Finance

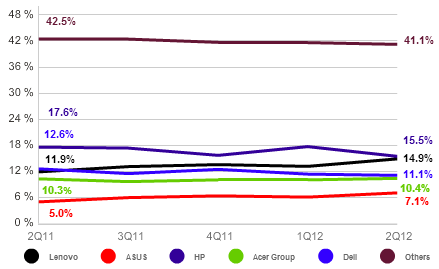

1. Introduction Rapid and dramatic changes in consumer technology market in the global scale are compromising the effectiveness of competitive advantage for many players in the marketplace. Hewlett-Packard Company (HP) can be specified as one of the giants in the industry and the company is finding difficult to address modern challenges in its market in an effective manner. HP is experiencing loss of sales and profitability due to a combination of certain factors discussed in this paper. Behind the overall 7% sales decline in the third quarter of 2012 lay 25% decline of sales of PCs and 15% decline of consumer printers (Walters, 2012). The public acknowledgement of the issue of declining profitability and pessimistic sales growth forecast made by HP President and CEO Ms. Meg Whitman on October 3, 2012 has caused the fall of HP share prices by 11% on the same day. Moreover, according to estimations of a global research agency, Millward Brown (2012), HP brand value has declined 35% in 2012 compared to 2011, and the company has moved down from 18th place to 26th in the list of Top 100 Most Valuable Global Brands within the same period. This article represents a critical analysis of declining profitability of HP using an analytical method. The article starts with introducing HP corporate profile and relevant background information. This is followed by a critical analysis of major factors contributing to the loss of profitability at HP. Namely, factors discussed in a detailed manner include increasing popularity of computer tablets, economic uncertainties in Europe, and leadership challenges. Moreover, this article proposes recommendations for HP senior level management in dealing with its current problem of declining profitability and contributing to long-term growth of the company. 2. HP: Corporate Profile Founded in 1939 by W.R. Hewlett and D. Packard, HP has been…

1. Introduction Once the largest provider of internet-based communication services and the second largest long-distance telephone company in the US, WorldCom became one of the most popular case studies for corporate ethics, financial frauds and senior management irresponsibility along with Enron. This article contains analysis of the fall of WorldCom employing four-stage fundamental analysis. The article starts with discussions of business strategy in general and analysis of strategies that exposed WorldCom to major risks in particular. This is followed by analysis of analysis of accounting practices used at WorldCom. Moreover, the article contains discussions devoted to financial analysis and the role of auditors in relation to WorldCom case study, as well as, prospective analysis that addresses valuation models employed by WorldCom accountants. This article is completed by reflecting upon important lessons to be gained from this particular case study for international business practices. 2. Business Strategy Analysis: Strategies and Practices that Exposed WorldCom to Major Risks Business strategy analysis is the first stage of the four-stage fundamental analysis of the business entity. Business strategy analysis associated with in-depth study of effectiveness and sustainability of competitive advantage of the company. Business strategy is a broad topic with multiple facets with varying levels of impacts on firms’ competitiveness and long-term growth. займ на карту мгновенно круглосуточно без отказа According to the framework of Porter’s Generic strategies (1985) businesses can base their competitive advantage on differentiating products and services or offering products and services for competitive prices. Importantly, the choice between is faced by overall businesses entity, as well as, separate segments within the entity. Primarily, WorldCom’s business strategy was most related to cost advantage, offering discount long-distance telephone services, according to the former name of the company Long Distance Discount Services Inc. (LDDS). However, as the company entered the phase of massive expansion…

This paper represents a policy paper that contains a critical analysis of Bank of England monetary policy. The paper starts with reflecting upon the main principles of Monetary Policy Committee (MPC) practices. This is followed by discussions about the role of The Bank of England policies in maintaining macroeconomic stability in UK with the particular focus on MPC impact on the level of inflation, prices of assets, the level of exchange rate and unemployment rate. Moreover, the paper reflects upon a range of inefficiencies associated with MPC monetary policy practices and it also provides recommendations in terms of improving Bank of England monetary policy practices. The Bank of England was founded in 1694, it was nationalised in 1946, and gained its independence in 1997. The Bank is “committed to promoting and maintaining monetary and financial stability as its contribution to a healthy economy” (About the Bank, online, 2013) The Bank of England has two major purposes: monetary stability and financial stability. The Bank “acts as the government’s bank, regulates the money stock growth rate and the availability of credit, and serves as a banker’s bank for commercial banks, making loans and holding deposits” (Allen, 2009, p.29). Monetary Policy Committee (MPC) of The Bank of England deals with issues related to the monetary policy in UK. The members of MPC are appointed by The UK HM Treasury that also sets the inflation target. Monetary policy is best defined as “the actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, which in turn affects interest rates” (Investopedia, 2013). Four main characteristics of monetary policy have been specified as goals, instruments, discretion, and intermediate targets (LaBonte and Makinen, 2006). Instruments are policy options available to central banks to control…

This paper critically analyses the extent at which a failure in global governance contributed to the recent global credit crunch. The paper starts with discussing the primary reasons of the credit crunch of 2007-2009, and its implications on the global economy. This is followed by analysis of the current state of global governance, and its impact on credit crunch. Moreover, the paper highlights potentials for avoiding credit crunch in the future through improving global governance practices. The global economic and financial crisis of 2007 – 2009 has shed a light in inefficiencies of the international financial system and the current pattern of the global governance. The current system of global financial governance has found to be mainly insufficient to predict and contains financial instability. The need for efficient global governance needs a shift to an improved balance between the two worlds of financial globalization i.e. private financial activity and public financial governance (Porter, 2009). The credit crunch reveals great challenges and threats to the developed economies as well as developing states. The global banking industry, which was by far the most profitable sector in 2006, is in much trouble and the risk that this poses to the real economy is thoughtful (Wade, 2008). The global financial crisis of 2007-triggered by the sub-prime mortgage crisis in the spring previously led to a significant decrease in production in autumn 2008, which has continued in 2009 and went on to produce the spring of 2009 to the present day effects, both social (rising unemployment decrease in disposable income, declining demand, social problems) and political (government changes, erosion of confidence citizens in the performance of governments and the political class), and thus increased the difficulties of public finances in developed countries causing in 2010 a series of crises (Nesvetailova, 2010). 1. Introduction 1 2.…

The routines of adoption have been the conservative and the formats to be prescribed in detail in valuation of assets. The differences under IFRS and GAAP have been seen in the example of Telofonica Company, as its balance sheet showed two different figures in valuation of assets. The financial statement prepared under IFRS showed higher result of assets compared to GAAP mainly because the IFRS lets the companies revalue their assets. Moreover, the strict control of compliance with the Directives (Fourth and Seventh) when using IFRS has also been mentioned as one of the main factors to be taken into consideration. Furthermore, according to one of the respondents, the requirement under the Fourth Directive that annual accounts should present a true and fair view of a company’s assets, liabilities, financial position has also been mentioned as a key factor while adopting IFRS. The findings regarding the adoption of IFRS by EU listed companies are that majority of EU listed companies have adopted the IFRS for more than just for consolidation purposes and their answers have been categorised below according to their level of importance: The process of adoption is complex, burdensome and at the sae time expensive Companies do not think that they can lower the cost of capital even if they apply IFRS Key challenges as mentioned during the interview are lack of guidance while converting and implementing IFRS, lack of uniform interpretation even though IFRS tends to be more flexible and informative And majority of EU companies would not adopt IFRS if it was not required by EU regulation. Moreover, conversion to IFRS will also improve the shareholder orientation in countries such as France and Germany as they used to emphasize on tax regulations and stakeholder orientation, therefore, these country’s investors benefit greatly due to them being as…

1. Advantages of IFRS compared to GAAP reporting standards 1.1 Focus on investors One of the significant advantages of IFRS compared to GAAP is its focus on investors in the following ways: The first factor is that IFRS promise more accurate, timely and comprehensive financial statement information that is relevant to the national standards. And the information provided by financial statements prepared under IFRS tends to be more understandable for investors as they can understand the financial statement without the necessity of other sources which makes investors more informed This also helps new or small investors by making the reporting standards simpler and better quality as it puts small and new investors in the same position with other professional investors as it was impossible under the previous reporting standards. This also helps to reduce the risk for new or small investors while trading as professional investors can not take advantage due to the simple to understand nature of financial statements. Due to harmonization and standardization of reporting standards under IFRS, the investors do not need to pay for processing and adjusting the financial statements to be able to understand them, thus eliminating the fees of analysts. Therefore, IFRS reduces the cost for investors. Reducing international differences in reporting standards by applying IFRS, in a sense removes a cross border takeovers and acquisitions by investors. Based on information mentioned above, it can be assumed that because higher information quality reduces both the risk to investors from buying and owning shares and the risk to less informed investors due to wrong selection due to lack of understanding, it should lead to reduction in firms cost of equity capital. This on one hand should increase the share prices, and on the other should make new investments by firms more attractive. Moreover, the following…

The main differences between GAAP and IFRS, are mainly that IFRS has wider rules and less specific guidance which gives more room to interpretation of the financial statements. Because the IFRS incorporates the value of judgement by the accountant, it tends to be less detailed, more flexible and more informative. The differences between GAAP and IFRS have been analysed in terms of their financial statement presentation, technicalities, and their importance for users of financial statements. 1. The statement of financial position The changes in the layout of the statement of financial position as it is more concise and less detailed compared to the layout of the statement of the financial statement prepared under GAAP. An example for this can be the layout of the financial statements. US GAAP requires its public companies to follow Regulation S-X where it specifically shows the detailed list of elements to be included in the financial statements. However, IFRS also requires what to include in the financial statements, but it is far less detailed than the US GAAP. Moreover, the guidance on offsetting of assets and liabilities can be indicated as another difference, thus, US GAAP gives limited guidance on offsetting of assets and liabilities whereas IFRS gives specific guidance. And another difference is the exclusion of long term debt being refinanced under GAAP whereas under IFRS, the exclusion of long term debt from current liabilities. And the similarities is the same components of financial statements under both IFRS and GAAP as both financial standards require to have balance sheet, income statement, cash flow and the accompanying notes to the financial statements. 2. Financial periods required Firstly, US GAAP requires the last two years of balance sheet to be presented, and other statements are required to be for the last 3 years. However, IFRS…

Globalisation has been one of the factors that has played great role in accelerating the harmonization of IFRS to improve the transparency and comparability. As more and more countries are opening their domestic markets to join international trade, the access to international financial markets has also been very crucial. Therefore, the implementation of IFRS as a single set of reporting standards has been fast tracked with the help of globalisation. Moreover, the improved information and communication technologies have changed the way financial statements are reported and at the same time, removed the barriers of physical distance and making information available globally. This has brought new investors into the capital markets who needed more than usual information so that they can base their decision on. The GAAP reporting standards produced financial statements which were complicated to understand by investors, therefore, they had to hire a financial analyst to interpret the financial statements which was both time consuming and cost more. Moreover, investors had to make decisions based on the interpretation of financial analysts. However, the new International Financial Reporting Standards focused on investors more, unlike GAAP by making it easy to understand. Under IFRS, investors can understand the financial statements rather than hiring a third party. Therefore, investors can save both time and money due to simplistic nature of financial statements under IFRS. ). The demand for international financial reporting standards that cross national borders is set to fulfil this role. Adopting a financial reporting language will enable the company to be better understood in the international marketplace. If a single set of reporting standard is achieved, this helps the companies to access world market. New IFRS also helps to reduce the costs. Moreover, adopting IFRS lets its people apply common accounting across their subsidiaries which in turn can improve internal communications,…

“The decision of the Commission of the European Union (EU) to oblige listed European companies…to establish their consolidated financial statements according to IFRS (IAS) represents a preliminary peak in the internationalisation process of financial accounting in Europe” (Haller and Kepler, 2002). The need for Harmonization: The activities of companies extend beyond national frontiers and shareholders and other stakeholders need protection throughout the EU. And in order to achieve this and to encourage the movement of capital, it is necessary to create a flow of reliable homogeneous financial information about companies from all parts of the EU. And they further argue that since companies in different EU countries exist in the same form and are in competition with each other, they should be subject to the same laws and taxation. Obstacles for harmonization in the EU: The obstacles for harmonization are the fundamental differences between the contexts and purposes of the various national accounting systems in the EU. And the main differences are: Differences between creditor/secrecy in the traditional Franco-German systems and investor/disclosure in the Anglo-Dutch systems Differences between law/tax-based rules and private sector standards These difference shave contributed towards the great variations in the size and strength of the accountancy profession. Here are some social-cultural related problems that IFRS can encounter by its implementation in various countries: One of the most crucial issues is the lack of strong professional bodies in some countries to promote the harmonization. The bodies such as IASC (International Accounting Standards Committee). Due to lack of these professional bodies, there will be less guidance to follow and support available. Another point is the degree of professional education and training systems for accounting. Education and training systems in developed and western countries are more professional than in developing countries. Therefore, the accountants in these countries will be sooner…

Presence of world’s leading retailers such as Tesco, Sainsbury’s and Marks & Spenser, fierce competition in pricing and in other terms and difficulties of market entry are the main characteristics of UK retail industry. Despite such complexities, some retailers could manage to do better during the recession achieving even higher revenues and profits. Although lack of financial resources and higher risk aversion by investors caused many difficulties for the retailers, some of the retailers introduced new strategies such as price cut downs and reinforcing their current positions rather than expanding, which helped them sustain the temporary difficulties and overcome the recession. Two types of factors, direct and indirect impacts of recent financial recession on consumer spending during and after crisis have been discussed in the report of Office for National Statistics. Direct impacts are said to be uncertainty of income and high rates of unemployment with scarcity of finance to support public spending by the governments. Indirect impacts on the other hand are credit crunch of financial organizations which makes them unable to process their businesses of providing loans the businesses. The research by Burt et al (2009) analyse and examine the impacts of financial crisis on the consumer buying behaviour in the UK and lists the following factors that had direct impact on the consumer spending: job uncertainty, declining savings, increased risk aversion and lower disposable income. Due to these factor consumers restrained themselves from excessive spending as they used to and focused mostly on important things. Respondents who participated in the study expressed their opinions saying that due to uncertainty in their future income or at least decline in the income they no longer can afford to spend excessively as previously. As it has been stated earlier, disposable income is considered to be one of the main effects…