PESTEL is a strategic analytical tool used to evaluate external environment for the business. Specifically, Tesco PESTEL analysis involves an evaluation of political, economic, social, technological, environmental and legal factors affecting the retail chain. Political Factors A range of political factors can affect Tesco in direct and indirect ways. The list of political factors that may affect Tesco include but not limited to political stability in the UK and abroad, bureaucracy and the extent of corruption in Tesco’s home market in international markets. Moreover, activities of trade unions and home market lobbying initiatives in international markets are important political factors that affect the retail chain. Tesco’s new Chairman, John Allan has proved himself as an outspoken business leader to express his views about impacts of political factors on the business. For example he has stated that “the prospect of an EU referendum is causing uncertainty for investors, and this represents a “heavy pebble” placed in the scales of the British economy”[1]. Certain political factors can potentially have negative implications on Tesco’s bottom line. For example, in 2014 a group of local councils in the UK formally asked the government to for new powers to tax large supermarkets, an initiative that became known as ‘Tesco Tax’.[2] Although, this specific initiative was refused by the UK government to avoid price increases, similar political initiatives may succeed in the future with negative implications for Tesco. Economic Factors Various macroeconomic factors affect Tesco to a great extent. The cost of labor is one of the major economic factors greatly impacting the revenues of the supermarket chain. The company’s annual wage bill accounts to GBP 4.5 billion. Accordingly, increase of 1 per cent in the cost of labor costs the company about GBP 45 million. An increase of the national minimum wage to GBP 7.20…

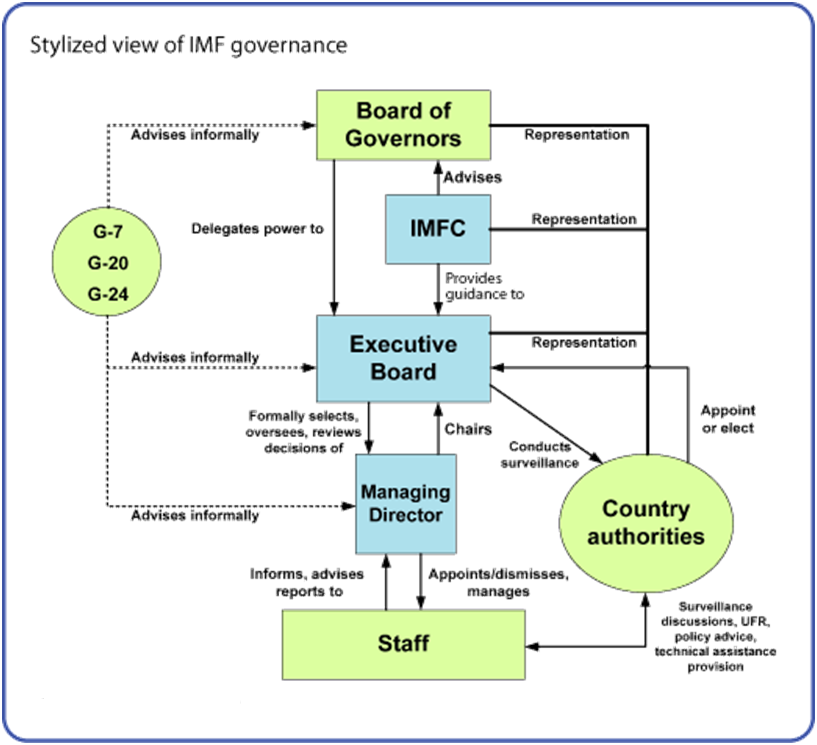

Abstract The International Monetary Fund (IMF) as one of the leading global financial organisations that deals with the issues of securing financial stability, facilitation of international trade, promoting economic growth in a sustainable manner, and poverty reduction in a global scale. There are mixed opinions about the role and performance of organisation in dealing with these issues. Some people perceive IMF to be an important organisation making valuable contribution to macroeconomic stability, whereas others blame the organisation for financial problems within specific countries and areas. Nevertheless, nowadays IMF has to deal with a set of complex challenges in local and global scales. This paper attempts to critically evaluate a set of issues directly related to IMF performance. The paper has identified major challenges faced by IMF to include its governance structure, increasing level of politicisation, leadership challenges, performance evaluation difficulties, and dealing with social instability. займы срочные в день обращения Moreover, necessary changes have been proposed for IMF that should assist in dealing with the challenges the organisation is facing. These changes include reforming IMF governance, gaining focus on role and objectives, developing performance accountability frameworks, improving lending policy, and increasing the level of comprehensiveness in country analysis. 1. Introduction The International Monetary Fund (IMF) is “an organization of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world” (About IMF, 2016). IMF was set up during Bretton Woods Agreements in 1944 with only 44 countries and it is governed by a Managing Director and Chairman of the Executive Board, currently Christine Lagarde, who is assisted by the First Deputy and three other Deputy Managing Directors. The Articles of Agreement of IMF state that the Managing Director “shall be chief of the operating…

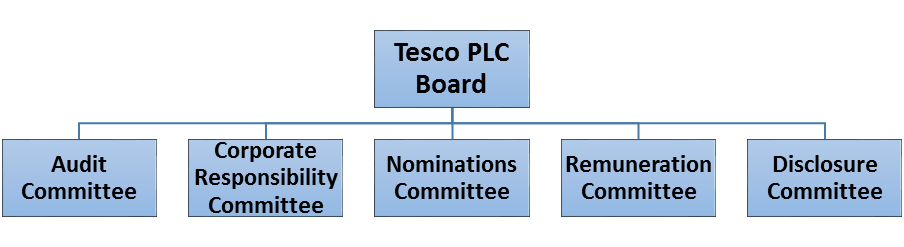

Tesco Board of Directors comprises 10 members and there were significant changes in the Board during the financial year 2014/15. These changes include the appointment of John Allan as the Chairman of the Board, the appointment of a new CEO Dave Lewis and new Chief Financial Officer Alan Steward, the retirement of four Non-Executive Directors and the appointment of three new Non-Executive Directors. In 2015, Mr. Lewis announced the reduction of costs across head office functions by 30 per cent with direct implications on the management structure. As it is illustrated in Figure 1 below, Tesco governance structure comprises five committees reporting to Tesco PLC board. There are 11 members in Tesco Executive Committee led by Group Chief Executive Dave Lewis. Figure 1 Tesco Corporate Governance Structure Tesco organizational structure is highly hierarchical reflecting the large size of the business. Even in store level, there are as many as four layers of management in some large stores. The Figure 2 below illustrates a typical organizational structure within Metro, Superstore and Extra formats. It is important to note that the structure below is not rigid for all Tesco stores and some stores operate with a slightly different structure reflecting their location, size and a range of other store-specific factors. Figure 2 Tesco organizational structure at store level It can be argued that three or four management layers within a single store may create unnecessary bureaucracy with a negative implications on the flow of information across the management layers. Therefore, the senior level management needs to consider delayering opportunities i.e. increasing the flexibility of operations and changes within store and accelerating the flow of information via reducing the layers of management. Tesco PLC Report comprises a comprehensive analysis of Tesco. The report illustrates the application of the major analytical strategic frameworks in…

1. Introduction Mergers, acquisitions and formation of alliances are commonplace in global airline industry and they are fuelled by the search of competitive advantages in order to achieve long-term growth. However, the implementation of mergers, acquisitions and formation of strategic alliances in practice can be associated with a set of complex challenges that might include differences in organisational culture, clash of personalities within top level management, lack or absence of strategic fit between the two companies and others. Lufthansa Group is a global airline company that employs more than 120,000 workforces that have contributed to generate 713 million EURO through serving 100.6 million passengers during the year of 2011 alone (Annual Report, 2011). Germanwings is a budget airline company that employs 1355 members of staff and served 7.52 million customers in 2011 offering flights to more than 90 destinations with 33 Airbus A 319 airplanes (Facts and Figures, 2013, online). Germanwings is wholly owned by Lufthansa since 2009. This report investigates a range of business issues related to the acquisition of Germanwings by Lufthansa German Airlines in 2009. The report starts with analysis of motives for choosing acquisition method among other alternatives by Lufthansa. This is followed by discussions of strategic and organisational fit between Lufthansa and Germanwings. Moreover, this report addresses potential gains and risks faced by Lufthansa due to the acquisition of Germanwings. The report is concluded with assessing outcomes relative to expectations in relation to this specific airline acquisition. 2. The Motives for Choosing Acquisition Method by Lufthansa Top level management of Lufthansa have selected the method of acquisition among other alternatives such as initiating a merger or forming a strategic alliance in relation to Germanwings due to the set of reasons that include less time required to complete the acquisition, increasing the market share, overcoming entry…

Tesco leadership had to change following a major scandal in 2015 that involved the cases of supplier mistreatment and profit mis-declarations as revealed by BBC’s Panorama.[1] John Allan has been elected as a new Chairman of the Board and Dave Lewis, who once was a supplier for Tesco has been appointed as the new CEO to lead a new senior management team. Restoration of trust of stakeholders in general and consumers and suppliers in particular has been announced as the main strategic task by the new management. The new leadership has introduced a new Code of Business Conduct, supported17 by a company-wide training programme along with other measures in order to prevent wrongdoings in the future. Simplification of the business has emerged as another main priority for the new management team. Range of initiative declared by Tesco leadership also include concentrating on “availability, service and selectively on price; undertaking a significant programme of restructuring and financial discipline; and launching a programme of renewal to restore trust in every aspect of the brand”[2] The new management aims to address supplier relationship issues proactively and it has established new Supplier Helpline, designed to resolve payment and administrative issues quickly and simply.[3] The first ‘outsider’ to lead Tesco since its foundation in 1919, Dave Lewis has been able successful so far as a CEO with his drastic measures that included “selling Blinkbox entertainment arm; slashing up to 10,000 positions and shutting stores; closing down Cheshunt and putting its GBP1bn Clubcard data business Dunnhumby and its South Korean arm up for sale. A new deal is reportedly on the table with staff to end its costly defined-benefit pension scheme, worth GBP3bn.”[4] Tesco PLC Report constitutes a comprehensive analysis of Tesco business strategy. The report illustrates the application of the major analytical strategic frameworks in business…

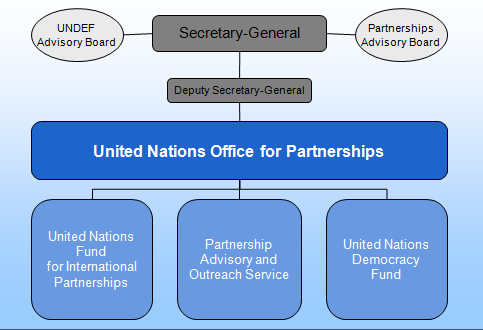

1. Introduction This article attempts to answer the question What is the United Nations? Moreover, the article represents a detailed analysis of the level of effectives of the UN in global governance. The article starts with discussing the role of functions of the UN, explaining the roles and functions of each UN’s six organs in an individual manner. This has been followed by identification of gaps in global governance and discussions about the role of the UN in terms of the extent of filling each gap. Furthermore, the article critically analyses the overall level of effectiveness of the UN in global governance and discusses the potentials for increasing the level of effectiveness in the UN in global governance by proposing a set of recommendations. Increasing level of integration and cooperation between counties in various levels creates a need for reputable international bodies that could assist in facilitating international relations, and more importantly, deal with disagreements and conflicts that may occur in international relations. The reality of the present nature of global governance is the outcome of conflict between the need to introduce global rules and regulations, and the willingness of retaining control over national boundaries. The is a set of reputable international organisations currently operating in the global scale such as The United Nations, The World Trade Organisation, The World Bank, North Atlantic Treaty Organisation and others, and each of these organisations engages in global governance with varying levels of effectiveness depending on their aims and objective, resources, sources of funds and other factors. The United Nations (UN) is an international organisation “committed to maintaining international piece and security, developing friendly relations among nations and promoting social progress, better living standards and human rights” (UN at a Glance, 2016, online). Founded on October 24, 1945, the UN comprises 193 member…

Tesco business strategy can be described as cost leadership and its motto ‘Every Little Helps’ guides its business strategy to a considerable extent. Economies of scale is one of the main competitive advantage extensively exploited by Tesco due to the vast scale of its operations. Tesco business strategy has traditionally involved experimentation with various aspects of the business and this strategy changed the overall retail industry in the UK to a certain extent. For example, Tesco was the first retailer to introduce 24-hour shopping experience and today it has thousands of Click & Collect points across the country.[1] Tesco business strategy for the short-term is aimed at regaining stakeholder trust in general and customer trust in particular following commercial income reporting scandal in 2015. The senior level management has announced that this objective will be achieved via the following set of initiatives: Focusing on availability, service and selectively on price Undertaking a significant programme of restructuring and financial discipline Launching a programme of renewal to restore trust in every aspect of the brand Moreover, as an outcome of income reporting scandal combined with a set of other factors, Tesco is currently in a difficult financial position with a total leverage debt of GBP 22 billion and the net debt of GBP 8.5 billion.[2] The following initiatives have been introduced by the senior level management in order to reduce the volume of debt: Not paying final dividends to shareholders for the financial year 2014/15 Reducing the amount of capital expenditure to GBP 1 billion Replacing defined benefit pension scheme for all employees Reviewing Tesco’s property portfolio, including leases that amount to GBP 1.5 billion annual rent bill The sale or closure of all three Blinkbox businesses (movies, music and books) and Tesco Broadband Tesco PLC Report contains more detailed discussion of…

There is a set of macro and micro environmental factors that affect marketing decisions of Tesco marketing management in direct and indirect manners. Macro-environmental factors impacting Tesco marketing decisions are identified through the process of environmental scanning and they include political, economic, social, cultural, technological and legal factors. Micro-environmental factors, on the other hand, relate to the impact of internal and external organisational stakeholders, and the extent of competition in supermarket industry in general. Products and services offered by Tesco and other businesses cannot be attractive to all people in equal terms, because differences in needs and wants among people. Therefore businesses do engage in market segmentation and targeting practices. It can be specified that “market segmentation is based on the generally true concept that the market for a product is not homogenous to its needs and wants”[1]. In simple terms, market segmentation is dividing population members into groups according to their needs, wants and other criteria and developing products and services that aim to satisfy needs and wants of particular groups. Segmentation can be divided into geographic, demographic, psychographic, and behavioural bases. Segmentation, targeting and positioning can be implemented in relation to Tesco brand in general, as well as, its individual products. The Table 2 below specifies target customer segment for Tesco’s own brand TV – Tesco 19-230 18.5 inch Widescreen HD Ready LCD TV DVD Combi with Freeview: Segmentation bases Target customer segment for Tesco Technika 19-230 18.5 inch Widescreen HD Ready LCD TV Geographic Region UK, and 13 other countries Density Rural and urban Demographic Age All age categories Gender Males and females Income Low and middle income category Occupation Students, employees, professionals Education High school, technical, Bachelors, Social status Working class, skilled working class, lower middle class, middle class Family size Single individuals, nuclear…

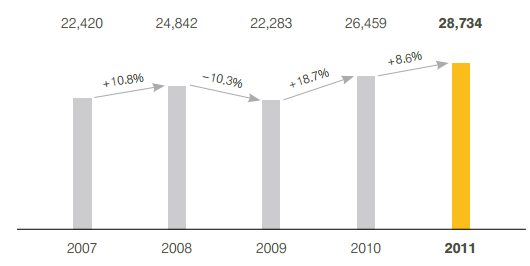

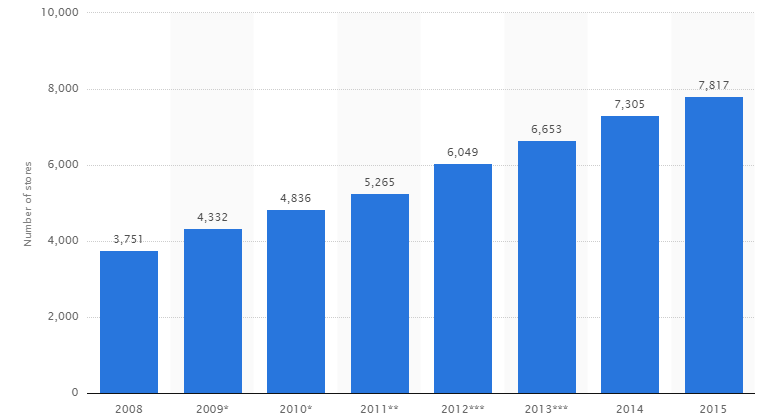

The term marketing mix “is used to describe the tools that the marketer uses to influence demand”[1]. Traditionally, marketing mix contained four elements – product, price, place, and promotion, and additional elements that have added to the concept of marketing mix consist of people, process and physical evidence. Tesco marketing mix is manipulated by the marketing and the senior management to a great extent in order to offer competitive benefits to target customer segment with positive effects on the bottom line. Product. Tesco offers a comprehensive range of products. Specifically, along with food and grocery products the following product categories can be purchased from the supermarket chain: Clothing & jewelry Technology & gaming Health & beauty Home electrical Entertainment & books Home appliances Baby & toddler Garden Toys DIY & Car accessories The range of product categories sold in Tesco stores depend on the type of store with Express stores having the least variety of products and Extra stores offering the widest choice. Moreover, Tesco Bank offers a range of popular banking products such as mortgages, credit cards, personal loans and savings. Place. Place element of the marketing mix relates to locations where customers purchase products and services and the distribution of products to those locations. Tesco utilises two channels to sell its products and services: online and offline. As it is illustrated in figure below, despite the global financial and economic crisis of 2007 – 2009 and other challenges faced by the company, the number of Tesco stores have been consistently increasing for the last eight years to reach 7817 stores in 11 countries by the end of 2015. More than two-thirds of total Tesco sales are made in the UK.[2] Stores are operated in the following format: Metro Express Extra Superstore Changes in the number of Tesco stores worldwide[3] Online sales…

Introduction There always have been disparities between countries in terms of the levels of economic developments and this tendency is most likely to continue in the future. However, there have been attempts by highly developed countries to assist the level of economic development of developing countries through various programs involving financial aids and recommendations. A set of policy recommendations proposed by the US to developing countries has been known as Washington Consensus, and there are mixed opinions about the implementation and outcome of these recommendations (Bandelj and Sowers, 2010). This article critically analyses the ideology of Washington Consensus. The article starts with discussions about factors and circumstances that have caused the emergence of Washington Consensus. This is followed by discussing positive implications of Washington Consensus for certain countries by referring to relevant facts. Moreover, the article highlights major points of criticism of Washington Consensus and the attempts to assess the level of their validity of these points and discusses reasons and circumstances for introduction of Post-Washington Consensus also known as Washington Consensus II. The article is completed by attempting to the future of Washington Consensus prescriptions in modern dynamic global geo-political environment. Emergence of Washington Consensus The term of Washington Consensus has been coined by in 1989 by John Williamson to label “list of ten policies that more or less everyone in Washington would agree were needed more or less everywhere in Latin America” (Williamson, 2008, p.14). Williamson had specified these ten reforms proposed to Latin American countries as a greater level of fiscal discipline, re-ordering of public expenditure priorities, taxation reforms, liberalisations of interest rates, increasing the levels of competitiveness of interest rates, liberalisation of trade, liberalisation of inward foreign direct investment, privatisation, deregulation, and property rights. Latin American countries were facing severe economic challenges throughout the 1980s, and this…