FDI was recognized by Chinese authorities to be one of the important success factors for transformation from the centrally planned economy to the market economy from the very beginning of the transformation process. At the same time, authorities were unwilling to significantly reduce the level of the state control over the economy. According to Tseng and Zebregs (2002) ‘ideological obstacles’ had to be overcome by authorities, as well as traditional stereotypes that related FDI to imperial colonialism that needed to be avoided. It is a common opinion that due to the fact that these stereotypes have been around for several generations the inflow of FDI into China was increased at a reduced speed compared to its actual potential. Long (2002) mentions such legislations as Law of the People’s Republic of China upon Foreign Wholly Owned Enterprises, Law of the People’s Republic of China upon Sino-Foreign Joint Ventures, Law of the People’s Republic of China upon Sino-Foreign Cooperative Enterprises, and the Guiding Directory on Industries open to Foreign Investment that have been devised to regulate the activities related to the foreign direct investment in China. Tseng and Zebregs (2002) claim that rules and regulations imposed by the government regulate investment activities that involve the use of scarce resources, projects that are take place in designated areas, projects that present hazard to environment or national safety, and productions that compete with the state monopoly. It is also known that rules and regulations were promoted in China that favor liberalization in many aspects, including in economic activities in order for the China to get membership of World Trade Organization (WTO). These rules and regulations include compliance to non-discriminatory treatment of foreign and domestic businesses, compliance to the universal rules on intellectual rights and others. This opinion is supported by Long (2005), who informs…

By John Dudovskiy

Category: Finance

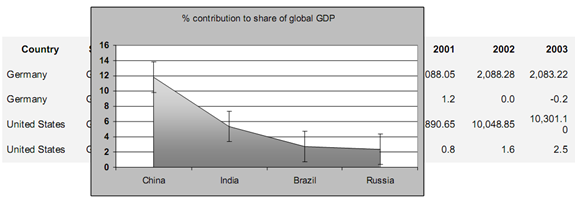

Arora and Vamvakidis (2010) inform that starting from the late 1970’s China has been achieving incredibly high level of GDP with an increase of 9% in average. China has been the biggest contributor to the global GDP that has accounted for more than half the combination of GDP contributions by India, Brazil, and Russia which is illustrated in Table 1 below: Source: International Monetary Fund China current strong position is also supported by the fact that it’s GDP has ranked No.4 in the world with USD 3.52 trillion, or 8% of the total world in 2007 which is a great accomplishment taking into account the fact that in 1978 it was only 1% (The Foreign Economic Research Institute, 2009). Today China is seen as an attractive destination in terms of investing funds and outsourcing operations. Although the country does not offer the cheapest labor costs with one USD per hour (Biz China 2007), many other factors contribute China to be attractive to investors and thus attracts huge amount of FDI inflows The Factors Contributing to FDI inflow to China There are many factors proposed that contribute to the FDI inflow into China several of them being the most important. Increasing workforce within the country as a result of the migration of large numbers of inland farmers to the mainland of China for purposes of employment is seen one of the main reasons for the increase of the FDI. Justin and Fox (2007) inform about proposition of USD 20 billion investment by western companies that has contributed to the reduction to the level of unemployment to 6% in 2007. The number of population is seen as another important factor to the inflow of FDI in China due to the fact that large number of population of 1.3 billion with 800…

By John Dudovskiy

Category: Finance

The future geographical presence strategy of Lidl includes expansions into the new markets such as Brazil, Mexico, Russia and USA. This is an effective market expansion strategy that promises to increase Lidl’s global presence, and at the same time boost the revenues of the company significantly. However, further recommendations related to international market expansion can be made for Lidl, that if implemented would contribute to achieving global aims and objectives of the company. Specifically, Lidl should also enter into Chinese and Indian markets as well, because the great number of potential customers living in these countries may ensure the greater level of profitability compared to the markets of Brazil, Mexico, Russia and USA. If the amount of financial resources possessed by Lidl allows the expansion to all of the above named countries than the relevant plans should be devised and implemented. However, if the choice needs to be done between Brazil, Mexico and Russia in one hand, and India and China on the other hand, in terms of international expansion, the preference should be given to the latter group of countries due to the following reasons: Firstly, the total amount of population living in China and India exceed several times the total amount of population living in Brazil, Mexico and Russia. Moreover, Chinese and Indian population have a similar mindset as German people in terms of associating cheap price of the product with the value, and therefore there are reasons to believe that Lidl’s core strategy of offering low priced products will prove successful in these countries. Secondly, even though China and India are developing in fast paces, still the average standard of life in these countries are considered to be poorer than the average standard of life in Brazil, Mexico and Russia, and therefore people in China and India…

The classical business concept of Aldi that had proved to be successful in Germany and many other countries had to be altered in UK and Switzerland due to a set of reasons. As we know the main business model Aldi practiced consisted of offering low priced limited range of products that was achieved by compromising the quality of customer service and shop premises. However, this strategy did not prove to be successful in UK and Switzerland and Aldi management had to change its strategy in these countries by increasing the prices of their products and invest extra financial resources that were created in this way in increasing the number of product range, improving the quality of the customer services, and increasing the spending on marketing communication mix. Taylor and Lee (2007) stress the importance of cultural differences in international buyer behaviour. Culture itself, can be defined as shared values and mindsets and methods of doing things within a specific group (Holden, 2002). Therefore, local cultural differences in UK and Switzerland were the main reasons behind the change of strategy practiced by Aldi. To be more specific, in Germany and many other countries value of the product is usually associated with cheap price of the product. In other words, if the product is cheap it is perceived as value by customers in Germany and a range of other countries. And this fact has ensured the success of traditional strategy of low pricing practiced by Aldi in Germany and many other countries. However, culture in UK and Switzerland is different in a way that if the price of the product is very cheap, consumers tend to form low opinions about the quality of these products. Value in UK and Switzerland is mainly associated with the quality of the product, not necessarily with…

Greenfield investment is a type of business expansion where investments are made on the facilities in a new market where there were no such a facilities previously (Barclay, 2002). Aldi and Lidl have increasingly relied in greenfield investment as they main new market entry strategy. The choice of greenfield investment was done by Aldi and Lidl management among other alternative methods of new market entry such as exports, forming joint-ventures, mergers and acquisitions etc. for a range of reasons. All of these new market entry strategies have their advantages and disadvantages some of them have been discussed below. According to Ando (2006) companies will be in a better position to fully utilize their company-specific advantages if their choose greenfield investment as their new market entry strategy. This statement can be shown as one of the main reasons why Aldi and Lidl have increasingly relied on greenfield investment as their main new market entry strategy. Both companies had their competitive advantages that were their ability to keep business costs down by saving on additional costs such as customer services, ‘art-of-state’ shop designs and additional features. If Aldi and Lidl had chosen any alternative new market entry strategy their current competitive advantages would be put under risk, threatening to the overall success of the business. Moreover, “reasons for greenfield investment could be that companies frequently make foreign investments where there is little or no competition, so finding a company to buy may be difficult” (Epperlein, 2007, p.22). This argument was true as well due to the fact that discount retailing business concept Aldi and Lidl adhered to was relatively new at the time of their expansion and there were no retailers using the same business concepts in Aldi and Lidl target markets, these companies could form joint-ventures with. Another possible reason for the…

Symbol has been defined by Smith (2009) as a material object, written sign or something invisible that is used to represent something else. “The idea of ‘binding a matter with the matter’s image” is one that speaks to a more visceral aspect of symbolism and suggests a dimension of relational meaning for symbols that can play no comparable role in our understanding of a simple phonetic latter in the modern sense” (Scranton, 2010, p.47). According to Brodskaya (2007) in literature symbolism can be in forms of damnation, salvation, and reincarnation. Currently symbols are used for commercials purposes as well by many companies through associating their brands with a particular symbol or logo. Consumption can be interpreted as buying, using and interpretation of things (Aldridge, 2003) and in this sense it is a different term from a traditional economic definition of consumption. “Consumption involves consuming ideas, images on television and in advertisements” (Bocock, 1993, p.33). There are debates about the role and scope of the notion of consumption, but generally, many researchers agree on the current meaning of consumption in a way that modern identities are structured around the experience of consumption (Dunn, 1998). An interesting point relating to the issue of consumption is that it is very difficult for people to distinguish their ‘true’ and ‘false’ needs. True needs are air, water, food, sleep, and sex, without which it is impossible to live and people have to ‘consume’ them regularly, whereas ‘false’ needs are the ones created by marketing professionals, which makes people want to ‘consume’ their products or services. For instance, thirst for Coca Cola is a ‘false’ consumption need created by marketers. This is possible because people tend to express their desire through their consumption patterns. For example, if an individual desires to become a senior level executive,…

Vodafone SWOT Analysis.SWOT analysis is a technological tool through which strengths and weaknesses, as well as opportunities and threats of the business can be identified (Kotler et al, 2008). Strengths and weaknesses are considered to be internal factors affecting the company, whereas threats and opportunities are external factors. Vodafone’s leadership position in the market can be considered to be the main strength the company possesses, because due to this fact the company is better positioned to finance new projects and to introduce new services to the market. Moreover, Vodafone has a wide geographical reach and its network infrastructure is considered to be highly developed. The main weakness Vodafone has relates to its centralised management system that can cause inflexibility in today’s highly competitive marketplace. Pang (2009) informs that customer churn rate is the degree at which companies are able to retain their current customers. High level of customer churn rate is another weakness Vodafone has. However this issue is not unique to Vodafone and has negative effects to many subscriber-based service model companies. There are range of opportunities for Vodafone that if taken can improve its position in the marketplace. These opportunities include strengthening its position in new markets, forming strategic partnerships with technology and internet-related companies in order to increase the number of its services and the level of global presence of the company, and also focusing more in utilising 3G technologies. Threats to the profitability and long-term growth of the company are the level of global competition intensifying even more, market saturation in developed countries, as well as the emergence of alternative telecommunications technology. References Company Description, Vodafone Group Plc, Hoovers, Available at: http://www.hoovers.com/company/Vodafone_Group_Plc/cksxti-1.html Accessed February 12, 2011 Kotler, P, Armstrong, G, Wong, V & Saunders, J, 2008, Marketing Defined. Principles of marketing (5th ed.), Prentice Hall Pang,…

Vodafone PEST Analysis. PEST analysis is a strategic tool used to analyse external factors affecting the business and stands for political, economical social and technological factors (Lancaster et al, 2002). The main political factors affecting Vodafone include EU Roaming Regulation that aims to decrease charges for mobile phone usages abroad by 70% (Preissl et al, 2009) and increasing level of consumer rights within Europe, and decisions made by European Union Regulatory Framework for the communications sector. Moreover, any government intervention through legislation or otherwise in the markets Vodafone operates can be considered as political factors. Economical factors also affect Vodafone main of which are the growth of GDP and the level of inflation rate within markets where the company operates. Furthermore, global economic issues like the global financial crisis of 2007-2010 are also economic factors affecting Vodafone. Generally any external economic changes affecting Vodafone can be classified as external economic factors. There is a range of social factors as well that affect Vodafone. For instance, changing work patterns that are becoming very popular make people work from home increasingly relying in communication technologies. Also, there are issues like people going ‘green’ and ageing population in developed countries that are going to affect Vodafone directly or indirectly. The impact of technological factors on Vodafone is without any doubt due to the nature of the telecommunications industry. Specifically, a technological innovation in communications and emergence of alternative means of communication such as online chatting, and Yahoo! Messenger are going to affect Vodafone strategy in a way that the company is left with a choice of either to form strategic alliances with above companies or to commit to considerable amount of research and development in order to introduce innovative products and services to the market. References Lancaster, G, Massingham, L & Ashford, R, 2002,…

One of the most popular theories related to the topic of change is Lewin’s Force-Field Theory of change according to which there are two forces affecting to change at the same time (Rickards, 1999). There are driving forces that positively contribute to the change to happen and there are also restraining forces that are obstructions to change. Most of the restraining forces on individual basis have been explained above. Accordingly, in order for the change plan to succeed driving forces should be strong, restraining forces should weaken, or both of these should take place at the same time. For instance, if a company has proposed a change plan that requires employees to use new software when preparing report instead of old software the workforce is used to there are driving forces, as well as restraining forces that affect the success of this change plan. The main driving force in this case would be the fact that reports prepared with the new software would result in more detailed information for decision making, and thus create competitive edge for the company. However, restraining forces are the facts that employees are used to the old software, more time needs to be spent with the new software and the new software is more complex to use. The practical implications of this theory are that senior level management of this company should strengthen the driving force for the change which can be achieved through explaining to the workforce the advantages of the new software for decision-making and how this advantage is connected to the long-term growth of the company, and ultimately how it will affect the future of each employees. At the same time company management should minimise restraining forces through organising training for employees and teach them how to use the new software.…

By John Dudovskiy

Category: Change

Implications of Individual Resistance to Change. Because of the highly competitive nature of today’s local and global business environment constant change has become an integral part of any business strategy. Companies that refuse to change constantly according to the changing market environment risk losing their market share and customer loyalty. Therefore, today most companies understand the importance of change and try to implement changes constantly in order to improve the efficiency of their business processes. However, understanding the importance of change and having a good change plan is not enough for companies to succeed, because there are many barriers to implementing change in an organisation and individual resistance to change is one of them. “Individual sources of resistance are rooted in basic human characteristics such as needs and perceptions” (Griffin and Moorhead, 2009, p. 514). The main obstructions in the way of devising an effecting change plan and implementing it include habit, security, economic factors, fear of unknown, lack of awareness, social factors and others (Dantzker, 1999). This article analyses the implications of individual resistance to change in detail. The main factors seen as barriers to chain are analysed separately in great detail and the implications of individual resistance to change are illustrated with personal and professional examples. Moreover, strategies are discussed that can help to overcome individual resistance to change as suggested by respected scholars in the field of organisational change. Habit as Resistance to Change One of the strongest reasons for individual resistance to change is considered to be habit. “Habits are hard-wired into the basal ganglia part of the brain. In this area the brain makes connections to experiences and insights and functions effectively and efficiently without using a lot of energy” (Training, online magazine, 2009). In other words, in organisational context habits are the ways of…

By John Dudovskiy

Category: Change