Posts by John Dudovskiy

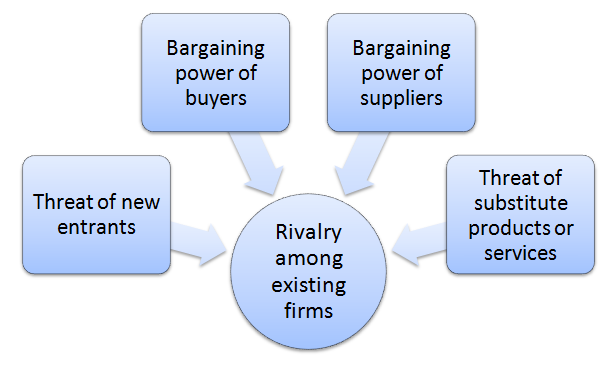

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. These forces are represented in figure below: Threat of new entrants in the industry is insignificant. This is because the global market of carbonated drinks is highly saturated and new entrants cannot benefits from the economies of scale extensively exploited by existing market players. Moreover, there is a substantial knowledge barrier in terms of being able to develop soft drinks that could successfully compete with industry leaders such as Coca Cola and Pepsi and the relevance of technological barrier can be assessed as substantial as well. Bargaining power of buyers is great and this power is fuelled by the availability of great choice of cola beverages. Moreover, there is no switching costs for customers and the price elasticity of products further increases buyer purchasing power. At the same time, the issue of Coca Cola addiction has surfaced in the media a number of times, addiction of Peter Lawrie, a professional golfer being a noteworthy exampe[2]. Accordingly, it can be argued that bargaining power of small segment of buyers who can be classified as ‘Coke addicts’ is not significant. Bargaining power of suppliers varies according to the type of supplier. There are few suppliers with great bargaining power such as Ajinomoto Co., Inc. and SinoSweet Co., Ltd suppliers of spartame, a non-nutritive sweetener and Nutrinova Nutrition Specialties & Food Ingredients GmbH, supplier of acesulfame potassium. Coca Cola operates Supplier Diversity Program that promotes diversity among suppliers for reportedly noble reasons, at the same time decreasing the bargaining power of each individual supplier. As it is illustrated in figure below, the volume of investment on supplier diversity has been consistently increasing for the last four years…. Coca Cola…

Effective marketing strategy has played a critical role for Coca Cola’s success in the global marketplace. The company has declared its total compliance with the following 4 principles of Responsible Marketing Policy: Choice – providing a great range of product options, so that customers can choose according to balanced diets and active lifestyles. Balance – encouraging the consumption of beverages in sensible manners and moderated amounts. Honesty – adhering to the principles of honesty and transparency in all marketing and sales activities. No marketing to children – marketing of any products should not be aimed at children under the age of 12. In addition to its own marketing initiatives, Coca Cola provides promotional and marketing services to distributors, bottlers and resellers on a discretionary basis. In 2014 marketing expenses of this category amounted to $7 billion respectively[1]. The company has announced ‘One Brand’ marketing campaign that is aimed to unite four different brands – Coca Cola, Diet Coke, Coca Cola Zero and Coca Cola Life under the umbrella of Coca Cola. The level of marketing spending to advertise lower sugar, no sugar and no calorie beverages has been doubled in 2015[2]. Advertising Coca Cola advertising strategy is boldly experiential with innovative design of posters and print and media advertising. The company is announced that media advertising investments will increase by $1 billion by 2016[3]. According to “One Brand” marketing campaign Coca Cola advertising via various channels will feature all four different brands of Coca Cola as illustrated in Figure 2 above. Viral marketing is accepted as an important element of the advertising mix by the company and it is extensively applied to promote specific marketing initiatives such as ‘Sharing a Can, personalization of Cola cans and bottles by printing names, as well as, “Sing For Me” campaign, an initiative that…

Political Factors Coca Cola is impacted by a set of political factors, both, in the US and abroad. These include, but not limited to the level of political stability in the country, impact of international pressure groups and domestic market lobbying groups and the government attitude towards the industry and the company. There are few specific instances that illustrate the impact of political factors on Coca Cola performance. “One Day without Coca Cola” campaign launched by University organizations of the Social Nicaraguan Movement was a protest against the US-led invasion of Iraq with an inevitably negative impact on Coca Cola revenues in respective markets[1]. Similarly, Israeli attacks on Gaza in 2014 have caused some of the businesses in Turkey and more than 100 hotels in Mumbai stop selling products of Coca Cola Company[2]. Economic Factors Coca Cola sales are impacted by a set of economic factors that beyond of company’s control. These factors include the level of economic growth in the country and in the industry, tax rates and currency exchange rates, interest rates, labor costs and others. The global economic and financial crisis of 2007 – 2009 is a relevant example of an economic factor that greatly impacted the majority of businesses around the globe. However, the crisis has impacted Coca Cola to a lesser extent compared to many other businesses. Its operating margin remained at industry-front 22% despite the crisis, although dividend yield was reduced to 2.6%[3]. Arguably, fluctuations in exchange rate is the most significant economic factor that has adversely impacted Coca Cola performance in recent years. For example, due to severe currency devaluation in Venezuela, Coca Cola’s reported profits in this market has to be reduced by 55% in the fourth quarter of 2014 and there are similar instances in other parts of the world[4].…

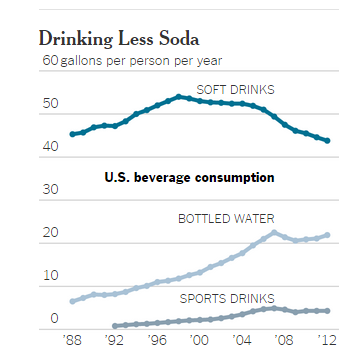

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Coca Cola SWOT analysis: Strengths 1. Ownership of leading brands in soft drinks market segment 2. Brand value 3. Highly sophisticated distribution channel 4. Solid financial position Weaknesses 1. Lack of clear competitive advantage over PepsiCo 2. Brand image is associated with ‘high sugar’ carbonates 3. Lack of product diversification 4. Negative publicity Opportunities 1. Focusing on health & wellness 2. Engaging in product diversification and brand extension 3. Packaging innovation 4. Engagement in acquisitions Threats 1. Consumer avoidance from soft drinks due to health considerations 2. Loss of market share to PepsiCo 3. Negative publicity due to water usage patterns 4. Changes in currency exchange rates Coca Cola SWOT Analysis Strengths 1. The company owns and markets four of the five leading brands in the market – Coca-Cola, Diet Coke, Fanta and Sprite. As it is illustrated in Figure 1 below, in 2014, products belonging to Coca Cola Company possessed 36.1% market share in carbonated soft drinks segment in the USA. Significant market share is associated with a solid revenue stream that can be channeled to new product development and marketing initiatives to contribute to long-term growth prospects. 2. Estimated at $81.6 billion, Coca Cola brand value is the 3rd valuable brand in the world. This position provides the company a set of substantial benefits in terms of customer loyalty and bargaining power with suppliers. Moreover, a great brand value is a confirmation of efficiency of competitive advantage and it also provides grounds to increase profit margin. 3. Coca Cola Company has a highly sophisticated distribution channel that enables the sales of more than 2 billion unit cases of products across 28 countries and three continents. Coca Cola products are distributed via…

This report contains application of SWOT, PESTEL, Porter’s Five Forces and Value-Chain analytical frameworks towards the case study of Coca Cola Company. The report also comprises analysis of Coca Cola’s marketing strategy and company’s approach towards Corporate Social Responsibility (CSR). The world’s largest beverage company, The Coca Cola Company is owner or licenser of more than 500 non-alcoholic beverage brands. The company sells a wide range of beverages that include waters, enhanced waters, juices and juice drinks, ready-to-drink teas and coffees, and energy and sports drinks . Products belonging to Coca-Cola Company are sold in more than 200 countries around the globe since its incorporation in 1886. Incorporated in 1919, The Coca Cola Company offers well-known brands such as Coca-Cola, Fanta, Sprite, Minute Maid, Powerade, Del Valle, Schweppers, Aquariues and others. In addition to its core business of manufacturing and selling non-alcoholic drinks, Coca Cola Company is also engaged in some other affiliated businesses such as distribution of Monster Energy beverage drinks, products of DPSG brands and joint venture with Nestle S.A. to produce and distribute Nestea products in Europe, Canada and Australia. Coca Cola Company’s 2020 Vision is based on its mission that consists of three parts: a) to refresh the world, b) to inspire moments of optimism and happiness and c) to create value and make difference. Recently the company initiated a new marketing campaign ‘One Brand’ that aims to unite four different brands – Coca Cola, Diet Coke, Coca Cola Zero and Coca Cola Life under the umbrella of Coca Cola. TABLE OF CONTENTS 1. Introduction 2. SWOT Analysis 2.1 Strengths 2.2 Weaknesses 2.3 Opportunities 2.4 Threats 3. PESTEL Analysis 3.1 Political Factors 3.2 Economic Factors 3.3 Social Factors 3.4 Technological Factors 3.5 Environmental Factors 3.6 Legal Factors 4. Marketing Strategy 4.1 Advertising 4.2 Sales Promotion 4.3…

Biersteker (1995) explores apparent triumph of liberal economic ideas in the developing world by concentrating on the nature of change in economic thinking. According to this article dramatic changes in economic thinking in developing countries took place mainly during the period of 1980s and 1990s. Differences in perceptions between countries and their impact on implementing liberal economic ideas are stressed by Biersteker (1995) to explain variations on the levels of economic liberalisation amongst Latin American countries. Biersteker (1995) offers an interesting account of the impact of liberalism on developing countries. Specifically, Biersteker (1995) discounts the impact of following four factors in facilitating change in economic thinking – perception of superiority of liberal ideas by developing countries, exercise of power by international financial institutions such as IMF and the World Bank, intensifying forces of globalisation, and collapse of socialism. Instead, Biersteker (1995) offers explanation for change in economic thinking from four different perspectives: ideational, systematic, domestic interest, and international institutional perspectives. A noteworthy shortcoming associated with this approach is associated with being overly idealistic. While the author accepts this fact by stating that “each of these should be considered as an idealised construction” (Biersteker, 1995, p.181), nevertheless, the idealised approach undermines the level of practical relevance of the work. Reyes and Sawyer (2011) offer an alternative approach to the work of Biersteker (1995) by identifying perception of superiority of liberal ideas as the most significant factor fuelling change in economic thinking in developing counties during the last three decades of the last century. References Biersteker, T.J. (1995) “The “triumph” of liberal economic ideas in the developing world” in Global Change, Regional Response: The New International Context for Development, editor Stallings, B., Cambridge University Press Reyes, J.A. & Sawyer, C.W. (2011) “Latin American Economic Development” Taylor & Francis

Today many innovations are associated with businesses as opposed to individuals. There are several reasons behind this phenomenon. Rapid development of knowledge management practices and processes in companies can be mentioned as one of the primary reasons behind many innovations being associated with businesses as opposed to individuals. Levels of sophistications of knowledge management systems in organisations have been increasing with rapid paces during last several years and this tendency has had positive correlation with creativity and innovation in most organisations. This argument can be better explained by referring to the concept of knowledge life cycle. According to this concept, knowledge life cycle comprises capture, verification, codification, integration, synthesis, dissemination and utilisation stages. Towards the end of the last stage organisational knowledge has a great potential to be used to make innovations of products, services and processes through collaboration and teamwork. Senior level management in increasing numbers of businesses do understand the importance of creativity and ‘thinking outside of box’ in terms of producing innovative products and services and attempt to shape organisational culture accordingly. One of the most innovative companies of the present day – Google is a suitable case study to justify this point. Specifically, Google offices around the globe are famous for their unique, innovative and highly informal design to encourage creativity amongst employees. Moreover, Google practices ’20 per cent rule’ according to which employees are free to spend one fifth of their paid time at work doing activity of their choice that does not have to be aligned with the corporate strategy (Kotter, 2013). Such a move enables Google to introduce innovative products and services in a regular basis allowing the company to diversify to a great extent. Many other companies are also following this path to varying extents in terms of creating informal work environment…

The twenty first century has been accepted as a century of information with the amount of information increasing with a geometrical progression, however this tendency is associated with a set of challenges that include protection of intellectual property which can be defined as any patterns of original creation that can be purchased or sold. Main forms of intellectual property protection are patenting, trademarks, trade secrets and copyright. Patenting is a popular way of protecting intellectual property, and patents are obtained for inventions that have potentials to generate revenues for inventor. Patents allow the patent holder to market the invention and patenting rights to the third party or license the invention when retaining intellectual property rights. Patents are considered to be intangible assets and many global businesses possess considerable amount of such type of asset. For example, gross carrying amount of patents of Ford Motor Company has exceeded USD 27 million by 2012 with the net carrying amount of USD 7 millions (Annual Report, 2012). Due to increasing numbers of innovations, and willingness of businesses to take advantage of these innovations there are many patent infringement lawsuits amongst many multinational corporations at any given time. For example, one of the most recent and noteworthy patent infringement disputes is the one between Finland-based global communications corporations – Nokia and HTC its Taiwan-based direct competitor. Patent infringement dispute initiated by Nokia for the use of Broadcom and Qualcom chip for HTC One model has attracted extensive media coverage due to its scale and significance and Nokia has emerged as a victor in the dispute with detrimental impacts on HTC in terms of damage to the brand image and future profits (Arthur, 2013). Moreover, there are instances where businesses decide to end their patent infringement disputes due to cost considerations of lawsuits, damage to…

It has been stated that Total Quality Management (TQM) “is difficult to define precisely because it is a philosophy of total organisational involvement in improving all aspects of quality” (Allen, 2004, p.68), nevertheless, in a broad manner TQM can be defined as a quality improvement philosophy that adopts a holistic approach and requires active participation of all employees. Initially developed by Edward Deming in 1940s, TQM became a buzzword in the US several decades later due to its implementation by a range of large companies such as Ford Motor Company, Motorola, and Xerox. University and colleges, as well as, many other organisations in all industries can apply TQM elements in practice in order to increase the level of customer satisfactions significantly. TQM elements include understanding customer needs, doing things right the first time, continuous improvement, regular assessments of quality related costs, developing effective systems and procedures etc. ‘Getting things right the first time’ is one of the fundamental TQM elements. This approach substitutes quality inspection practices with constant search and utilisation the potentials for quality improvement. The approach of ‘getting things right the first time’ can benefit the college in terms of avoiding waste of resources, and saving substantial amounts of time and money. TQM principle of continuous improvement is associated with Kaizen philosophy and its applicability is extended beyond organisational environment to cover personal life, relationships, social life etc. Main advantages of Kaizen principles for the college The value of continuous improvement or Kaizen for the college is even grater taking into account the fact that implementation of this principle does not require vast financial investments on behalf of the college and improvements can be introduced in a gradual manner. Another vital TQM element can be identified as understanding customer needs in the first place so that relevant products…

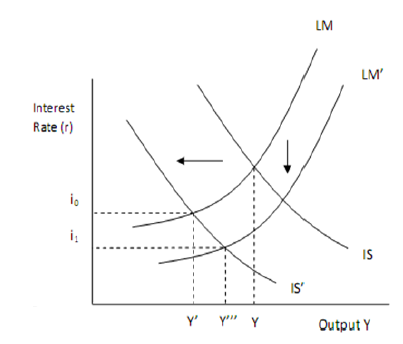

Great Depression is rightly perceived as the main stimulating factor behind the emergence of Keynesian framework and ISLM model and the model proved effective to deal with the crisis to a certain extent. However, a set of significant shortcomings associated with ISLM model such as neglecting expectations, static nature of the model, unrealistic closed-economy assumption, assuming prices to remain fixed etc. have led to the evolution of alternative models. Proposed by Robert Mundell and Marcus Fleming, the Mundell-Fleming model represents an economic model that explains the nature of relationship between the nominal exchange rate and the output of the economy in the short run. Traditionally, this model has been used to justify the argument that maintenance of fixed exchange rate, movement of free capital and independent monetary policy in a simultaneous manner is impossible to achieve. The main difference between Mundell-Fleming model and ISLM model relates to the fact that while ISLM model is effective under a closed-economy, Mundell-Fleming model attempts to analyse an open-economic system. In other words, unlike ISLM, impacts of international finance and international trade are acknowledged in Mundell-Fleming model. Different countries respondent the global economic crisis of 2007 – 2009 differently taking into account unique set of internal and external factors, however, macroeconomic responses to the crisis by many developed counties can be effectively explained with the use of ISLM model. Dramatic decline in the level of consumer spending which also caused the decline of consumer confidence in markets has facilitated the shift of IS curve in ISLM model to the left. Range of responses by governments to this event included reducing the level of interest rates significantly. For example, interest rates were reduced in US, UK and Japan to 0.25 per cent, 0.5 per cent and 0.1 per cent respectively. Reduction of the level of…