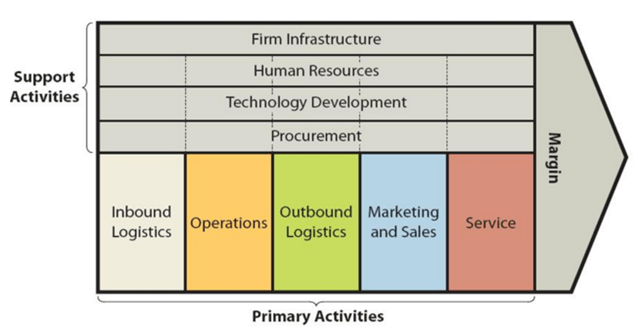

Xiaomi Value Chain Analysis

Xiaomi value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the mobile internet company. Figure below illustrates the essence of Xiaomi value chain analysis.

Xiaomi Value Chain Analysis

Xiaomi Primary Activities

Xiaomi inbound logistics involves the delivery and storage activities of raw materials by the mobile internet company. Strategic relationships with Taiwan-based manufacturers of various components is one of the main sources of value for Xiaomi inbound logistics. Specifically, Xiaomi partners with Inventec and Hon Hai for assembly, Wintek and TPK for screen technology and Unicorn for PCB (printed circuit boards).

Moreover, Taiwan Semiconductor Manufacturing Corporation (TSMC) is the main processor supplier for the company. Xiaomi also procures various electronic components from nearby countries. For example, MOS and batteries are mainly imported from Thailand.

Operations activities within Xiaomi value chain analysis refer to the processes of transforming raw materials into ready products. The mobile internet company has established its presence in 70 countries and regions and it is among the top 5 in 16 markets. Xiaomi manufactures locally more than 75% of smartphones it sells in India.[1]

Location of manufacturing units in China and India is one of the main sources of value in Xiaomi operations. This is because the costs of human resources in these developoing countries are cheap. Along with proximity of manufacturing units to the sources of raw materials, cost-effective human resources play an instrumental role in sustaining cost advantage competitive edge of the business. Moreover, Xiaomi sophisticates its manufacturing processes in a systematic manner using advanced technologies and benefiting from technological innovations.

Initially, Xiaomi outbound logistics practices were limited to the shipment of products directly to end-users via couriers. At that stage the company was using only online sales channels in order to save costs and maintain its cost leadership position in the global marketplace. However, due to increasing demand for Xiaomi products and intensifying competition in the market, the electronics and software company had to open company-operated stores as well. Xiaomi opened its first offline retail store in February 2016 and by the end of 2017 had more than 155 stores.[2]

Known as Mi Home stores, company-operated stores are places where customers can see and use Xiaomi smartphones water purifiers, portable air purifiers, laptops, rice cookers, robot vacuum cleaners, Ninebot hoverboards and a wide range of other products.

In March 2017, the company established a new sales channel called Xiaomi kiosks to reach districts without Mi Home Stores and towns and villages with limited e-commerce access[3]. In March 2018, the company opened its 25th Mi Home and the first Mi Home Experience store in Chennai, India.[4] Xiaomi has plans to open 2000 stores around the world by 2020.[5]

Increasing numbers of sales channels and expanding geographical scope is expected to complicate Xiaomi outbound logistics in the foreseeable future. This can create certain challenges for the business. Having been founded only in 2010, Xiaomi does not have many years of experience in operating in the global marketplace. Its major competitors such as Apple and Samsung, on the contrary, have decades of experience in the global marketplace and accordingly, they are more experienced in global supply chain management and addressing the issues of cross-cultural differences .

Xiaomi marketing and sales practices are based on its cost leadership business strategy. As discussed above, the mobile internet company was initially selling its products using only online sales channels and later adapted traditional offline sales channels as well. The company uses hunger marketing strategy and flash sales frequently, making only limited numbers of products available online for a short duration of time.

Xiaomi has set a Guinness World Record for selling the most number of phones ever in a single day — 2.12 million units.[6] In India, “to increase its offline sales, Xiaomi is opening direct stores called Mi Home, and partnering with big retail chains like Croma, Univercell, Poorvika, and Sangeetha.”[7]

Xiaomi post-sale service was often criticized as poor. This problem was rooted on company’s cost leadership business strategy, because the mobile internet company was looking for opportunities to save costs everywhere includin2g in customer services and post-sale services.

However, due to intensifying competition in home market and abroad, Xiaomi had no choice but to pay greater attention to customer service aspect of the business. For example, nowadays in India “95 percent of all repair jobs at authorized service centres are processed within a day, with 86 percent processed within four hours of the customer handing over the device to the service centre.”[8]

Xiaomi Inc. Report contains a full version of Xiaomi value chain analysis. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Ansoff Matrix and McKinsey 7S Model on Xiaomi. Moreover, the report contains analyses of Xiaomi leadership, business strategy, organizational structure and organizational culture. The report also comprises discussions of Xiaomi marketing strategy, ecosystem and addresses issues of corporate social responsibility.

[1] Sushma, U. (2017) “How Xiaomi is winning over India’s booming smartphone market” Quartz, Available at: https://qz.com/1115071/samsung-beware-how-xiaomi-is-winning-over-indias-booming-smartphone-market/

[2] Jun, L. (2017) “Xiaomi CEO Lei Jun: How Xiaomi Turned the Tables” Pandaily, Available at: https://pandaily.com/xiaomi-ceo-lei-jun-how-xiaomi-turned-the-tables/

[3] FROM MI FANS TO PARTNERS (2018) Xiaomi, Available at: http://blog.mi.com/en/2018/01/31/from-mi-fans-to-partners/

[4] Kumar, K. (2018) “Xiaomi opens 25th Mi Home and the first Mi Home Experience store in Chennai to display products yet to be launched in India” First Post, Available at: https://www.firstpost.com/tech/news-analysis/xiaomi-opens-25th-mi-home-and-the-first-mi-home-experience-store-in-chennai-4372125.html

[5] Yan, S. (2017) “China’s Xiaomi plans to flood the world with 2,000 stores within three years” CNBC, Available at: https://www.cnbc.com/2017/07/10/chinas-xiaomi-plans-to-flood-the-world-with-2000-stores-within-three-years.html

[6] Yan, S. (2017) “China’s Xiaomi plans to flood the world with 2,000 stores within three years” CNBC, Available at: https://www.cnbc.com/2017/07/10/chinas-xiaomi-plans-to-flood-the-world-with-2000-stores-within-three-years.html

[7] Sushma, U. (2017) “How Xiaomi is winning over India’s booming smartphone market” Quartz, Available at: https://qz.com/1115071/samsung-beware-how-xiaomi-is-winning-over-indias-booming-smartphone-market/

[8] Pardiwala, A. (2017) “Xiaomi after-sales service in India: A closer look at the company’s efforts towards customer satisfaction” BGR, Available at: http://www.bgr.in/news/xiaomi-after-sales-service-in-india-a-closer-look-at-the-companys-efforts-towards-customer-satisfaction/