Posts by Anna Jordan

Plog’s tourist motivation model (1974) is a popular framework widely referred to in tourism studies. According to the model tourists can be divided into two broad categories: allocentrics and psychocentrics. Allocentrics usually choose exotic destinations and unstructured tours and vacations they prefer to get involved with local culture to a great extent. Psychocentrics, on the other hand, choose familiar destinations and they usually engage in tourism via packaged tours in a conventional manner (Plog, 1974). The terms of allocentrics and polycentric were later replaced by Plog (1974) to the terms of venturer and dependable respectively, in order to make them more ‘reader-friendly’ (Hudson, 2008). Plog’s (1974) Psychographic Personality Types Source: Hudson (2008), adapted from Plog (1974) and Plog (2002) As it is evident from figure above, according to Plog’s tourist motivation model the majority of tourists can be classified as mid-centric, i.e. they do not belong to neither psychocentric or allocentric categories. Plog’s (1974) Psychographic Personality Types has been criticised for being difficult to be applied because individuals may travel motivated by different factors in different occasions (Hudson, 2008). In other words, an individual may choose an exotic destination for tourism and get closely involved with local culture, yet it may not be appropriate to brand the individual as allocentric because the same person may purchase a conventional tourism package the following year. References Hudson, S. (2008) “Tourism and Hospitality Marketing: A Global Perspective” SAGE Publications Plog, S.C. (1974) “Why Destination areas rise and fall in popularity” Cornell Hotel and Restaurant Quarterly, Vol.14, Issue:4 Plog, S.C. (2002) “The power of psychographics and the concept of venturesomeness” Journal of Travel Research, Vol.40

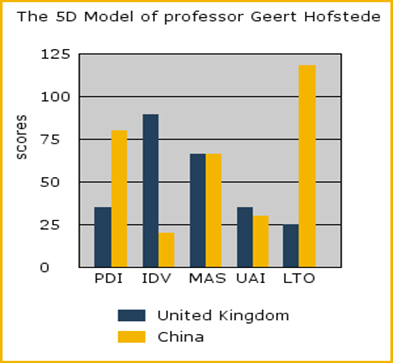

According to Hofstede’s model for cultural differences and analysis between China and UK, the following table has been produced in reference to the link provided. Adopted from: http://www.geert-hofstede.com/hofstede_dimensions.php?culture1=94&culture2=18#compare According to power distance index, the Chinese understanding of power distribution and inequality is more than two times higher than the UK expectations. This indicates that the Chinese team management style is inclined to one person in the organization to have higher power than others and that person is perceived to be in a higher position than others. And according to individualism aspect of the above table, theUKorganization culture tends to have more individualistic approach than that ofChina. This indicates that individualism is more developed inUKcompanies and team management than Chinese. The reaction to risk in both countries tends to be in a very similar level. However, in terms of planning, the UK culture indicates to have short term planning, whereas, the Chinese to be long term planning. Based on above analysis, it can be concluded that the following type of management would be most appropriate to operate the business unit effectively in China: The management style similar to autocratic, where management tends to have more power to run the company as collectivism is highly appreciated in Chinese organizations. This indicates that subordinates are happy to follow the leader. In terms of planning skills of management, a manager with long term planning goals should be most appropriate here as Chinese management and employees tend to think well into future. Gender does not make big difference as both countries tend to have same levels of approach to genders, according to table above. Therefore, a person who can work collectively with others, more challenging towards others and risk aware would be ideal for the manager position here. The person suitable for this position…

The structure of an organisation is a formal framework for making decision through which division; coordination and grouping of tasks are done. It defines the organization units and policies explicitly and states the procedures and objectives of the organization. A representation of the organisational structure can be done using a chart which shows relationship between different jobs, departments and leaders. The structure of an organization shows the hierarchy in responsibility and management of the organisation. It is essential for management during implementation of changes to an organization and acts as a guide to new recruits in the organization.

The routines of adoption have been the conservative and the formats to be prescribed in detail in valuation of assets. The differences under IFRS and GAAP have been seen in the example of Telofonica Company, as its balance sheet showed two different figures in valuation of assets. The financial statement prepared under IFRS showed higher result of assets compared to GAAP mainly because the IFRS lets the companies revalue their assets. Moreover, the strict control of compliance with the Directives (Fourth and Seventh) when using IFRS has also been mentioned as one of the main factors to be taken into consideration. Furthermore, according to one of the respondents, the requirement under the Fourth Directive that annual accounts should present a true and fair view of a company’s assets, liabilities, financial position has also been mentioned as a key factor while adopting IFRS. The findings regarding the adoption of IFRS by EU listed companies are that majority of EU listed companies have adopted the IFRS for more than just for consolidation purposes and their answers have been categorised below according to their level of importance: The process of adoption is complex, burdensome and at the sae time expensive Companies do not think that they can lower the cost of capital even if they apply IFRS Key challenges as mentioned during the interview are lack of guidance while converting and implementing IFRS, lack of uniform interpretation even though IFRS tends to be more flexible and informative And majority of EU companies would not adopt IFRS if it was not required by EU regulation. Moreover, conversion to IFRS will also improve the shareholder orientation in countries such as France and Germany as they used to emphasize on tax regulations and stakeholder orientation, therefore, these country’s investors benefit greatly due to them being as…

1. Advantages of IFRS compared to GAAP reporting standards 1.1 Focus on investors One of the significant advantages of IFRS compared to GAAP is its focus on investors in the following ways: The first factor is that IFRS promise more accurate, timely and comprehensive financial statement information that is relevant to the national standards. And the information provided by financial statements prepared under IFRS tends to be more understandable for investors as they can understand the financial statement without the necessity of other sources which makes investors more informed This also helps new or small investors by making the reporting standards simpler and better quality as it puts small and new investors in the same position with other professional investors as it was impossible under the previous reporting standards. This also helps to reduce the risk for new or small investors while trading as professional investors can not take advantage due to the simple to understand nature of financial statements. Due to harmonization and standardization of reporting standards under IFRS, the investors do not need to pay for processing and adjusting the financial statements to be able to understand them, thus eliminating the fees of analysts. Therefore, IFRS reduces the cost for investors. Reducing international differences in reporting standards by applying IFRS, in a sense removes a cross border takeovers and acquisitions by investors. Based on information mentioned above, it can be assumed that because higher information quality reduces both the risk to investors from buying and owning shares and the risk to less informed investors due to wrong selection due to lack of understanding, it should lead to reduction in firms cost of equity capital. This on one hand should increase the share prices, and on the other should make new investments by firms more attractive. Moreover, the following…

The “Open Doors Policy” or the economic reformations of the late 1970s in China enormously changed the entire economy of the country. The trade reformation which focused on liberalizing the trade which shifted the country a step closer to free market attracted huge foreign capital into the country in the form of FDI since 1978. The huge scarce resources of China had to be utilized soon after the reformations which indeed required huge capital. However,China heavily relied on the external funds in order to promote its manufacturing industry and the financing of newly privatized formerly state-owned companies. Therefore,China’s government issued series of policies which favoured the foreign investors. The inflows of foreign capital in the form of FDI brought in advanced technology, knowledge, management know-how which accelerated the economic growth in China in the last three decades. Since the “Open Doors” policy and trade reformations in the country in 1978, the country has been consistently achieving significant economic growth which averages at 10% of GDP. When the growth rate of China is compared to other developed economies such as USA which has an average of 3% GDP growth in the 100 years and Germany which has an average growth rate of 1.3% of GDP and Japan at 3.85% of GDP in the few decades, China is far ahead (IMF, 2009). However, many western policy makers and commentators believe that the main source of growth of China has been mainly due to FDI inflows which have been encouraged by fixed exchange rate. The source of economic growth of China is derived from three phases of development which are broken down into three periods of years. The first phase of development lasted from 1952-1978 where the Chinese government prioritized the development of heavy industries such as steel, chemicals and machinery. The second…