Posts by John Dudovskiy

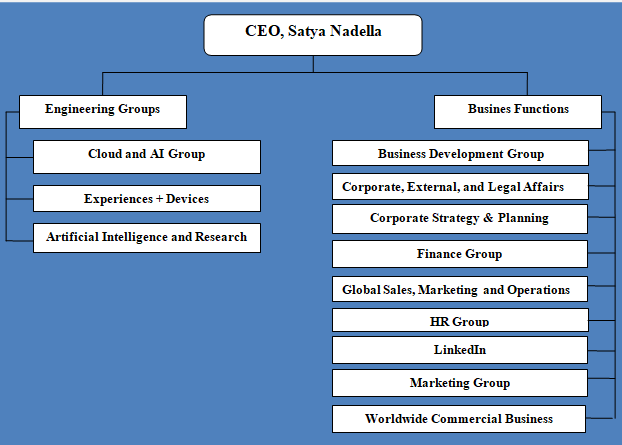

Microsoft organizational structure can be classified as divisional. In June 2015, the senior management announced a change in Microsoft organizational structure to align to its strategic direction as a productivity and platform company. This restructuring initiative resulted in elimination of approximately 7,400 positions in fiscal year 2016.[1] The current divisional pattern of Microsoft organizational structure is the result of this restructuring initiative. As it is illustrated in figure below, Microsoft organizational structure is divided into divisions according to engineering groups and business functions. Specifically, on the basis of engineering groups, the company is divided into three divisions, whereas according to business functions it is divided into 9 divisions: Microsoft Organizational Structure The latest restructuring of Microsoft organizational structure and shift to divisional organizational structure offers the following advantages to the business: Firstly, under the new organizational structure, heads of engineering groups directly report to CEO Satya Nadella with positive implications on new product development initiatives and innovation potential. This is particularly important to be able to introduce new products and services to the marketplace in the short duration of time. Moreover, a clear distinction between engineering groups and business functions, as illustrated in figure above, is an indication of the technology giant ‘s focus on business directions under engineering groups such as cloud and artificial intelligence. Secondly, organizational restructuring eliminates bureaucracy in business processes and procedures to a great extent, increasing the flexibility of the business to adapt to changes in the external marketplace. Thirdly, the initiative resulted in the elimination of approximately 7,400 positions, thus saving considerable amount of financial resources that can be channelled for new product development and increasing the competiveness of the business in many other ways. Another important aspect of corporate culture at Microsoft refers to a high level of dynamism. Specifically, the CEO of…

Co-founder of the company, Bill Gates was at the helm of Microsoft leadership since its inception in 1972 until 2000, when Steve Ballmer succeeded him as CEO. While Steve Job’s leadership was rightly regarded as successful, Steve Ballmer was pointed to as the worst CEO of a large publicly traded American company in 2012 by Forbes. This viewpoint is shared by many business analysts and practitioners. It has been noted that Microsoft peaked at USD 60/share in 2000, just as Mr. Ballmer took the reins. By 2002 it had fallen into the USD 20s, and has only rarely made it back to USD30s value, until Ballmer’s replacement by Satya Nadella as CEO in 2014.[1] Currently, Microsoft leadership team comprises 21 members led by CEO Satya Nadella. Specifically, there are 12 executive vice presidents responsible for various critical directions and aspects of the business, along with chief technology officer, chief legal officer and CEO of LinkedIn. Microsoft Board of Directors comprises 14 members, who are experienced senior leaders across a range of industries. Microsoft leadership practices are based on the following principles: 1. Focus on organizational culture. Leadership style exercised by Satya Nadella places a great emphasis on developing and maintaining the right type of organizational culture. Specifically, the leader of the tech giant cultivates the integration ‘learn-it-all’, rather than ‘know-it-all’ mentality into Microsoft organizational culture. 2. Efficiency and practicality. Microsoft leadership at the most senior level has been praised for being practical and CEO Satya Nadella told employees “to stop wasting their times at pointless meetings”[2]. 3. Regular coordination of efforts across the departments and groups. CEO Satya Nadella has 8-hour meeting with his leadership team every month and he runs 4-hour meetings other three weeks.[3] These meetings involve performance review of top executives on the basis of dashboards and…

Microsoft business strategy integrates the following 3 elements: 1. “Cloud-first, mobile-first”. Intelligent cloud represents one of the solid sources of Microsoft competitive advantage and Microsoft business strategy places a great emphasis on cloud segment of the business. ‘Mobile first’ part of this strategy stands for the mobility of experiences[1] and the technology giant pays a due attention to this direction as well. Nadella’s bet on cloud has paid off handsomely. By October 2018, Microsoft surprised Amazon in 12-month cloud revenues. Specifically, while Microsoft earned USD 26,7 billion revenues, Amazon’s revenues totalled to only USD 23,4 billion for the same period.[2] 2. Growing through mergers and acquisitions. Mergers and acquisitions play an important role in Microsoft business strategy and the multinational technology company engages in mergers and acquisitions to increase its capabilities, product range and value offering. The list of the most notable recent acquisitions include Nokia Corporation’s Devices and Services business for USD 9.4 billion in 2014 and Mojang Synergies AB the Swedish video game developer of the Minecraft gaming franchise, for USD 2.5 billion.[3] Moreover, in June 2016, Microsoft acquired LinkedIn for USD 196 per share in an all-cash transaction valued at USD 26.2 billion.[4] This particular acquisition plays an instrumental role to connect the world’s professional cloud and the world’s professional network – creating new experiences and new value for business users. With more than 1.2 billion Office users and 433 million LinkedIn members, the combined data graphs is expected to improve how Sales, HR, and other professionals get work done.[5] In 2018 alone, Microsoft completed 16 acquisitions of companies ranging from video games producers to artificial intelligence to employee engagement. 3. Focusing on augmented and virtual reality (VR). CEO Satya Nadella has placed augmented and virtual reality at the core of Microsoft business strategy. It has been noted…

Since the appointment of Satya Nadella as CEO, Microsoft marketing strategy has changed to become less ‘hostile’ abandoning kinds of advertising that ‘attacked’ competitors in a direct manner. For example, a marketing campaign known as ‘Scroogled!’ launched in 2012 informed about Google’s decision to display paid advertisements to search results related to shopping. ‘Scroogled’ was launched to ensure the shift of some Google users to use Microsoft’s Bing search engine, but Nadella stopped this and some other similar campaigns as an attempt to improve the image of the company.[1] ‘Scroogled’ marketing campaign as illustration of old-style Microsoft marketing strategy In other words, since his appointment on the top job, Satya Nadella has been focusing on humanising the brand and taking a customer-centric approach with direct implications on the marketing strategy of Microsoft. Microsoft sales and marketing expenses amounted to USD 17,469 billion, USD 15,461 billion and USD 14,635 billion for the fiscal years of 2018, 2017 and 2016 respectively . In 2018 the tech giant’s sales and marketing expenses increased USD2.0 billion or 13% compared to the previous year.[2] Microsoft marketing strategy is based on the following principles: 1. Investing in the communication of marketing message through various marketing communication channels in an integrated manner. The technology giant uses a range of marketing communication channels such as advertising, sales promotion, events and experiences, public relations, direct marketing and personal selling in an integrated way to communicate its marketing message to its target customer segment. 2. Focus on product element of the marketing mix. Microsoft 7Ps of marketing focuses on the product element of the marketing mix to a greater extent compared to other elements. Accordingly, the multinational technology company has accepted high level of user convenience of its products and services as unique selling proposition associated with the brand. 3.…

Microsoft marketing mix (Microsoft 7Ps of marketing) comprises elements of the marketing mix that consists of product, place, price, promotion, process, people and physical evidence. The multinational technology company manipulates with elements of the marketing mix according to its marketing strategy, as a part of its business strategy. Product Element in Microsoft Marketing Mix The majority of Microsoft’s products relate to productivity and business processes and to support digital work and life of customers. The company also builds the platforms upon which others build their own digital platforms. Some of Microsoft products are clear leaders in the global marketplace. For example, more than 135 million people use Office 365 commercial every month and Outlook Mobile is installed into more than 100 million iOS and Android devices worldwide.[1] Similarly, Microsoft Teams is used by more than 300 organizations worldwide, including 87 of the Fortune 100 and nowadays there are nearly 700 million devices around the world with active Windows 10.[2] Generally, Microsoft products and services can be divided into three broad categories as illustrated in table below: Category Products and services Productivity and Business Processes Microsoft 365, SharePoint, Skype for Business, Outlook Mobile, One Drive, Dynamics 365, Microsoft Teams, Linked In Intelligent Cloud Server products and cloud services, including SQL Server, Windows Server, Visual Studio, System Center, and related CALs, as well as Azure Enterprise Services, including Premier Support Services and Microsoft Consulting Services More Personal Computing Windows Devices, including Microsoft Surface (“Surface”), phones, and PC accessories. Gaming, including Xbox hardware; Xbox Live, Search advertising. Microsoft product categories and products Place element in Microsoft Marketing Mix Microsoft sells its products and services through the following three channels: 1. Official website: www.microsoftstore.com/store. Microsoft online store is a convenient platform where customers can choose products and services according to categories such as…

Microsoft segmentation, targeting and positioning can be explained as a set of activities that constitute the core of marketing efforts for the multinational technology company. Segmentation involves dividing population into groups on the basis of certain characteristics. Businesses focus on certain customer segments and position their products and services to satisfy needs and wants of these particular segments. Microsoft uses the following types of positioning: a) Multi-segment positioning. The company targets more than one customer segments at the same time with different product and service packages. For example, Dynamics 365, a software for building and supporting customer relationships starts with USD 115/month Customer Engagement Plan for cost-conscious customer segment. Unified Operations Plan starting from USD 190/month, on the other hand is developed for a different customer segment that do not mind to pay extra for additional set of functions and features within Dynamics 365. b) Standby positioning. Standby positioning technique involves the development of products and services that can await changes in the market to find demand in the future. When Microsoft announced its ‘cloud-first, mobile-first’ business strategy in 2014, cloud data storage was a new segment. CEO Satya Nadella saw a potential in cloud business, focused on the development of cloud services using standby positioning technique. The demand for cloud consistently increased and in Q2, 2018 alone, Microsoft commercial cloud revenues reached USD 6.9 billion, a growth of 53% compared to the previous period.[1] The following table illustrates Microsoft segmentation, targeting and positioning: Type of segmentation Segmentation criteria Microsoft target customer segment Geographic Region Global marketplace Density Urban and rural Demographic Age 16 and older Gender Males & Females Life-cycle stage Bachelor Stage young, single people not living at home Newly Married Couples young, no children Full Nest I youngest child under six Full Nest…

Microsoft Corporation is a US-based global technology company with headquarters in Richmond, Washington. Founded in 1975, Microsoft’s mission is ‘to empower every person and every organization on the planet to achieve more’. Microsoft employs more than 130 000 people internationally. During the fiscal year 2018 the tech giant generated USD 110.4 billion in revenue and USD 35.1 billion in operating income. Microsoft produces a wide range of products and services related to productivity and business processes and to support digital work and life of customers. Some of its products and services have become highly popular in the global scale. For example, more than 135 million people use Office 365 commercial every month and Outlook Mobile is installed into more than 100 million iOS and Android devices worldwide. Similarly, Microsoft Teams is used by more than 300 organizations worldwide, including 87 of the Fortune 100 and nowadays there are nearly 700 million devices around the world with active Windows 10. In 2014, Satya Nadella replaced Steve Ballmer as CEO of Microsoft. Since taking over the top job, Nadella has focused on ‘humanising’ the company by improving its organizational culture and he also enhanced the coordination of efforts across the departments and groups of the company. Microsoft business strategy can be classified as product differentiation. The company develops advanced technological products and services and sells them for premium costs. Moreover, Microsoft business strategy is currently focused on “cloud-first, mobile-first”, growth through mergers and acquisitions and exploring business opportunities related to augmented and virtual reality. Recently, the multinational technology company has also included ‘tech intensity’ as one of the important pillars of its business strategy Microsoft Corporation Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and…

Tesla Inc. (formerly Tesla Motors Inc.) is an alternative fuel vehicles manufacturer founded in 2003 by Martin Eberhard and Marc Tarpenning in Palo Alto, California, USA. The company produces fully electric vehicles, energy generation and storage systems and also installs and maintains such systems and sells solar electricity. Tesla’s mission statement is ‘to accelerate the world’s transition to sustainable energy’. The electric automaker operates stores and galleries in the US and 35 other countries worldwide and employs more than 70,500 people globally. In 2020, Tesla achieved operating margin of 6,3% which is the highest in the industry. The electric automaker had an operating cash flow less capex (free cash flow) of USD 2.8 billion during the same period. In the last quarter of 2020 alone, Tesla had USD 4.9 billion increase in cash and cash equivalents. Free cash flow during the same period reached USD 1.9 billion. Tesla business strategy integrates focus on electric cars and ownership of distribution of products. Moreover, the company stresses the low cost of ownership of Tesla electric vehicles as one of the solid bases of its competitive advantage. The alternative fuel vehicles manufacturer has a divisional organizational structure and its divisions include energy, engineering and production, HR and communications, legal and finance, sales and software. Tesla organizational culture, on the other hand, is associated with ambitious innovation, adherence of First Principles method of decision making and lack of bureaucracy throughout the company. Tesla possesses a set of competitive strengths. These include the first mover advantage, increasing numbers of vehicles sales, expertise in innovation and a high level of brand recognition at an international level. At the same time, there are certain issues that cast a doubt over long-term growth prospects of the electric automaker. These points of concern for Tesla include overly expensive price…

Xiaomi does not publish annual CSR report. It has been noted that despite its branding effort to resemble the minimalist style of Apple, Xiaomi does not show similar commitment in environmental responsibility.[1] However, the mobile internet company may start publishing CSR reports after initial public offering (IPO) of its stocks that is expected to take place in the foreseeable future. Official Xiaomi website declares company’s pledge “to reduce the use of hazardous substances in products.”[2] However the website does not disclose any data at all regarding emissions or any other environmental impact of Xiaomi products and services. According to German Federal Office for Radiation Protection (Bundesamt für Strahlenschutz) Xiaomi smartphone Mi A1 has “Specific Absorption Rate” of 1,75 watts per kilogram, which is the highest level of radiation of smartphones worldwide.[3] In general, there is a lack of information related to Xiaomi CSR programs and initiatives, as it is illustrated in table below. CSR aspect of the business Xiaomi performance Supporting Local Communities No information available Educating and Empowering Workers No information available Labour and Human Rights No information available Employee Health and Safety No information available Gender Equality and Minorities It has been noted that Xiaomi uses “yanzhi,” or physical appearance metric when hiring, leading to discriminaton during employee recruitment and selection process.[4] Energy Consumption No information available Water Consumption No information available Waste Reduction and Recycling MI INDIA maintains PRODUCT TAKE-BACK & RECYCLING PROGRAM. Xiaomi Authorised e-waste recycler can collect e-waste from customer’s location, or customers can also drop e-waste at any of company’s service centers[5] Carbon Emissions No information available Sustainable Sourcing No information available other CSR Initiatives and Charitable Donations No information available Xiaomi CSR Programs and Initiatives Xiaomi Inc. Report contains a full analysis of Xiaomi corporate social responsibility including Xiaomi CSR issues. The report…

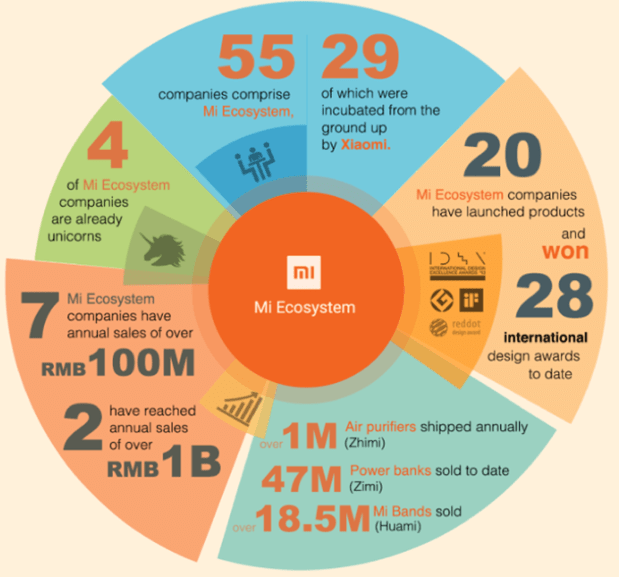

Xiaomi ecosystem is vast and comprises 55 companies including 29 companies that have been incubated from the beginning by Xiaomi. The company sells a wide range of products from smartphones to kettles and gloves. [1] Moreover, ever-expanding corporate ecosystem has been placed at the core of Xiaomi business strategy. Usually, producing a wide range of products and services threats to compromise the focus on core products and services. However, Xiaomi claims to have addressed this threat in a proactive manner. Specifically, according to its official website, while the company focuses on its core products – smartphones, smart TVs and smart routers, Xiaomi invests in companies that produce other types of products without being involved in operational management.[2] Xiaomi Ecosystem[3] Smartphones are placed at the core of Xiaomi ecosystem. Moreover, smartphones are used to facilitate the sales and use of many other products and services. Xiaomi smart devices include Mi Water Purifier, Mi Air Purifier, Mi Induction Heating Rice cooker and other products. All smart devices are connected to Xiaomi IoT platform and can be managed though Xiaomi smartphone. In 2013, the electronics and software company announced its plans to invest in 100 hardware startups.[4] The company also sells a range of “non-smart” products, like towels, and suitcases. Increasing numbers of startups are currently joining Xiaomi ecosystem to gain support to grow rapidly. Xiaomi has experienced technical staff, engineers and product managers, who can play an instrumental role in fuelling the growth of small-sized companies. At the same time, joining Xiaomi ecosystem also has some drawbacks. Specifically, start-ups need to operate with low profit margin according to Xiaomi business strategy. Moreover, over-dependence on Xiaomi for branding and distribution can be mentioned as another drawback of belonging to Xiaomi ecosystem.[5] Xiaomi Inc. Report contains a full analysis of Xiaomi ecosystem. The report illustrates…