Contribution of the class to analytical and behavioural skills I have gained huge benefits from learning the module of International Marketing both at personal and professional levels. Professional benefits include the knowledge I have gained regarding the subject and all the related principles, and theories like the impact of globalisation in international marketing, the importance of segmentation, the current global marketing issues, the global marketing environment and its influence to companies, global market entry strategies, components of a global marketing plan etc. Personal benefits I have obtained as results of the module include skills I have gained like increasing the level of my cross-cultural awareness, the ability to critically analyse global issues, improving my communication skills etc. I was familiar with the subject of marketing even before the module through marketing management module I have attended before. However, International Marketing module has equipped me with knowledge and way of thinking that allowed me to approach the issues of marketing I was already familiar with from a global perspective. For example, the analysis of external business environment in marketing management which is done using PESTEL strategic tool, external factors affecting the business were looked at in a specific country level. In international marketing, on the other hand, each individual factor of PESTEL analysis is looked at in the global level, allowing me to see the bigger picture. This is very important taking into account the fact that the forces of globalisation are ever-increasing, the importance of trade border between the various countries are decreasing, and as a result today companies may expect competition for their businesses from any parts of the world. I found the decisions regarding the components of marketing mix to be more challenging in international marketing than these decisions to be taken within company’s home country alone, because increasingly…

By John Dudovskiy

Category: Personal reflection & development

China’s rapid growth last three decades offered big opportunities for foreign companies eager to expand their business and market. Moreover, special privileges and tax incentives provided for these big companies led them heavily invest in China’s market and increased inflow of FDI into country. As a result, today most global companies like General Motors, Siemens, Coca-Cola, Nike and many others are making more aggressive push into China, in some cases moving not only their production centres but their research and development centres too (Barboza, 2010). Also, it is clear that FDI is usually imported to a host country by rather multinational companies than small-medium sized businesses, whose seeking to take advantage of particular benefits, that is to say cheaper work force, cheaper land value, cheaper taxes etc, in order to reduce the production cost and to gain a competitive advantage over rival companies. Therefore, it is important to acknowledge how vital these Multi-National companies (MNC’s) have been to China’s rapid expansion in foreign trade and its export growth as they introduced new and advanced technologies in many sectors and industries, most of which are export oriented, which in turn raised product quality. Furthermore, with creation employment and higher wages, they helped to raise living standards and to improve local infrastructure in rural areas of country. Main determinants of FDI in China There have been numerous factors that resulted in significant proportion of FDI inflows into China. But the most important ones that attracted huge levels of FDI into the country are the following: First of all, since the economic reformation of China in 1979, the country realized that it needs foreign capital in order to improve the economic infrastructure of the country, therefore, it promoted the trade openness that enhanced the levels of FDI. Secondly, due to increasing levels of…

As part of the economical reforms that began in 1978, the Chinese authorities shaped preferential policies to attract foreign investments. As a result, China received a hundreds of billions of dollar in FDI, making it largest developing country to host FDI as recent inflows account for nearly 40 percent of combined flows of FDI to all developing countries (IMF 2000). Though these figures very impressive, however, there are certain problems that Chinese government has to overcome if FDI is needed to sustain country’s continuing record growth rate and further its economic development. The figures published by OECD (2000) shows that distribution of FDI in Chine has been very disproportionate among regions. Between period of 1983 and 1998, eastern region attracted 87.8 percent of FDI whereas the central region took 8.9 percent and western region grabbed only 3.3 percent. The report states that main reason behind this inequality is inappropriate FDI policies taken by the Chinese authority. Creation of special economic zones (SEZs) and preferential regimes for 14 coastal cities resulted in geographically an overwhelming concentration of FDI in the east region. Only after adoption of more broad-based economic reforms and open door policies for FDI in the late 1990s, spreading of FDI inflows into other provinces accelerated. However, Broadman and Sun (1997) argue that FDI’s geographically distribution in China is influenced by many different factors rather than solely government policies. They empirically analysed the geographic determinants of FDI in China and concluded that to a large extent the destination of FDI within China is determined by market size, the extent of infrastructure development, the basic education level among adults, vicinity to import and export markets as well as capital sources and special investment policies. The sectoral of FDI varies from country to country and from year to year. As for…

By John Dudovskiy

Category: Finance

Total inward and outward FDI flows Inward FDI – Since after the economic reformation of China, the country moved towards more market oriented economy, it has received a very large part of international direct investment flows.China has become the second largest host country to FDI in the world afterUnited States, and the largest FDI recipient among the developing countries. In fact, as stated by OECD report (2000), for period of twenty years, actual amount of FDI inflows from 1979 to 1999 totaled to 306 billion US dollar, which is equal to 10 percent of direct investments worldwide and around 30 percent of investment amount for all the developing countries. Furthermore,China consistently continued to receive a large share of direct investments in developing countries in the first decade of 21st century. This argument backed up with figures published by OECD (2005) with the inward FDI into mainland China rising to amount of $55billion in 2004 from $47 billion in 2003. However, there is significant concern among experts in China about possible overheating of the investment cycle as much of this investments accounted toHong Kongbased investors. Outward FDI – While China continues to be largest FDI recipient, it is also gaining importance in world stage as outward investor as well. Many large companies operating in China appear to developing into truly international corporate networks through investments. Moreover, Chinese enterprises are increasingly trying to do “strategic” investments abroad, not least to gain access to raw material. However, the process has been uneven. Figures released by China’s State Administration for Foreign Exchange (OECD Observer, 2005) shows that net outward FDI declined from a peak of $6,9 billion in 2001 to £152,3 million in 2003, then slightly recovered to $1,8 billion in 2004. Nevertheless, OECD figures suggest that these figures may understate the position. …

China’s economic transformation towards more market oriented economy has been one of the most dramatic economic developments of recent decades. Between the period of 1979-2009, China’s growth rate averaged 9% per annum and its integration into the world trading system has been crucial (IMF, 2010). Between the period of 1979 to 2005 its share in world trade has increased from less than 1% to 6, 4%. After three decades of spectacular growth,China even beat Japan to become world’s second largest economy behind the US (Barboza, 2010). Thanks to its open economy, the ration of foreign trade to GDP increased from 12 per cent to 34 per cent (OECD, 2005). According to study of Zhang (2006) and many others, the significant growth in China’s foreign trade in the past two decades has strong relationship with the inflow of FDI as it has been core at the core of China’s foreign trade expansion. Furthermore, this was backed by the OECD report (2000) that FDI has been decisive factor in China’s involvement in the international segmentation of the production process known as globalization. Following the large amount of FDI in manufacturing field, exports and imports as a share of GDP rose from negligible amounts to nearly 25 percent in 2000. The average tariff rate fell from 50 percent in the early 1980s to about 15 percent in 2000, less than half of that India as China exempts so many goods entirely from custom duties. Moreover, a significant share of imported goods are illegally imported, the tariff collection rate as a percent of total value of imports has been much lower. As a result, the tariff revenue as a percent of total imports is only 3 percent in China, compared with 23 percent inIndia. As matter of fact, the net FDI inflows into China…

By John Dudovskiy

Category: Finance

FDI was recognized by Chinese authorities to be one of the important success factors for transformation from the centrally planned economy to the market economy from the very beginning of the transformation process. At the same time, authorities were unwilling to significantly reduce the level of the state control over the economy. According to Tseng and Zebregs (2002) ‘ideological obstacles’ had to be overcome by authorities, as well as traditional stereotypes that related FDI to imperial colonialism that needed to be avoided. It is a common opinion that due to the fact that these stereotypes have been around for several generations the inflow of FDI into China was increased at a reduced speed compared to its actual potential. Long (2002) mentions such legislations as Law of the People’s Republic of China upon Foreign Wholly Owned Enterprises, Law of the People’s Republic of China upon Sino-Foreign Joint Ventures, Law of the People’s Republic of China upon Sino-Foreign Cooperative Enterprises, and the Guiding Directory on Industries open to Foreign Investment that have been devised to regulate the activities related to the foreign direct investment in China. Tseng and Zebregs (2002) claim that rules and regulations imposed by the government regulate investment activities that involve the use of scarce resources, projects that are take place in designated areas, projects that present hazard to environment or national safety, and productions that compete with the state monopoly. It is also known that rules and regulations were promoted in China that favor liberalization in many aspects, including in economic activities in order for the China to get membership of World Trade Organization (WTO). These rules and regulations include compliance to non-discriminatory treatment of foreign and domestic businesses, compliance to the universal rules on intellectual rights and others. This opinion is supported by Long (2005), who informs…

By John Dudovskiy

Category: Finance

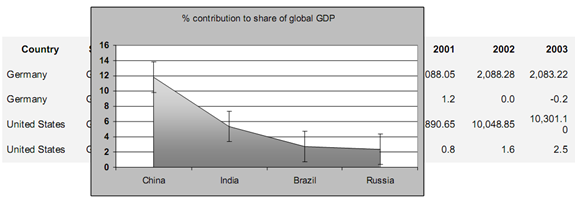

Arora and Vamvakidis (2010) inform that starting from the late 1970’s China has been achieving incredibly high level of GDP with an increase of 9% in average. China has been the biggest contributor to the global GDP that has accounted for more than half the combination of GDP contributions by India, Brazil, and Russia which is illustrated in Table 1 below: Source: International Monetary Fund China current strong position is also supported by the fact that it’s GDP has ranked No.4 in the world with USD 3.52 trillion, or 8% of the total world in 2007 which is a great accomplishment taking into account the fact that in 1978 it was only 1% (The Foreign Economic Research Institute, 2009). Today China is seen as an attractive destination in terms of investing funds and outsourcing operations. Although the country does not offer the cheapest labor costs with one USD per hour (Biz China 2007), many other factors contribute China to be attractive to investors and thus attracts huge amount of FDI inflows The Factors Contributing to FDI inflow to China There are many factors proposed that contribute to the FDI inflow into China several of them being the most important. Increasing workforce within the country as a result of the migration of large numbers of inland farmers to the mainland of China for purposes of employment is seen one of the main reasons for the increase of the FDI. Justin and Fox (2007) inform about proposition of USD 20 billion investment by western companies that has contributed to the reduction to the level of unemployment to 6% in 2007. The number of population is seen as another important factor to the inflow of FDI in China due to the fact that large number of population of 1.3 billion with 800…

By John Dudovskiy

Category: Finance

The future geographical presence strategy of Lidl includes expansions into the new markets such as Brazil, Mexico, Russia and USA. This is an effective market expansion strategy that promises to increase Lidl’s global presence, and at the same time boost the revenues of the company significantly. However, further recommendations related to international market expansion can be made for Lidl, that if implemented would contribute to achieving global aims and objectives of the company. Specifically, Lidl should also enter into Chinese and Indian markets as well, because the great number of potential customers living in these countries may ensure the greater level of profitability compared to the markets of Brazil, Mexico, Russia and USA. If the amount of financial resources possessed by Lidl allows the expansion to all of the above named countries than the relevant plans should be devised and implemented. However, if the choice needs to be done between Brazil, Mexico and Russia in one hand, and India and China on the other hand, in terms of international expansion, the preference should be given to the latter group of countries due to the following reasons: Firstly, the total amount of population living in China and India exceed several times the total amount of population living in Brazil, Mexico and Russia. Moreover, Chinese and Indian population have a similar mindset as German people in terms of associating cheap price of the product with the value, and therefore there are reasons to believe that Lidl’s core strategy of offering low priced products will prove successful in these countries. Secondly, even though China and India are developing in fast paces, still the average standard of life in these countries are considered to be poorer than the average standard of life in Brazil, Mexico and Russia, and therefore people in China and India…

The classical business concept of Aldi that had proved to be successful in Germany and many other countries had to be altered in UK and Switzerland due to a set of reasons. As we know the main business model Aldi practiced consisted of offering low priced limited range of products that was achieved by compromising the quality of customer service and shop premises. However, this strategy did not prove to be successful in UK and Switzerland and Aldi management had to change its strategy in these countries by increasing the prices of their products and invest extra financial resources that were created in this way in increasing the number of product range, improving the quality of the customer services, and increasing the spending on marketing communication mix. Taylor and Lee (2007) stress the importance of cultural differences in international buyer behaviour. Culture itself, can be defined as shared values and mindsets and methods of doing things within a specific group (Holden, 2002). Therefore, local cultural differences in UK and Switzerland were the main reasons behind the change of strategy practiced by Aldi. To be more specific, in Germany and many other countries value of the product is usually associated with cheap price of the product. In other words, if the product is cheap it is perceived as value by customers in Germany and a range of other countries. And this fact has ensured the success of traditional strategy of low pricing practiced by Aldi in Germany and many other countries. However, culture in UK and Switzerland is different in a way that if the price of the product is very cheap, consumers tend to form low opinions about the quality of these products. Value in UK and Switzerland is mainly associated with the quality of the product, not necessarily with…

Greenfield investment is a type of business expansion where investments are made on the facilities in a new market where there were no such a facilities previously (Barclay, 2002). Aldi and Lidl have increasingly relied in greenfield investment as they main new market entry strategy. The choice of greenfield investment was done by Aldi and Lidl management among other alternative methods of new market entry such as exports, forming joint-ventures, mergers and acquisitions etc. for a range of reasons. All of these new market entry strategies have their advantages and disadvantages some of them have been discussed below. According to Ando (2006) companies will be in a better position to fully utilize their company-specific advantages if their choose greenfield investment as their new market entry strategy. This statement can be shown as one of the main reasons why Aldi and Lidl have increasingly relied on greenfield investment as their main new market entry strategy. Both companies had their competitive advantages that were their ability to keep business costs down by saving on additional costs such as customer services, ‘art-of-state’ shop designs and additional features. If Aldi and Lidl had chosen any alternative new market entry strategy their current competitive advantages would be put under risk, threatening to the overall success of the business. Moreover, “reasons for greenfield investment could be that companies frequently make foreign investments where there is little or no competition, so finding a company to buy may be difficult” (Epperlein, 2007, p.22). This argument was true as well due to the fact that discount retailing business concept Aldi and Lidl adhered to was relatively new at the time of their expansion and there were no retailers using the same business concepts in Aldi and Lidl target markets, these companies could form joint-ventures with. Another possible reason for the…