some barriers for their growth, financing and expansion, SMEs still do not tent to be treated equally same as large private banks.

The People’s Bank of China (2006) stated that the official number of SMEs in China exceeded 12 million in 2005 which accounted to 99% of the private sector companies. Their contribution to the economic growth of the country also has been huge as SMEs contributed more than 50% of the GDP in 2005 alone, more than 48% of the overall tax collected by the government came form SMEs in China. Moreover, SMEs also have been reducing the unemployment in the country that helos the government to achieve its macroeconomic targets.

Furthermore, especially, after the government lifted the restrictions of SMEs operating in certain business sectors have been removed in 2005 there has been rapid growth in the number of SMEs operating in many business branches of China. Another factor that helped SMEs to expand in size have been the granting of license to export their products to foreign countries by the government.

However, even if the government has been lifting barriers for the development of private sectors, there still seems to be a lot more barriers for SMEs in terms of access to the sources of finance. One of the reasons, as suggested by Liu (2008) is the weak linkages with the external market, weak technological innovation and limited SMEs financing have limited Chinese SMEs growth.

Financing is very crucial to help and support SMEs to set up and expand their operations, develop new products, and invest in new staff recruitment, training or production facilities. If SMEs are successful, there comes a time for developing SMEs when they need new investment to expand or innovate further. Financing is the area where SMEs often run into problems, because they find it much harder than larger businesses to obtain financing from banks, capital markets or other suppliers of credit. (OECD, 2006). Liu identified and proposed two main reason for the difficulties in financing SMEs in China which are the following:

Access to both internal and external sources of finance

As mentioned by many researchers, SMEs lack access to external financing due to political reasons, or simply due to the fact that they do not meet the requirements of the external financing. As mentioned by Gray et al (2007) external financing is one of the best possible sources of finance for any business as the small enterprises may find not only a lender, but also a partner when the credit is sourced from outside the country.

The difficulties in obtaining loans from the local banks is another difficulties as the amount of the loan required by SMEs are fairly small and insignificant for state-owned commercial banks, therefore, banks usually prefer issuing loans to large and listed companies, moreover, due to fairly young age, experience of SMEs in the marketplace, banks assume that the level of risk in defaulting their payments is really high for SMEs compared to other larger companies in China.

Structure of the financial structure

Fontes (2005) states that China lacks adequate credit system that supports the financing of SMEs due to the structure of its financial system. Almost all large banks are state-owned or even the ones which are private have are strongly controlled by the government as the government holds more than 95% of the deposits in those banks either directly or indirectly. Moreover, these banks, due to strict regulations and intervention by the government, require really high credit ratings. This creates extra burden for SMEs in China as they can not always meet these high credit ratings.

Furthermore, even if SMEs can meet the credit rating requirements by the banks, the amount of loans being offered by banks are excessively high which is much more than the needs of the SMEs for their financing. At the same time, banks are not eager to issue smaller portion of loans to SMEs due to economies of scale, therefore only large banks benefit from these loans offered in the cost of SMEs.

Moreover, the capital markets are also not well developed to meet the needs of all enterprises in China(OECD, 2006). This cerates extra hardship for small and medium sized enterprises to obtain loans in the capital markets.

Furthermore, Kanamori and Zhao (2004) also mentioned that there is lack of institutional shareholders in China, therefore, there is lack of liquidity to absorb outstanding shares in the markets.

Therefore, the government has been encouraging the entrance of insurance companies and securities investment funds to invest into the stock markets which has been growing recently.

Political Risks

According to Mu (2002), since the most SMEs are from private sector, they impose great risk to the larger companies such as banks which are still state-owned. Therefore, due to strict regulations and intervention by the government, banks can not risk by issuing loans to SMEs which are highly likely to turn into bad debts that adversely affects the government investments in those banks.

Moreover, even though China has been reforming its financial markets and lifting barriers from private sector companies to make them have equal treatments as publicly-owned companies, there is still preference of state-owned enterprises over the private sector companies, including SMEs.

Tax and Investment policy treatments

Kanamori and Zhao (2004) stated that private SMEs have disadvantages in terms of accessing credit and receiving approval due to their weak links and connections with the local authorities as compared to state-owned enterprises or privatized former state-owned enterprises. They further pointed out to the fact that the degree of disadvantages for SMEs are also true for incentives in investment policy with respect to state-owned and foreign invested companies. Another disadvantage or discrimination of SMEs compared to foreign-invested companies is that when the foreign-invested companies get two years of tax exemptions after they announce their first profit, the domestic SMEs simply carry on paying tax at the rate of 33% income tax and 20% individual adjustment tax.

This may have a negative impact on the future expansion and growth of SMEs as they are not being supported and promoted by the government with tax incentives or other advantages of this nature.

Economies of Scale

Economies of scale have been found as another obstacle in the way of financing SMEs in China (Fontes, 2005). The banks in China are predominantly in monopoly position as most of them either belong to the government or even if private, normally intervened by the government as the government holds the highest deposits in the banks. Due to relatively large sizes of the banks, they do not prefer to give out small amount of loan to SMEs as the interest income receivable from them does not satisfy the banks. Therefore, they usually prefer dealing with large companies who can borrow in large amounts and return large interest income as well as being more stable and secure compared to SMEs.

Accounting and Auditing

Accounting and auditing has been one of the factors that create difficulty for SMEs to gain an access to credits in the banks and capital markets. Nugent and Yhee (2001) stated that financial structure of private firms, mainly SMEs are not accurate and consistent as there is a lack of transparent, audited financial records. There are restrictions to register under different forms of incorporation in order to claim for incentives or to misrepresent financial flows or statements.

Credit rating

Fontes (2005) also mentioned about the credit rating as another critical issue that needs to be addressed in order to ease the situation for financing SMEs in China. He stated that there is a lack of credit rating assessments for SMEs in China together with a low priority and incentive to build a credit reputation for SMEs since it does not have a direct effect on the future borrowing.

It may seem to be easier to apply and obtain loan in the first sight, however, as mentioned by Kanamori (2004) this affects negatively the quality of loans and decreases further the credit rating of SMEs which once again makes them less credible in the eyes of banks and other financial institutions.

Existence of collateral to banks

Berger and Udell (1998) stated that in general it is easier to assess the value of the company’s assets rather than its expected future cash flows. They further stated that 92% of the SMEs debt is secured by appropriate collateral in the US and 52% of the debt is secured or guaranteed by the owners of the businesses. One of the common and available sources of collateral for SMEs are the trade receivable from credit sales and the inventory that they have on hand.

However, this is not the case in China as there is lack of appropriate collateral to support their repayment ability in front of banks. The eligible collateral that can be used as a guarantee when obtaining a loan is specifically shown in the form of a law which are usually hard for the SMEs to have or to provide to banks.

Firms financing constraints

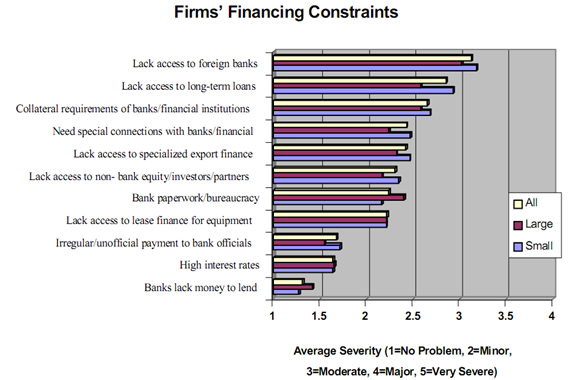

Fischel and Lai (2004) identified the key constraints in financing firms in China. Their findings have ranked the constraints in order of importance and difficulty. The constraint that scored the highest among all obstacles in financing firms in China is the lack of finance to foreign banks. This obstacle also has bee indicated by Fontes (2005), Liu (2007), Mu (2001) and many other researchers in this field. This obstacle has scored more than 3 marks (refer to table below) which means that the issue is between moderate and major.

The second highest scoring constraint in their findings has been the lack of access to long term loans available to SMEs in China. This is due to the fact that the credit ratings of SMEs do not allow them to be able to obtain long term loans. This is further strengthened by the historic adverse relationship between the state-owned banks and the companies from private sector.

Source: Fischel and Lai (2004)

Collateral requirements also has been mentioned by many previous researchers into the filed as one of the major obstacles to finance the SME in China. Fischel and Lai (2004) findings ranked this as the third most important constraint in their findings due to its strict rules that discourage SMEs to obtain loan.

SME financing Policies in China

The increasingly significant contribution of private sector to the economic growth og the country has enabled the Chinese government to take some measures in order to support and promote the private. One of the barriers that the government has been trying to lift is to make an easier access to finance SMEs in China.

Therefore, after the reformations of private sector in 2005, the government started to issue policies to support SME financing that has consisted of a mixture of interventions in financial markets and programs for local governments for SME development.

The initial restructuring of SME sector started in 1999 in a series of measures (OECD, 2006). The series of programs included the promotion of firm groups and the exit og non-viable small firms, set up of business development services that assist SMEs on consulting, funding, marketing, credit guarantee, technical support and many other beneficial support schemes.

Wu and Song (2008) stated that the SME Promotion Law was enacted, emphasizing fair treatment for SMEs in the country. These support schemes were complimentary to the initial Government Procurement Law of 2002 which encourages the banks to ease the loan approval procedures for SMEs with a good credit records. There have been other supports as well in the financial sector where the banks established ceiling on interest rates for loans to SMEs (Wako, 2004).

References

- Barton, S. and Gordon, P. (1987), “Corporate Strategy: Useful Perspective for the Study of Capital Structure?”AcademyofManagementReview, Vol. 12, No. 1, pp 67-75

- Bank of England (2003), “Quarterly Report on Small Business Statistics”, Bank of England, October, available at: www.bankofengland.co.uk.Acessed on 05.01.2011

- Berger A.N. and Udell G.F. (1995), “Relationship lending and lines of credit in small firm finance”, Journal of Business, Vol. 68, pp351–382.

- Berger, A. N. and Udell, G.F. (1998), “The economics of small business finance: The role of private equity and debt markets in the finance growth cycle”, Journal of Banking and Finance, Vol.22, No. 6–8

- Berger, A.N., and Udell, G.F. (2006), “A more complete conceptual framework for SME finance”, Journal of Banking & Finance, Vol. 30

- Cassar, G., & Holmes, S. (2003), “Capital structure and financing of SMEs: Australian evidence”, Accounting and Finance Vol. 43

- China Banking Regulatory Commission (CBRC) (2006), Strengthening Regulations, Improving City Commercial Bank’s Reform and Development

- Chen, J. (2006), “Development of Chinese Small and Medium-sized enterprises”, Journal of Small Business and Enterprise Development, Vol.13

- Gregory, B.T., Rutherford, M.W., Oswald, S. and Gardiner, L. (2005), “An empirical investigation of the growth cycle theory of small firm financing”, Journal of Small Business Management, Vol. 43, No. 4

- Fu Zhuo.China’s SMEs financial management model [D].XiamenUniversity, 2001

- Jensen, M. and Meckling, W. (1976), “Theory of the firm: managerial behaviour, agency costs and ownership structure”, Journal of Financial Economics, Vol. 3, pp305–360

- Kimki, A. (1997), “Intergenerational Succession in Small Family Businesses: Borrowing Constraints and Optimal Timing of Succession”, Small Business Economics, Vol. 9

- Kanamori,T.(2004) Fiscal Reforming the People’s Republic of China-Current Issues and Future Agenda. Research Paper55,Asian Development Bank Institute.

- Kanamori,T.&Zhao,Z.(2004).Private Sector Development In the People’s Republic of China. Asian Development Bank Institute.

- Mayers, S.C. (1984), “The capital structure puzzle”, The Journal of Finance, Vol. 39 No.3

- Mu,Y.(2002).Impediments for SME Access to Finance and Credit Guarantee Schems inChina. Financial Sector Operations and Policy Department, The World Bank

- National Development and Reform Committee (NDRC) (2006), 2005 Annual

- Nugent,J.B.&Yhee,S.-J.(2001).Small and Medium Enterprises inKorea: Achievements, Constraints and Policy Issues. World Bank Institute, Washington D.C

- Development Report of China’s Growing SMEs, 06/01/2006, Beijing, China

- Organisation for Economic Cooperation and Development (OECD) (2005), China OECD Economic Survey (2005)/13, Sept

- Zhang, X. (2004), “The difficult way to marketisation of interest rates”, Caijing Magizine, 29, Nov.

- Zhang, D. (2006), “ABC Bank to restructure by end of ’06”, China Daily, 18 Jan.

- Wang Lei. For SMEs financial management thinking [J]. Commercial modernization, 2007, (06)

- SCOTT David and WANG Jun, (2006), Developments and Prospects for Rural Finance in China, Washington, World Bank