Posts Tagged ‘internet’

Xiaomi does not publish annual CSR report. It has been noted that despite its branding effort to resemble the minimalist style of Apple, Xiaomi does not show similar commitment in environmental responsibility.[1] However, the mobile internet company may start publishing CSR reports after initial public offering (IPO) of its stocks that is expected to take place in the foreseeable future. Official Xiaomi website declares company’s pledge “to reduce the use of hazardous substances in products.”[2] However the website does not disclose any data at all regarding emissions or any other environmental impact of Xiaomi products and services. According to German Federal Office for Radiation Protection (Bundesamt für Strahlenschutz) Xiaomi smartphone Mi A1 has “Specific Absorption Rate” of 1,75 watts per kilogram, which is the highest level of radiation of smartphones worldwide.[3] In general, there is a lack of information related to Xiaomi CSR programs and initiatives, as it is illustrated in table below. CSR aspect of the business Xiaomi performance Supporting Local Communities No information available Educating and Empowering Workers No information available Labour and Human Rights No information available Employee Health and Safety No information available Gender Equality and Minorities It has been noted that Xiaomi uses “yanzhi,” or physical appearance metric when hiring, leading to discriminaton during employee recruitment and selection process.[4] Energy Consumption No information available Water Consumption No information available Waste Reduction and Recycling MI INDIA maintains PRODUCT TAKE-BACK & RECYCLING PROGRAM. Xiaomi Authorised e-waste recycler can collect e-waste from customer’s location, or customers can also drop e-waste at any of company’s service centers[5] Carbon Emissions No information available Sustainable Sourcing No information available other CSR Initiatives and Charitable Donations No information available Xiaomi CSR Programs and Initiatives Xiaomi Inc. Report contains a full analysis of Xiaomi corporate social responsibility including Xiaomi CSR issues. The report…

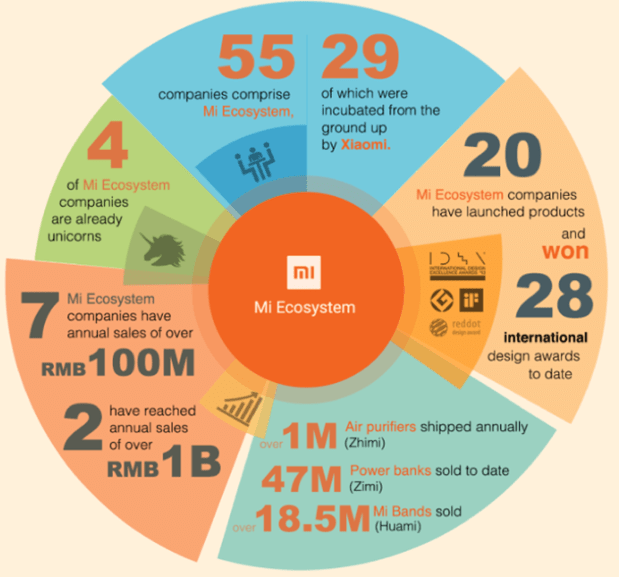

Xiaomi ecosystem is vast and comprises 55 companies including 29 companies that have been incubated from the beginning by Xiaomi. The company sells a wide range of products from smartphones to kettles and gloves. [1] Moreover, ever-expanding corporate ecosystem has been placed at the core of Xiaomi business strategy. Usually, producing a wide range of products and services threats to compromise the focus on core products and services. However, Xiaomi claims to have addressed this threat in a proactive manner. Specifically, according to its official website, while the company focuses on its core products – smartphones, smart TVs and smart routers, Xiaomi invests in companies that produce other types of products without being involved in operational management.[2] Xiaomi Ecosystem[3] Smartphones are placed at the core of Xiaomi ecosystem. Moreover, smartphones are used to facilitate the sales and use of many other products and services. Xiaomi smart devices include Mi Water Purifier, Mi Air Purifier, Mi Induction Heating Rice cooker and other products. All smart devices are connected to Xiaomi IoT platform and can be managed though Xiaomi smartphone. In 2013, the electronics and software company announced its plans to invest in 100 hardware startups.[4] The company also sells a range of “non-smart” products, like towels, and suitcases. Increasing numbers of startups are currently joining Xiaomi ecosystem to gain support to grow rapidly. Xiaomi has experienced technical staff, engineers and product managers, who can play an instrumental role in fuelling the growth of small-sized companies. At the same time, joining Xiaomi ecosystem also has some drawbacks. Specifically, start-ups need to operate with low profit margin according to Xiaomi business strategy. Moreover, over-dependence on Xiaomi for branding and distribution can be mentioned as another drawback of belonging to Xiaomi ecosystem.[5] Xiaomi Inc. Report contains a full analysis of Xiaomi ecosystem. The report illustrates…

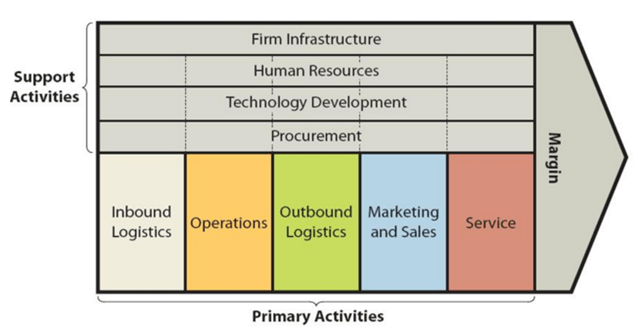

Xiaomi value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the mobile internet company. Figure below illustrates the essence of Xiaomi value chain analysis. Xiaomi Value Chain Analysis Xiaomi Primary Activities Xiaomi Inbound logistics Xiaomi inbound logistics involves the delivery and storage activities of raw materials by the mobile internet company. Strategic relationships with Taiwan-based manufacturers of various components is one of the main sources of value for Xiaomi inbound logistics. Specifically, Xiaomi partners with Inventec and Hon Hai for assembly, Wintek and TPK for screen technology and Unicorn for PCB (printed circuit boards). Moreover, Taiwan Semiconductor Manufacturing Corporation (TSMC) is the main processor supplier for the company. Xiaomi also procures various electronic components from nearby countries. For example, MOS and batteries are mainly imported from Thailand. Xiaomi Operations Operations activities within Xiaomi value chain analysis refer to the processes of transforming raw materials into ready products. The mobile internet company has established its presence in 70 countries and regions and it is among the top 5 in 16 markets. Xiaomi manufactures locally more than 75% of smartphones it sells in India.[1] Location of manufacturing units in China and India is one of the main sources of value in Xiaomi operations. This is because the costs of human resources in these developoing countries are cheap. Along with proximity of manufacturing units to the sources of raw materials, cost-effective human resources play an instrumental role in sustaining cost advantage competitive edge of the business. Moreover, Xiaomi sophisticates its manufacturing processes in a systematic manner using advanced technologies and benefiting from technological innovations. Xiaomi Outbound Logistics Initially, Xiaomi outbound logistics practices were limited to the shipment of products directly to end-users via couriers. At that stage the company…

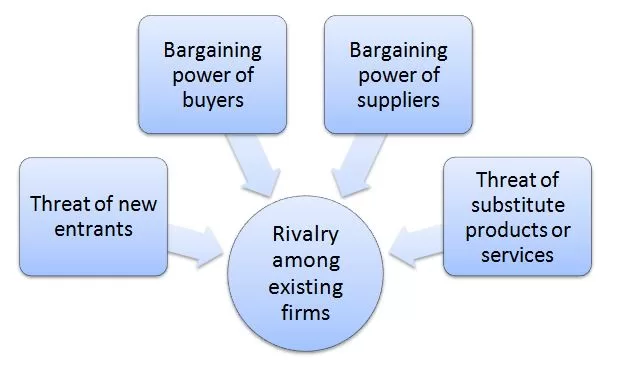

Porter’s Five Forces is an analytical framework developed by Michael Porter (1979)[1]. Xiaomi Porter’s Five Forces consists of five individual forces that shape an overall extent of competition in the industry. These forces are illustrated in Figure 1 below: Figure 1 Xiaomi Porter’s Five Forces Threat of New Entrants in Xiaomi Porter’s Five Forces Analysis Threat of new entrants into the internet technology is low. There are entry barriers for potentially new market players. Economies of scale is one of the major factors and entry barrier for new companies. Xiaomi is able to offer its products for competitive prices because it purchases raw materials in bulk and benefits from the economies of scale to a large extent. Moreover, entry into the electronics and software industry requires formidable capital investments. Xiaomi was initially funded with USD41 million in 2010 and the company went through series of funding and debt financing of several billion USD to reach its current state.[2] It may not be easy for new market entrants to secure funding at such a scale to enter the industry. Additional range of factors that decrease the threat of new entrants to the industry include access to distribution channels and likely retaliation from existing market players such as Apple, Samsung, Xiaomi and Huawei. Bargaining Power of Buyers in Xiaomi Porter’s Five Forces Analysis Bargaining power of buyers in technology and the mobile internet industry is significant. This is caused by primarily high level of competition in the global marketplace. Nevertheless, companies try to reduce buyer bargaining power through developing their ecosystem. For example, “all products belonging to Apple ecosystem are highly compatible with each-other and the purchase of one product belonging to the brand’s portfolio often leads to the purchase of other products. Gradually, it will come to the point that consumers…

Xiaomi segmentation, targeting and positioning is needed to indentify the target customer segment for the company and to develop products and services that are attractive to this segment. Segmentation involves dividing population into groups according to certain characteristics, whereas targeting implies choosing specific groups identified as a result of segmentation to sell products. Positioning refers to the selection of the marketing mix the most suitable for the target customer segment. Xiaomi uses mono-segment and imitative types of positioning. The internet technology company uses mono-segment positioning, appealing to the needs of a single customer segment. Specifically, Xiaomi targets a customer segment that want to use smartphones and other technology products, but have limited budget to make such a purchase. Xiaomi also uses imitative type of positioning by closely imitating the products of market leaders such as Apple and Samsung. The electronics and software company has even earned the nickname “Apple of the East” due to its close imitation of Apple products and Apple product presentation. The following table illustrates Xiaomi segmentation, targeting and positioning: Type of segmentation Segmentation criteria Xiaomi target customer segment Geographic Region 70 countries and regions globally Density Urban and rural Demographic Age 18 – 65 Gender Males & Females Life-cycle stage Bachelor Stage young, single people not living at home Newly Married Couples young, no children Full Nest I youngest child under six Full Nest II youngest child six or over Full Nest III older married couples with dependent children Empty Nest I older married couples, no children living with them Empty Nest II older married couples, retired, no children living at home Solitary Survivor I in labour force Solitary Survivor II retired Occupation Students, employees, professionals Behavioural Degree of loyalty ‘Hard core loyals’ ‘Soft core loyals’ ‘Switchers’ Benefits sought Cost attractiveness Personality Easygoing, determined and ambitious personality types User status non-users, potential…

Xiaomi marketing mix (Xiaomi 7Ps of marketing) comprises elements of the marketing mix that consists of product, place, price, promotion, process, people and physical evidence. Product Xiaomi mainly focuses on hardware, software and internet services. The company’s product range is vast and includes laptops, mobile phones, tablets, smart TVs, power banks, smartwatches etc. Xiaomi also manufactures and drones, sells water purifiers, vacuum cleaners and even rice cookers. Xiaomi products such as cellphones, TVs, TV boxes, and speakers have received more than 145 industrial design awards altogether.[1] Continuous expansion of ecosystem of products and services is placed at the core of company’s business strategy. Place Xiaomi is headquartered in Beijing, China and has offices in Asia-Pacific, India, and Brazil. The mobile internet company has established its presence in 70 countries and regions and it is among the top 5 in 16 markets. These markets include Turkey, Malaysia, Mexico, Thailand, Philippines, Russia, Singapore, Indonesia, Brazil, India, and Vietnam. The mobile internet company opened its first offline retail store in February 2016 and by the end of 2017 had more than 155 stores.[2] In March 2017, the company established a new sales channel called Xiaomi kiosks to reach districts without Mi Home Stores and towns and villages with limited e-commerce access[3] Price Xiaomi pricing strategy can be described as economy pricing. Accordingly, the internet technology company sets its prices low, keeping marketing and promotional costs to a minimum. Flash sales are integral component of Xiaomi pricing strategy. The electronics and software company uses the flash sales to announce the sales of its smartphones at a greatly reduced price. Xiaomi flash sales last only for a short duration of time. For example, in India “a flash sale for the Redmi 1S model in September 2014, around 40,000 pieces were sold out in just…

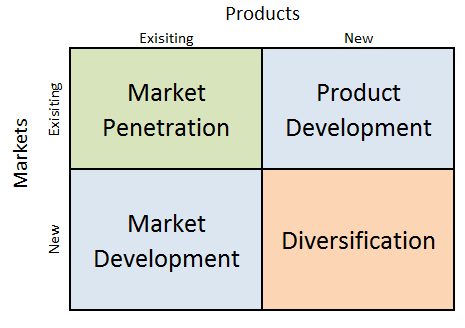

Xiaomi Ansoff Matrix is a marketing planning model that helps the mobile internet company to determine its product and market strategy. Ansoff Matrix illustrates four different strategy options available for businesses. These are market penetration, product development, market development and diversification. Xiaomi Ansoff Matrix Within the scope of Ansoff Matrix, Xiaomi uses all four growth strategies in an integrated manner: 1. Market penetration. When using market penetration, companies focus on selling existing products to existing customers. Xiaomi successfully uses market penetration strategy in its home market in China. According to Q1, 2018 smartphone sales results in China, Mi smartphones ranked third with the local market share of 12,8% after Huawei (20,8%), Oppo (18,5%), iPhone (18,2%) and Vivo (14,6%). 2. Product development. This strategy option involves developing new products to sell to existing markets. Xiaomi has ever-increasing product portfolio ranging from smartphones to water purifiers and tooth brushes. Product development strategy is likely to be continued by Xiaomi. This is because Xiaomi positions itself as a “company that provides innovation to everyone at every level — from smartphones and technology to IoT connected smart products to the basic everyday tools like power banks, backpacks and pens”.[1] 3. Market development. Market development strategy is associated with finding new markets for existing products. Xiaomi started market development in 2014, only four years after the company was founded. In mid-2013, the company hired Hugo Barra away from Google and Android to work on international expansion.[2] Since that time, the electronics and software company has established its presence in rapidly developing markets such as India, Singapore and Russia. The mobile internet company also has plans to enter US market.[3] 4. Diversification. Diversification involves developing new products to sell to new markets. Xiaomi is engaged in an aggressive diversification strategy. Xiaomi ecosystem is vast and comprises 55 companies,…

According to Harrison’s model of culture, Xiaomi organizational culture can be classified as power culture. Specifically, powers of decision making at the internet technology company are concentrated in the hands of founder and CEO Lei Jun. Inspirational and effective leadership style of Lei Jun justifies the necessity of power culture for Xiaomi. Xiaomi organizational culture integrates the following three key elements: 1. “Just for Funs” concept. The tagline “Just for fans” is placed at the core of Xiaomi organizational culture. Founder and CEO Lei Jun explains that “the culture of fandom is about becoming friends with our consumers.”[1] There is a story of a master’s student who spends free time doing MiUI testing and moderating a Xiaomi fan forum that nets 200,000 posts every day as a volunteer.[2] 2. Innovation and creativity. Company’s official website claims that “we are incredibly flat, open, and innovative. No never-ending meetings. No lengthy processes. We provide a friendly and collaborative environment where creativity is encouraged to flourish.”[3] In other words, Xiaomi aims to promote informal organizational culture at all levels with positive implications on employee creativity. 3. Intense working culture. Xiaomi organizational culture can be characterized as intense. This is due to cost leadership business strategy followed by the company in a way that effective application of this strategy involves deriving the maximum benefit from resources, including human resources. Departure of former Google executive Hugo Barra from the key post of Xiaomi international vice president has been said to be linked to negative elements of Xiaomi organizational culture. Specifically, Barra said he was leaving because difficulties of living in “such a singular environment” had “taken a huge toll” on his life.[4] Xiaomi Inc. Report contains a full analysis of Xiaomi organizational culture. The report illustrates the application of the major analytical strategic frameworks in business…

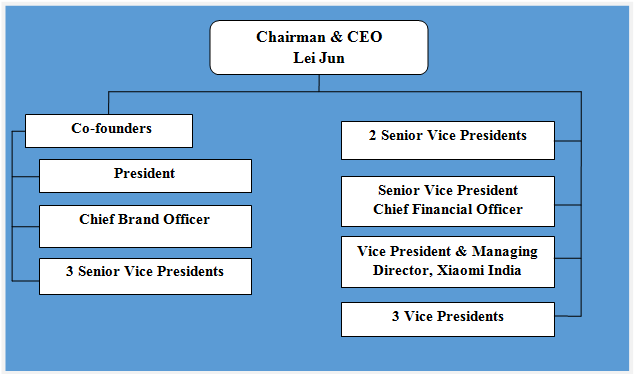

Xiaomi organizational structure can be classified as matrix. Specifically, Xiaomi organizational structure is decentralized, where different business units are managed independently. Despite the large size of the business involving presence in 70 countries with more than 18000 employees, the company has less layers of management compared to other businesses of similar sizes. Figure below illustrates Xiaomi organizational structure: Xiaomi organizational structure Matrix organizational structure allows the mobile internet company to develop its new products and services in a short duration of time. This is due to absence of bureaucracy that is associated with hierarchical organizational structures. However, disadvantages of matrix organizational structure for the business may include lack of strict control by the top management over separate business units and lack of integration between the operations of individual business units. Nevertheless, it is important for Xiaomi to maintain its flat organizational structure in order to remain flexible, so that the mobile internet company can adapt to frequent changes in the global marketplace. Xiaomi Inc. Report contains a full analysis of Xiaomi organizational structure. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and McKinsey 7S Model on Xiaomi. Moreover, the report contains analyses of Xiaomi leadership, business strategy and organizational culture. The report also comprises discussions of Xiaomi marketing strategy, ecosystem and addresses issues of corporate social responsibility.

Effectiveness of Xiaomi leadership can be considered as one of the main competitive advantages for the business. Xiaomi CEO Lei Jun is a respected businessman in China who previously led Kingsoft and founded Joyo.com that was sold to Amazon in 2014. It is said that Lei has never yelled at his staff. When he encounters a problem, he just smiles and gets down to business, and tries to find a solution. In social gatherings, Lei is always a good listener.[1] Named businessmen of the Year by Forbes in 2014 and along with Alibaba Founder Jack Ma, Lei Jun is rightly considered as the face of China Inc.[2] Xiaomi CEO is recognized as an effective charismatic leader worldwide. Along with Lei Jun, seven co-founders of the company have senior leadership roles with the titles of president and vice-presidents. Having co-founders in the senior management team is an important factor due to increased sense of ownership with positive implications on the performance of executives. Xiaomi has been dubbed as “Apple of China” for its emulation of design of Apple’s products, as well as, Lei Jun style of product announcements and his general image that resembles late Apple founder and CEO Steve Jobs. However, Lei Jun leadership style is fundamentally different from Steve Jobs leadership. Specifically, while Steve Jobs was known for his centralized and micro-managing leadership style, Xiaomi CEO has a reputation for being a good listener and takes into account views of other members of his senior management team. Xiaomi leadership challenges at present include maintaining cost leadership position amid intensifying competition from other budget internet technology brands such as Oppo and Vivo. Xiaomi Inc. Report contains a full analysis of Xiaomi leadership. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL,…