Square Porter’s Five Forces Analysis

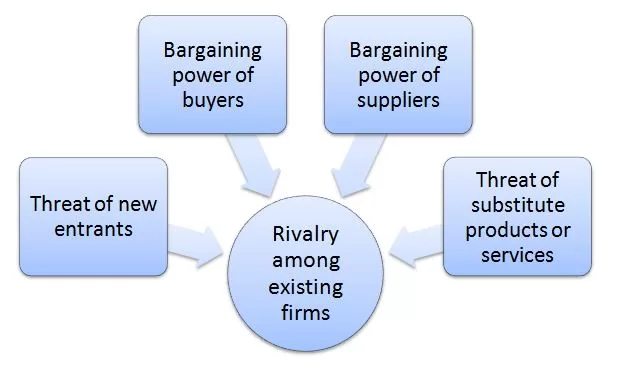

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape an overall extent of competition in the industry. Square Porters Five Forces are illustrated in figure 1 below:

Threat of new entrants in Square Porter’s Five Forces Analysis

Threat of new entrants into the fintech sector is considerable. The following points affect the formation of the threat of new entrants into Square’s industry.

1. Time of entry. Banking and finance is already being disrupted globally and Square has been at the forefront of changes. Nowadays it has become evident that the old ways of conducting financial affairs where businesses had to wait for days, if not weeks to get their loan applications reviewed and employees have to wait for several days to get their cheques cashed will become history soon. Accordingly, some entrepreneurs, as well as, many established financial institutions are currently realizing their own projects to claim their piece of pie in the formation of the new global financial landscape.

2. Expected retaliation from current market players. While there are many entities interested in participating in the formation of new financial systems, any new market entrant will face retaliation from Square. It has to be noted that Square even stood up against deep-pocketed behemoth called Amazon. In 2014 Amazon copied Square’s main product, card reader, undercut its price by 30% and offered free two-day shipping and live customer support.[2] In response Square increased its focus on the quality of its products and customer services. By the end of 2015, Amazon had to discontinue its Register card reader.

3. Legal and regulatory barriers. Finance and banking is one of the most heavily regulated industries worldwide. There are consumer protection laws, anti-money laundering laws, broker-dealer regulations, virtual currency regulations, protection and use of information laws and a wide range of other related rules and regulations that tend to be overly complex. Since its establishment in 2009 Square has gained valuable knowledge and experience to deal with regulatory complexity. For potential new market entrants, on the other hand, dealing with legal aspects of fintech can prove to be a considerable discouraging barrier.

Bargaining power of buyers in Square Porter’s Five Forces Analysis

Bargaining power of Square buyers is moderate. The following factors reduce the bargaining power of Square customers:

1. Diversity of customers and industries. Square does not depend on a few customers or on a few industries for the majority of its revenues. Specifically, the payments company has no buyer that accounts for greater than 10% of the total revenue. Moreover, as illustrated in Figure 2 below, no single industry accounts for greater than 27% of gross payment volume for the financial services and digital payments company. Accordingly, losing any single customer or decline in any single industry will not have severely detrimental impact on Square revenues.

Figure 2 Percentage of Gross Payment Volume (GPV) by industry[1]

2. Effectiveness of Square ecosystems. The financial services platform has an advanced and ever-growing ecosystem of products and services. For small businesses Square ecosystem offers payments, invoicing, appointments, customer engagement and payroll platforms that are seamlessly integrated. For example, businesses can pay wages on their employees Cash App accounts on the same day of generating the revenues. Discontinuing using Square implies not benefiting from a wide range of integrated products and services for small businesses and this fact diminishes their bargaining power.

Range of services within Square ecosystem for individuals include making person-to-person payments, receiving wages in Cash App, investing in Stock and Bitcoins and others. Again, stopping using Square implies not benefiting from all of these integrated services for individuals and this fact fuels customer loyalty towards the payments company.

3. Customer switching costs. There is a switching cost for small businesses to replace Square with an alternative financial services platform. Specifically, businesses will have to purchase new readers, stand, terminal, register, hardware kits and accessories from their new vendor if they want to make the shift. Taking into account that small businesses usually have restrained financial resources, the presence of switching costs does not motivate them to explore alternatives to Square.

Square Inc. Report contains a full analysis of Square Porter’s Five Forces Analysis. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Value Chain analysis, Ansoff Matrix and McKinsey 7S Model on Square. Moreover, the report contains analyses of Square leadership, business strategy, organizational structure and organizational culture. The report also comprises discussions of Square marketing strategy, ecosystem and addresses issues of corporate social responsibility.

[1] Porter, M. (1979) “How Competitive Forces Shape Strategy” Harvard Business Review

[2] McKelvey, J. (2020) “Innovation Stack: Building an Unbeatable Business. One Crazy Idea at a Time” Portfolio/Penguin

[3] Annual Report (2020) Square Inc.