Square ecosystem represents a growing ecosystem of financial services. Ecosystem of Square can be divided into two groups: seller ecosystem and cash ecosystem. Square seller ecosystem is a cohesive commerce ecosystem that helps its sellers start, run, and grow their businesses. As illustrated in Figure 1 below, the core services for sellers are managed payments and points of sales products and services. Specific functionalities that contribute to these services include customer engagement platform, payroll invoices services, functionality to make appointments and capital management tools. Moreover, e-commerce and developer platforms, as well as, virtual terminal are important components of Square ecosystem on the Seller front. Figure 1 Square Seller products and services Square cash ecosystem, represented by Cash App comprises a wide range of financial products and services that are designed to help individuals manage their money. These include a cash card, instant discounts tool Boost. The strongest feature of Cash App that has no analogue in the market is the functionality to purchase Bitcoints and stocks in a simple, secure and hassle-free manner. Figure 2 Square Cash App functionalities The financial services and digital payments company is increasing the linkage between its seller and cash ecosystem in order to from strengthen its position in the market. For example, employers with seller account can pay their employees from seller revenues the next business day using Instant Payments feature when employees use Cash App. There is still room for growth of Square ecosystem on both fronts – Seller and Cash App. Apart from connecting the both ecosystems. The finance sector disruptor can also scale each of them, as well as, engage in optimised cross-selling. Moreover, the developer platform can play an instrumental role in expanding the ecosystem for Square, through exposing Application Program Interface (API) to third party developers to adjust it…

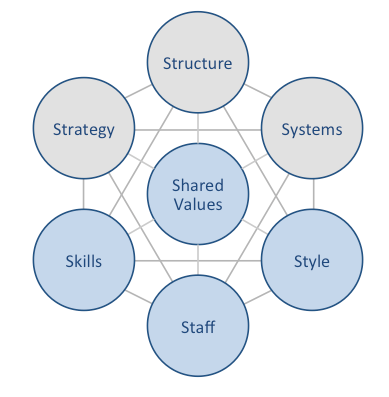

Square McKinsey 7S model is intended to illustrate how seven elements of business can be aligned to increase effectiveness. The framework divides business elements into two groups – hard and soft. Strategy, structure and systems are considered hard elements, whereas shared values, skills, style and staff are soft elements. According to Square McKinsey 7S model, there is a strong link between elements and a change in one element causes changes in others. Moreover, shared values are the most important of elements because they cause influence other elements to a great extent. McKinsey 7S model Hard Elements in Square McKinsey 7S Model Strategy Square business strategy is based on principles of simplifying financial transactions and developing an ecosystem of financial products and services. The financial services platform has two types of ecosystem – seller ecosystem and cash ecosystem. Square systematically expands both ecosystems with addition of new financial products and services that simplify processes and challenge the status quo. Structure Square organizational structure is highly dynamic, reflecting the rapid expansion of the range of financial products and services offered by the finance sector disruptor. Although it is difficult to frame Square organizational culture into any category due to the complexity of the business, it is closer to flat organizational structure compared to known alternatives. Specifically, co-founder and CEO Jack Dorsey has very little tolerance for bureaucracy and formality in business processes. Moreover, Dorsey believes in providing independence to teams and maintain the team sizes small. All of these are reflected in Square organizational structure. Systems Square Inc. business operations depend on a wide range of systems. These include employee recruitment and selection system, team development and orientation system, transaction processing systems and others. Moreover, customer relationship management system, business intelligence system and knowledge management system is also important…

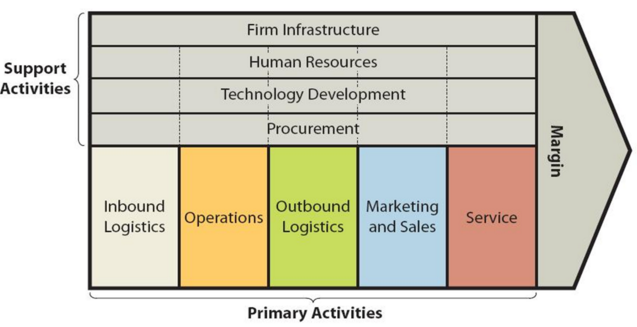

Value chain analysis is a strategic analytical tool that can be used to identify business activities that create the most value. The framework divides business activities into two categories – primary and support. The figure below illustrates the essence of Square value chain analysis. Square Value Chain Analysis Square Primary Activities Square Inbound logistics Inbound logistics refers to receiving and storing raw materials for their consequent usage in producing products and providing services. Along with a wide range of financial services, Square offers related hardware products such as card readers, stands, terminals, registers, hardware kits and accessories. The majority of hardware products are produced in China. Accordingly, cost-effectiveness of producing hardware products is the main source of value creation in inbound logistics for Square. Square Operations Square operations are divided into the following two segments: 1. Seller ecosystem. An expanding ecosystem of products and services that are designed to assist sellers to start, run and grow their businesses. In 2019 this segment processed USD106.2 billion of Gross Payment Volume (GPV), which was generated by nearly 2.3 billion card payments from 407 million payment cards.[1] 2. Cash ecosystem. This segment centred on Cash App integrates financial products and services that help individuals manage their money. As of December 2019, Cash App had approximately 24 million monthly active customers who had at least one transaction in any given month.[2] The main source of value creation in operations primary activity for Square refers to high level of speed and convenience of products and services enabled by technology. The finance sector disruptor spotted demand in both segments and developed products and services to satisfy demand with the use of the latest technology. Square Outbound Logistics Outbound logistics involve warehousing and distribution of products. Square uses the following distribution channels to distribute…

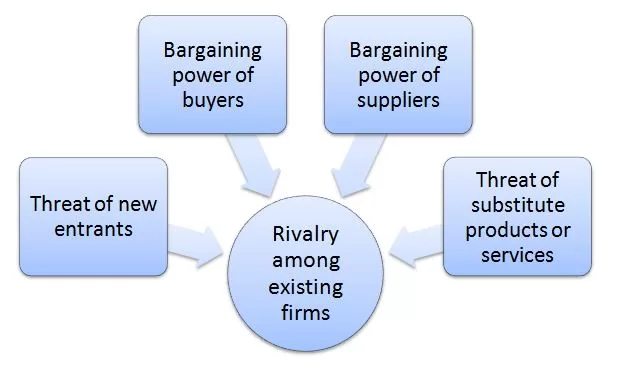

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape an overall extent of competition in the industry. Square Porters Five Forces are illustrated in figure 1 below: Figure 1 Porter’s Five Forces Threat of new entrants in Square Porter’s Five Forces Analysis Threat of new entrants into the fintech sector is considerable. The following points affect the formation of the threat of new entrants into Square’s industry. 1. Time of entry. Banking and finance is already being disrupted globally and Square has been at the forefront of changes. Nowadays it has become evident that the old ways of conducting financial affairs where businesses had to wait for days, if not weeks to get their loan applications reviewed and employees have to wait for several days to get their cheques cashed will become history soon. Accordingly, some entrepreneurs, as well as, many established financial institutions are currently realizing their own projects to claim their piece of pie in the formation of the new global financial landscape. 2. Expected retaliation from current market players. While there are many entities interested in participating in the formation of new financial systems, any new market entrant will face retaliation from Square. It has to be noted that Square even stood up against deep-pocketed behemoth called Amazon. In 2014 Amazon copied Square’s main product, card reader, undercut its price by 30% and offered free two-day shipping and live customer support.[2] In response Square increased its focus on the quality of its products and customer services. By the end of 2015, Amazon had to discontinue its Register card reader. 3. Legal and regulatory barriers. Finance and banking is one of the most heavily regulated industries worldwide. There are consumer protection laws, anti-money laundering laws, broker-dealer regulations, virtual currency regulations,…

Square marketing communication mix comprises communication channels to communicate the marketing message to the target customer segment. These channels are print and media advertising, sales promotions, events and experiences, public relations and direct marketing. Square Print and Media Advertising Despite being an internet-based financial services platform, Square uses traditional forms of advertising such as TV and radio ads occasionally. The financial services and mobile payments company also uses billboards and posters to communicate its marketing message to the target customer segment. Social media is the main platform that is extensively used by Square as an effective communication channel with perspective customers. Specifically, the financial services platform uses content marketing to inform about the cases of small businesses that were able to increase their sales using Square card readers and other products and services. These success stories are meant to inspire other small businesses worldwide to try using Square products and services. Square Sales Promotions Square uses the following sales promotion techniques. 1. Square Affiliate Program. The program offers various bonuses for the use of different types of products and services by referrals. For example, the payments the company offers USD5 per new sign-up, plus a USD15 bonus when an activation starts taking payments within 45 days of signup. Moreover, there is USD5 per new sign-up, plus a USD233 bonus when an activation processes their first transaction using Square for Retail within 45 days of signup.[1] 2. Point of sale materials. Square produces and sells a wide range of point of sale products such as card readers, stands, terminals, register and wide range of related accessories. The hardware and point of sales materials are designed in simple and eye-catching attractive manners. As of September 2021, Square does not use seasonal sales promotions, money off coupons, competitions, discount vouchers,…

Square segmentation, targeting and positioning refers to a series of consecutive marketing efforts. It comprises the following stages: 1. Segmenting the market. Generally, market segmentation involves dividing population into certain characteristics. For Square, segmentation also involves private entities taking into account B2B, as well as, B2C nature of its business. The most popular types of segmentation are geographic, demographic, behavioural and psychographic. 2. Targeting the selected segment(s). Choosing specific groups among those formed as a result of segmentation to sell products and/or services. In B2B front Square selected as target customer segment small businesses facing difficulties accepting credit cards. In B2C business, the target customer segment for Square is broad. The financial unicorn decided to target the individuals in developed countries who engage in financial transactions with other individuals and this segment of population is large. 3. Positioning the offering. Choosing and applying the elements of the marketing mix that appeal best to the needs and wants of the selected target customer segment. Square developed a card reader and positioned this product as an effective solution for small businesses that were facing difficulties in accepting credit cards. The payments company is making an important shift from mono-segment towards multi-segment type of positioning. Specifically, the financial services platform started with selling card readers to small business segment only. Nowadays, Square’s expanding range of financial products and services are attracting increasing numbers of medium business segment as well. For B2C customer segment the financial services platform positioned its products and services as simplified versions of products and services already available on the market. For example, Cash App offers individuals hassle-free possibilities of investing in stock and bitcoin without any commission. Square Inc. Report contains the above analysis of Square segmentation, targeting and positioning and Square marketing strategy in general. The report illustrates…

Square marketing mix (Square 7Ps of marketing) comprises elements of the marketing mix that managers can review and optimise in order to increase their revenues. The original 4Ps of the concept introduced by E. Jerome McCarthy in 1960 consisted of product, price, place and promotion. Later, additional 3Ps – process, people and physical evidence were added to further expand the model. Product Element in Square Marketing Mix (Square 7Ps of Marketing) Square offers financial products and services for small businesses, as well as, consumers. The company offers more than 30 distinct products and services to sellers that help them manage and grow their business. These include but not limited to Point of Sale (POS) systems, bank card readers, terminals, register and others. Cash App, on the other hand is an ecosystem of financial services that allows individuals to store, send, receive, spend, and invest their money. As of December 2019, Cash App had approximately 24 million monthly active customers who had at least one cash inflow or outflow during a given month.[1] The financial services and digital payments company is engaged extensively in development of new products and services to strengthen its ecosystem. Product development expenses for the year ended December 31, 2019, increased by USD173.1 million, or 35%, compared to the year ended December 31, 2018.[2] Place Element in Square Marketing Mix (Square 7Ps of Marketing) Place element of marketing mix refers to distribution strategies of products and services. Square distributes its products and services through the following channels: Online store in official website of the company Direct sales and account management teams to acquire large sellers Third-party developers and partners who offer Square solutions to their own customers. Price Element in Square Marketing Mix (Square 7Ps of Marketing) Square monetizes its products through a combination…

As a financial unicorn, Square was able to develop an effective ecosystem of payments products and services and gain an international acclaim. An effective marketing strategy plays an important role behind the phenomenal rise of the fintech. Sales and marketing expenses for the year ended December 31, 2019, increased by USD213.7 million, or 52%, compared to the year ended December 31, 2018. Total advertising costs for the three months ended March 31, 2021 and 2020, were USD85.9 million and USD36.2 million[1], respective. Square marketing strategy is based on the following principles: 1. Effective use of Freebies. Square offers peer-to-peer money transfer service to its Cash App customers for free as a marketing strategy. This strategy encourages extensive usage of Cash App which includes Cash Card among other features. 2. Reliance on Referrals as a marketing strategy. According to Square’s Referral Program if a customer refers her friend, both benefit from rewards. Rewards include credits on processing fees up to USD1.000 in sales over the next six months and discounts for certain type of products.[2] This program effectively contributes to the overall volume of revenues. 3. Attractive design of products. Square products are designed in a minimalistic, yet attractive manner. Designers at the B2B fintech are given a great degree of autonomy and they prioritise simplicity in their work. Square card readers, terminals, register and accessories usually attract customers’ attention due to their slick design and they effectively contribute to the overall design of small and medium business premises they are used by. 4. Content marketing. Focusing on content marketing on the basis of customer stories is one of the main pillars of Square marketing strategy. “The Square marketing team targeted tech- and social-media-savvy shop owners in the Bay Area, and these early customers helped them spread the word”[3] Nowadays,…

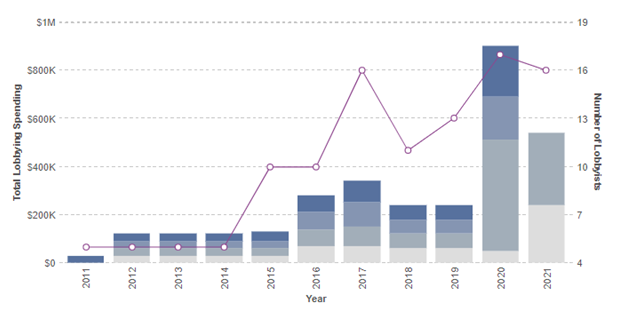

PESTEL is a strategic analytical tool. The acronym stands for political, economic, social, technological, environmental and legal factors. Square PESTEL analysis refers to the analysis of potential impact of these external factors on the performance of the financial services and digital payments company. Political Factors in Square PESTEL Analysis There are many political factors that can affect the bottom line for Square directly or indirectly. These include government stability, the level of bureaucracy, corruption, freedom of press and others. Moreover, activities of trade unions, government trade controls and tax policies, as well as, home market lobbying activities also belong to the list of political factors that can affect the business. Custom tariffs Square works with manufacturers from China to develop its hardware products. In September 2018, the United States imposed tariffs on certain imports from China, including on some Square hardware devices manufactured in China. The tariffs on these products were initially set at 10%, but were increased to 25% in May 2019. On September 1, 2019, the United States imposed new tariffs at 15% on additional imports from China, including Square’s remaining hardware products manufactured there, but rolled back these new tariffs to 7.5% effective February 14, 2020. The tariffs negatively affect the gross margin on the impacted products, which only partially has been offset by adjustments to the prices of some of the affected products. Bureaucracy Bureaucracy is one of the main political factors for Square. International market expansion for the financial services and digital payments company requires registering the business with local authorities in due manners. Business registration processes, as well as, the practice of conducting business can be highly bureaucratic, especially in developing countries and such a situation can have adverse effects on Square operations in respective markets. Particularly, bureaucracy can slow down…

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. Strengths and weaknesses are considered as internal to the business and companies can change them. Opportunities and threats, on the other hand, are external in a way that companies cannot influence them. The following table illustrates Square SWOT analysis: Strengths 1. Strong leadership by Jack Dorsey 2. Strong brand value 3. Effective ecosystems 4. Impressive growth rate of the business Weaknesses 1. Lack of global presence 2. High employee turnover 3. Dependence on payment cards networks 4. 4. High costs of operations Opportunities 1. International market expansion 2. Developing new products and services 3. Diversification 4. Support from governments Threats 1. Jack Dorsey conflict of interest or burnout 2. Increasing complexity of the business 3. Cyberattacks 4. 4. Emergence of new competitors Square SWOT analysis Strengths in Square SWOT Analysis 1. Square co-founder and CEO Jack Dorsey is a serial entrepreneur with proven leadership skills and business acumen. Dorsey successfully exercises purpose-driven leadership and his purpose at Square is making it easier for everyone to particulate in the economy. Moreover, Jack Dorsey is also a proven innovator and he is often compared to Steve Jobs, justifiably so. Dorsey’s effective leadership and innovative potential may play an instrumental role in expanding Square portfolio with more innovative products and services with positive implications on the long-term growth of the business. 2. Square market capitalization is more than USD 113 billion as of September 2021[1] As illustrated in figure below, Square stock value has increased more than 27 times from USD 9,00 since its IPO in October 2015 to its current USD 247,90. Specifically, market capitalization of the payments company soared during the past year once user conveniences associated with Square products and services became evident to a wider customer…