Strategy

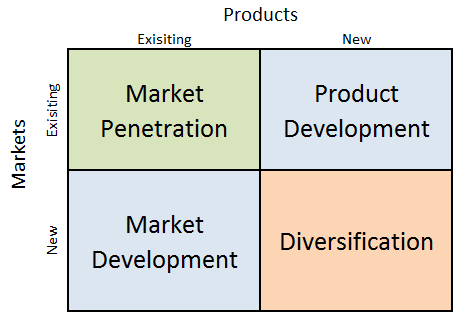

BYD Ansoff Matrix is a marketing planning model that helps the electric automaker to determine its product and market strategy. Ansoff Matrix illustrates four different strategy options available for businesses. These are market penetration, product development, market development and diversification. Ansoff Growth Matrix Within the scope of Ansoff Matrix, BYD uses all four growth strategies in an integrated manner: 1. Market penetration. Market penetration refers to selling existing products to existing markets and BYD uses this strategy extensively. The company offers EVs at competitive price points, particularly catering to budget-conscious consumers. This attracts new customers and makes EVs more accessible in price-sensitive markets like China. Moreover, the EV giant offers special discounts and promotional packages for specific customer segments, such as first-time buyers, government fleets, or ride-sharing companies. Such moves incentivize purchase and boost sales within defined target groups. 2. Product development. This involves developing new products to sell to existing markets. Product development sits at the heart of BYD’s long-term success, not just as a growth strategy but as a core pillar of their competitive advantage. The company consistently expands its EV portfolio developing new models across various segments (cars, buses, trucks) alongside enhancing existing models with improved range, performance, and features. Furthermore, BYD invests heavily in R&D for autonomous driving, battery improvements, intelligent connected vehicles, and alternative energy solutions like hydrogen fuel cells. 3. Market development. Market development strategy is associated with finding new markets for existing products and it is also a key growth strategy for BYD. Starting to produce EVs in 2003, BYD today sells EVs to more than 400 cities in over 70 countries and regions across the six continents of the world.[1] The company is expected to further intensify its focus on international market development strategy. 4. Diversification. Diversification involves developing new products to…

BYD business strategy consists of the following three pillars: 1. Cost leadership. Cost efficiency compared to its main competitor, Tesla is one of the key competitive advantages for BYD. Cost leadership has been a crucial component of BYD’s success, helping them establish themselves as a competitive contender in the EV market. BYD is able to maintain cost leadership business strategy in the global marketplace due to a number of factors such as lower cost of human resources in China, the extensive support by Chinese government to EV makers and an extensive vertical integration. Competitive pricing makes BYD’s EVs accessible to a wider range of consumers, particularly in cost-sensitive markets. This can drive market share gains and boost overall sales. Moreover, efficient cost management helps BYD maintain healthy profit margins even with lower prices, enhancing financial stability and fuelling further investments. 2. Extensive vertical integration. The electric automaker produces the majority of its spare parts in-house. For example, for BYD Dolphin only tyres and windows are delivered by suppliers and all other components are produced by the company itself. Vertical integration to such an extent allows the EV behemoth to maintain its cost leadership business strategy along with reducing the dependence on external vendors for spare parts. Moreover, controlling critical components minimizes dependence on external suppliers, mitigating risks of disruptions and shortages. Vertical integration also creates unique capabilities and intellectual property, setting BYD apart from competitors and bolstering brand differentiation. 3. Accelerated pace of new model development. While it takes about four years for an average automaker to develop a new car from scratch to design, for BYD it takes only 18 months. The electric automaker has adapted an accelerated pace of new model development to reflect changes in customer tastes and preferences as a cornerstone of its business…

Key Components of Marriott ecosystem include the following: – Properties. Marriott has a portfolio of over 8,000 hotels in 138 countries and territories. This includes a variety of brands, from luxury to budget-friendly, to meet the needs of all types of travellers. – Loyalty programs. The hotel chain has three loyalty programs – Marriott Bonvoy, Ritz-Carlton Rewards, and Starwood Preferred Guest. These programs offer members exclusive benefits, such as free nights, room upgrades, and early check-in and check-out. – Technology platform. The largest hotel chain in the world has a robust technology platform that powers its website, mobile app, and loyalty programs. The company also uses technology to improve the guest experience, such as with contactless check-in and mobile keys. – Partners. The company has a wide range of partners, including airlines, car rental companies, and credit card companies. These partnerships allow Marriott to offer its guests a one-stop shop for their travel needs. Marriott’s ecosystem is designed to provide guests with a seamless and personalized experience. For example, when a guest books a hotel room on the Marriott website, they can also book a flight and a rental car. They can also use their Marriott Bonvoy points to pay for their hotel stay, flights, and car rental. Marriott’s loyalty programs also play an important role in its ecosystem. By rewarding guests for their loyalty, Marriott encourages them to stay at Marriott hotels and use Marriott partners. This helps Marriott to build long-term relationships with its guests. The Marriott International ecosystem benefits both Marriott and its guests. For Marriott, the ecosystem helps to increase revenue and improve customer loyalty. The hotel chain is able to generate additional revenue from its partners, such as airlines and car rental companies. The company is also able to improve customer loyalty by providing guests with a seamless and personalized experience. For guests, the ecosystem provides a number of benefits such as convenience, savings…

Fundamental Analysis of Marriott Stock Fundamental analysis refers to the practice of using financial activity to forecast stock prices. The following table illustrates main financial ratios for Marriott International: Ratio Marriott International performance Price-to-Earnings (P/E) Marriott’s P/E ratio is currently 22.4, which is slightly above the average P/E ratio of the S&P 500 index (18.6). In other words, Marriott’s stock is currently trading at a premium to the broader market Price-to-book (P/B) Marriott’s P/B ratio is currently 3.2, which is above the average P/B ratio of the S&P 500 index (2.3). This can be interpreted as Marriott’s stock is currently trading at a premium to the broader market based on its book value. Enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) Marriott’s EV/EBITDA ratio is currently 11.5, which is in line with the average EV/EBITDA ratio of the hotel industry (11.0). This suggests that Marriott’s stock is currently trading at a fair valuation relative to its peers. Debt-to-Equity Ratio Marriott’s debt-to-equity ratio is currently 1.2, which is considered to be a healthy level of debt. In other words Marriott is well-positioned to manage its debt obligations. Return on Equity (ROE) and Return on Assets (ROA) Marriott’s ROE and ROA are both above the average ROE and ROA of the hotel industry. This suggests that Marriott is a profitable company that is generating good returns on its equity and assets. Marriott International main financial ratios Overall, Marriott’s financial ratios suggest that the company is well-managed and financially sound. Technical Analysis of Marriott Stock Technical analysis is the reliance of historical stock price activity to predict future price activity. Short-term trend The short-term trend for Marriott International is neutral. The stock is currently trading in a range between USD 198.23 and USD 206.55. A…

Marriott business strategy consists of the following 3 elements: 1. Pursuing asset-light business model. Operating in light-asset manner is one of the cornerstones of Marriott business strategy. Under this model, Marriott focuses on managing and franchising hotels, rather than owning them. This allows the hotel chain to expand rapidly and efficiently, without having to invest heavily in real estate. Light-assed strategy provides the company with a range of substantial advantages such as reduced capital investment and as a result, increased flexibility to enter into new markets and experiment with new brands. Furthermore, this strategy reduces exposure to the risk of real estate market downturns. 2. Growth through acquisitions. Marriott International has been a major user of acquisitions to fuel its growth. In 2016, it acquired Starwood Hotels & Resorts Worldwide in an USD 13.6 billion deal, which made it the world’s largest hotel company. The acquisition added nearly 1,300 hotels to Marriott’s portfolio, including brands such as Sheraton, W, and Westin. Since the Starwood acquisition, Marriott has continued to make smaller acquisitions to expand its reach into new markets and segments. For example, in 2017, it acquired Delta Hotels and Resorts, which added 38 hotels in Canada to its portfolio. In 2022, it acquired Hoteles City Express, which added 152 hotels in Mexico, Costa Rica, Colombia, and Chile. 3. Focusing on bleisure travellers. Bleisure travelling, a portmanteau of “business” and “leisure”, refers to the trend of business travellers extending their trips to include leisure activities. Marriott International is increasing its focus on bleisure travellers as part of its long-term business strategy. Up to date, this new customer segment, the business traveller who wants more choices for accommodations, that new blended traveller, and younger travellers who want more space for their travels, have been mainly served by Airbnb and…

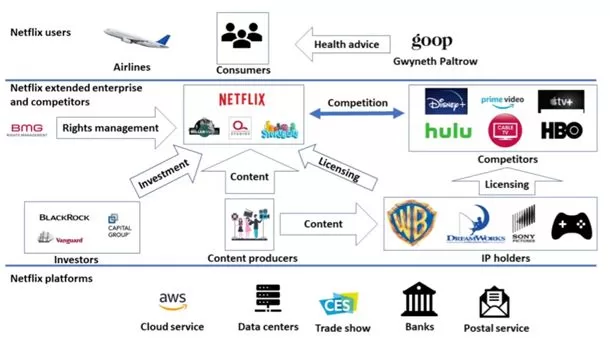

An ecosystem is a network of components (products, services and platforms) that depend on each other and fuel each other to jointly deliver greater value. Netflix ecosystem comprises the companies it owns, content producers, competitors, customers, as well as, investors. Moreover, assisting infrastructure such as AWS cloud service, data centres, trade shows, banks and postal service are also components of Netflix ecosystem. All of the entities listed above are considered elements of ecosystem, because they contribute to the survival and well-being of the ecosystem. Netflix ecosystem Development of business ecosystem can be divided into four stages[1]: 1. Pioneering stage is where ecosystem is formed. For video streaming ecosystem pioneering stage is the second half of 2000s. Netflix invented DVD rental business model and it is one of the first companies that offered online video streaming service. Hong Kong based iTV was the company that introduced online video streaming for the first time, but Netflix was the first company that perfected this business model and made it successful. 2. Expansion stage. Currently, Netflix has 231 million paid memberships in over 190 countries with offices in over 25 countries.[2] The rapid expansion of the company during the last decade caused the expansion of online streaming ecosystem in general, motivating media companies to launch their own rival streaming services such as Disney+, HBO, Hulu and others. 3. Authority stage is when an ecosystem matures. It can be argued that Netflix ecosystem is approaching its authority stage with the global marketplace becoming highly saturated with international, as well as, local on-demand media providers. The video entertainment industry is becoming ready for yet another disruption. 4. Renewal or death stage. It is hard to estimate the time when Netflix ecosystem is going to be renewed or if it is going to cease to exist altogether…

Fundamental Analysis of Netflix Stock Fundamental analysis refers to the practice of using financial activity to forecast stock prices. Revenue: Netflix’s revenue has been growing steadily in recent years, reaching USD30.9 billion in 2022. Earnings per share: Netflix’s earnings per share have also been growing steadily, reaching USD9.36 in 2022. Free cash flow: Netflix’s free cash flow has been positive in recent years, reaching USD10.7 billion in 2022. Debt: Netflix has a moderate amount of debt, with a debt-to-equity ratio of 1.3. Margins: Netflix’s margins are high, with a gross margin of 73% and an operating margin of 22%. Valuation As of September 11, 2023 Netflix’s stock is trading at a price-to-earnings (P/E) ratio of 37.05. This is higher than the P/E ratio of the S&P 500, which is currently at 21.08. However, Netflix’s P/E ratio is lower than its historical average of 50. Technical Analysis of Netflix Stock Technical analysis is the reliance of historical stock price activity to predict future price activity. As of September 11, 2023 Netflix stock (NFLX) is trading at USD442.80. The stock has been on a downward trend since January 2023, but it has been consolidating in recent weeks. The 50-day moving average is at USD432.97, and the 200-day moving average is at USD352.07. The relative strength index (RSI) is at 57.74, which is in the neutral zone. Technical indicators The moving average convergence divergence (MACD) indicator is positive, which is bullish. The MACD line is above the signal line, and the histogram is rising. The stochastic oscillator is also positive, and it is rising towards the overbought level. Support and resistance levels The nearest support level is at USD419.81, followed by USD402.99. The nearest resistance level is at USD453.45, followed by USD472.70. Sentiment Analysis of Netflix Stock Sentiment analysis is the process of determining the emotional…

Netflix business strategy is to continuously improve its members’ experience by offering compelling content that delights them and attracts new members. Netflix pioneered subscription streaming in 2007 and retains the first mover competitive advantage in this segment. Moreover, the largest streaming service in the world is pursuing the following strategies: 1. Focusing on revenues maximization over membership growth. Internet-based technology companies such as Netflix often have to choose between growing members or revenues. On one hand, brand recognition at a broad scale requires scaling of the business. On the other hand, scaling requires massive financial investments at the same time when you cannot increase the cost. If you increase the cost, you cannot scale because people will not purchase. This is why internet-based companies such as Uber and Airbnb traded revenues for membership growth and stayed unprofitable for a long time. For Netfix, on the other hand, membership growth is important, but revenue maximization per member is their primary concern. The on-demand media provider regularly increases prices. In the latest move it eliminated its cheapest USD 9,99 add-free plan for its US-based subscribers and the cheapest ad-free tier for new members is because USD15.49 per month in summer 2023.[1] 2.Investing in original content. Netflix is the first company to invest in original content starting with award-winning House of Cards series in 2011. This was followed by a series of quality original content such as BoJack Horseman (2020), Squid Game (2021), Kipo and The Age of Wonderbeasts (2020), Arecane (2021) and many others. Quality original content is one of the main competitive advantages for the on-demand media provider. 3. Staying focused on movies, series and documentaries. Netflix stays within its niche of movies, series and documentaries and the company is planning to continue with this strategy for the foreseeable future. The…

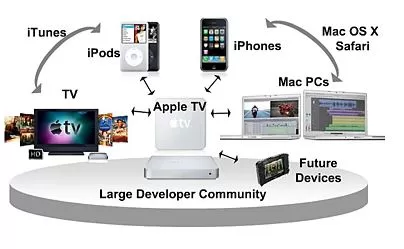

Ecosystem in its essence is “a biological community of interacting organisms”[1]. In technology terms, ecosystem refers to a group of devices and software that represent a single collaborative network. In other words, it is how well each product or service belonging to a company work individually and if end-users will get better experience when all of these products and services work together. It is the question if the whole is greater than sum of all parts. Apple ecosystem is one of the main competitive advantages associated with the brand. In fact, the iPhone maker is one of the earliest technology companies globally to purposefully form an ecosystem. Third-party products are not usually compatible with Apple products and all products belonging to Apple portfolio work well with each-other. At the same time, the ecosystem of Apple is much more than just a collection of more than 2 billion active devices[2] or services that work seamlessly. Apple ecosystem integrates the following key elements: Company image of creativity that motivates customers to upgrade their devices frequently. Perception of status and effectiveness that is associated with using Apple products Efficient devices and services that perform best with other Apple products and services Apple ID is the cornerstone of the ecosystem. It is used to register all Apple devices. Advantages of Apple Ecosystem Thanks to services such as iCloud, airplay, and airdrop, one can start a task in on one Apple device and continue it on another and there is no need to download or install anything. Moreover, Apple ecosystem offers features like AirDrop, iMessage, and FaceTime on macOS; unlocking a Mac laptop with an Apple Watch; or auto-pairing and finding lost AirPods, and the list goes on. Today, Apple ecosystem is widely considered to be the best in the industry, and arguably in…

Apple business strategy can be classified as product differentiation. Specifically, the multinational technology company differentiates its products and services on the basis of simple, yet attractive design and advanced functionality. Apple business strategy consists of the following four elements: 1. Focus on design and functionality of products. According to its business strategy, Apple has adapted advanced features and capabilities of its products and services as bases of its competitive advantage. The list of innovations introduced by Apple include, but not limited to the introduction of iPad, the first device of its kind that stored thousands of songs with a simple shuffle capabilities through songs, development Macintosh, the first computer to use a graphical user interface and the launch of iMac that “ripped up the computer design rule book, doing away with dull beige boxes and instead replacing them with fun, translucent machines in shades such as “Bondi Blue” that hinted at the aesthetic Apple would become so well-known for.”[1] The first company ever to be valued at $1 trillion systematically improves features and capabilities of its products, setting new standards for the industry at the same time. Take photos for example. Apple single-handedly advanced global photography industry with a range of innovations illustrated in table below. Innovation Year High dynamic range imaging 2010 Panorama photos 2012 True Tone flash 2013 Optical image stabilization 2015 Dual-lens camera 2016 portrait mode 2016 portrait lighting 2017 night mode 2019 LiDar scanning 2020 Photography innovations by Apple Inc. First mover advantage is another element of Apple competitive advantage. It has to be stated that Apple competitive advantage may be challenging to be sustained for long-term perspective. Specifically, the management may fail in terms of ensuring the addition of innovative features and capabilities in new versions of its products, thus compromising…