Walmart SWOT Analysis

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Walmart SWOT analysis:

| Strengths

1. Efficient utilization of online sales channels 2. Huge financial resources 3. Leadership position in the US 4. Sophisticated supply chain operations 5. High brand value |

Weaknesses

1. Low profit margin 2. Brand image damaged by a series of scandals 3. Lack of flexibility due to its large size 4. Business model easy to replicate |

| Opportunities

1. Further international market expansion 2. Formation of strategic alliances 3. Vitalizing CSR programs and initiatives 4. Exploring diversification opportunities

|

Threats

1. Failure to sustain cost advantage 2. Eruption of quality-related or ethics-related scandals 3. Negative impact to revenues from currency fluctuations 4. Risk of a new global economic crisis |

Strengths

1. Walmart has an impressive online presence. There are 11 countries with a dedicated Walmart e-commerce websites and the total e-commerce sales increased by 22 per cent in 2015, and about 75 percent of walmart.com sales come from non-store inventory[1]. Moreover, in Brazil, Walmart’s online assortment, including from marketplace partners grew 10 times and in China, Yihaodian saw traffic increase more than 60 percent in 2015[2]. Such a solid presence in online platform and an efficient utilization of online sale channel is a significant strengths that immensely contributes to Walmart’s core competitive advantage of cost leadership.

2. Walmart’s consolidated revenues during the fiscal year of 2015 equaled to USD 486 billion and free cash flow of more than USD 16 billion was generated during the same period[3]. This amount is more than the revenues of the following four companies combined—Costco, Kroger, Tesco in the United Kingdom, and Carrefour SA in France. Walmart’ AA credit rating, which is rare in retail further contributes to the financial strengths of the company. In other words, the company possesses an enormous investment capability and this can help in achieving the primary objective of profit maximization in multiple levels.

3. Walmart is the market leader in the US with a market share of about 24.5 per cent. As it is illustrated in Figure 1 below,Walmart’s closest competitors in the US, Kroger possesses only about half of Walmart’s market share. Leadership position in the US is a major strengths for the business taking into account the massive size of US grocery retail industry. Furthermore, while the company maintains leadership position in the US, revenues generated in the US account for only 60 per cent of Walmart’s total cash flow, indicating to the massive size of the total revenues generated by the company each year.

Figure 1. Market share of the leading grocery retailers in the United States in 2014[4]

4. Sophisticated supply chain operations is another point of strengths that contributes to Walmart’s competitive advantage. A set of efficient supply chain principles used by Walmart include using fewer links in the supply chain, forming strategic vendor partnership and employing cross docking as an efficient inventory tactic[5]. Moreover, Walmart supply chain operations immensely benefit from the economies of scale due to the massive scope and scale of its operations.

5. Walmart is estimated to be No.20 World’s Most Valuable Brand with the market capitalization brand value of USD 261.3 billion.[6] High brand value is a clear indication of a solid health of the business, as well as, a high level of consumer loyalty. Furthermore, Walmart’s immense brand value is a clear indication of the relevance of its business model in general and its competitive advantages in particular.

Weaknesses

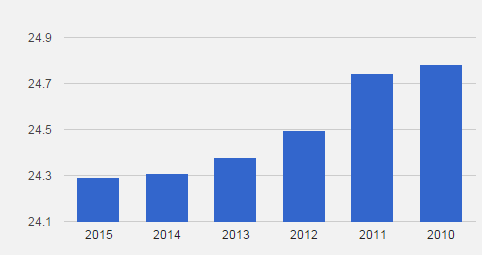

1. Walmart operates with a low profit margin in order to sustain its cost leadership competitive advantage. As it is illustrated in Figure 2 below, Walmart profit margin has been consistently decreasing during the past five years to amount to 24.29 per cent in 2015. Low profit margin can be a weakness for the business since it leaves a very little room for price adjustments if such a necessity arises, for example in times of economic crises.

Figure 2. Changes in Walmart profit margin[7]

2. Along with a high level of brand value as discussed above, Walmart brand image has been damaged due to a series of scandals. These include bribery scandal in Mexico[8], discriminatory employment practices used by some Walmart suppliers[9], low employee wages paid by Walmart suppliers in developing countries[10] and notorious stance of the company towards the work unions. These instances have weakened Walmart brand image to a significant extent.

Walmart Stores Inc. Report contains the full discussion of Walmart SWOT analysis. The report also illustrates the application of the major analytical strategic frameworks in business studies such as PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on Walmart. Moreover, the report contains analysis of Walmart’s marketing strategy, its leadership and organizational structure and discusses the issues of corporate social responsibility.

[1] Annual Report (2015) Walmart Stores Inc.

[2] Annual Report (2015) Walmart Stores Inc.

[3] Annual Report (2015) Walmart Stores Inc.

[4] Statista (2016) Available at: http://www.statista.com/statistics/240481/food-market-share-of-the-leading-food-retailers-of-north-america/

[5] Lu, C. (2014) “Incredibly successful supply chain management: how does walmart do it?” Tradegecko, Available at: https://www.tradegecko.com/blog/incredibly-successful-supply-chain-management-walmart

[6] The World’s Most Valuable Brands (2015) Forbes, Available at: http://www.forbes.com/companies/wal-mart-stores/

[7] Stock Analysis on Net (2015) Available at: https://www.stock-analysis-on.net/NYSE/Company/Wal-Mart-Stores-Inc/Ratios/Profitability#Gross-Profit-Margin

[8] Visvawanatha, A. & Barrett, D. (2015) “Wal-Mart Bribery Probe Finds Few Signs of Major Misconduct in Mexico” The Wall Street Journal, Available at: http://www.wsj.com/articles/wal-mart-bribery-probe-finds-little-misconduct-in-mexico-1445215737

[9] Chen, M. (2015) “Here Are All the Reasons Walmart’s Business Is Not Sustainable” The Nation, Available at: http://www.thenation.com/article/here-are-all-reasons-walmarts-business-not-sustainable/

[10] Osterndorf, C. (2015) “10 reasons Walmart is the worst company in America” The Daily Dot, Available at: http://www.dailydot.com/opinion/walmart-labor-unions-bad-company/