Posts by John Dudovskiy

British Airways is a premium segment airline and accordingly British Airways business strategy can be specified as service differentiation. The airline aims to generate a return on capital of a minimum 15 per cent with an operating profit margin of 12 – 15 per cent.[1] British Airways business strategy focused on service differentiation is planned to be continued in the following directions[2]: Replacement or refurbishment of 99 per cent of wide-body aircraft by 2020 Improvement of in-flight entertainment in-seat power and the rollout of on-board WIFI Further investments in digital technologies to provide personalised, seamless service British Airways business strategy also relies in international market expansion strategy in an aggressive manner. In 2016 alone the airline company is expected to fly to more than a dozen new routes, including Biarritz in France, Mahon in Menorca and Palermo in Sicily. The airline also announced additional services from Heathrow and Gatwick to Krakow in Poland, Stockholm in Sweden, Split in Croatia, Berlin in Germany, Olbia in Sardinia and Gibraltar. British Airways competitive advantage is based on the following points: The highest standards of service with a focus on service personalization. The variety of choice is another important aspect of British Airways competitive advantage. For example, in the World Traveller cabin, customers can choose from a wide range of Taste of the Far East’, ‘Gourmet Dining’, ‘Taste of Britain’, ‘Great British Breakfast’, ‘Healthy Choice’ and ‘Vegetarian Kitchen’.[3] Focus on digitalization and increasing integration of information technology into various aspects of service provision and business processes. British Airways Report contains more detailed discussion of British Airways business strategy. The report also illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on British Airways. Moreover, the report…

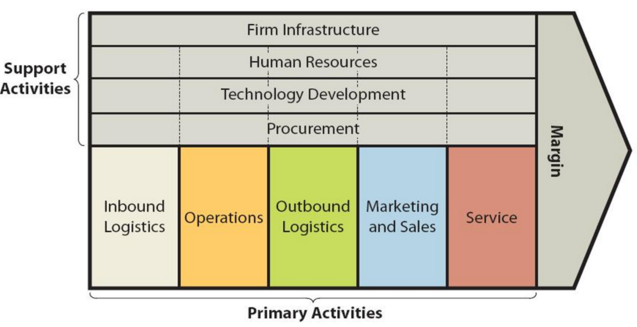

British Airways value chain analysis involves the adoption of a systematic approach in the analysis of competitive advantage. The framework makes a distinction between primary and support business activities identifies the sources of competitive advantage for each activity. The figure below illustrates the essence of value chain analysis. Primary Activities Inbound logistics British Airways inbound logistics operations are complex and involve the timely delivery of fleet of planes, catering products and a wide range of other on-board products. The necessity to ensure the freshness of foods and drinks served during the flights further complicates British Airways inbound logistics primary activities. Competitive advantage is achieved in inbound logistics stage of the business by British Airways through establishing on-going relationships with suppliers, sophisticated system for stock control and professional training that has been accredited by UK City and Guilds. Operations Generally, operations stage of the business involves preparing goods and services to be sold to customers. As the UK’s largest international scheduled airline, British Airways flies globally to more than 400 destinations. Therefore, the scope of its business operations is extensive. British Airways has a range of competitive advantages in operations part of the business through offering its customers increased security for their luggage, offering quick check-in services and also offering some services such as ticket bookings and online booking of other services. Moreover, a high level of customization of service provision and an extensive utilization of digital technologies in a wide range of business processes represent solid sources for additional value for British Airways. Outbound logistics Outbound logistics involves sending ready products to customers for consumption. Although outbound logistics mainly relate to manufacturing companies, it is also applicable towards service businesses such as airlines. British Airways flies to airports in nearly 80 countries worldwide. The airline derives value in outbound…

British Airways segmentation, targeting and positioning refer to ways in which the airline company identifies certain individuals among the general public to offer their service packages. Segmentation involves dividing population into groups according to certain characteristics, whereas targeting implies choosing specific groups identified as a result of segmentation to sell products. Positioning refers to the selection of the marketing mix the most suitable for the target customer segment. British Airways follows multi-segment concentration marketing strategy by offering four different service packages to different customer segments. Specifically, British Airways targets different customer segments for its four levels of services: economy, premium economy, executive and first class. The following table illustrates segmentation, targeting and positioning of each category of British Airways services: Segmentation bases Target segment Economy class Premium Economy Executive Club First Class Geographic Region Domestic flights in UK Europe and international flights Selected international flights Europe and international flights Selected international flights Density Urban & rural Urban & rural Urban Urban Demographic Age Kids, teenagers, middle-aged, old-aged Teenagers, middle-aged Middle-aged, old-aged Middle-aged, old-aged Gender Male, female Income Low Middle High High Occupation Students, salaried Students, salaried Businessmen Professionals Businessmen Professionals Education High school Bachelor’s Technical Bachelor’s Master’s Business schools Master’s Business schools Social status Low, middle Low, middle High High Family size Joint families Nuclear families Nuclear families Newly married Psychographic Lifestyle Moderate-orientated Moderate-orientated Achievement-oriented Achievement-oriented Personality Easygoing Easygoing Determined Ambitious Behavioural Occasions Regular travel Vacations Business trips Honeymoon Business trips Benefits sought Affordability Value Luxury Convenience Luxury User status Regular traveller Regular traveller First timer, Regular traveller First timer, Regular traveller Attitude Indifferent Indifferent positive Positive enthusiastic Enthusiastic Travel and tourism industry base Customer expectations Low Medium High High Customer image Neutral Neutral to positive Positive…

British Airways (BA) is the largest airline company in the UK and it flies globally to more than 400 destinations to airports in nearly 80 countries. British Airways is a part of International Airline Group (IAG) that also owns three other airline brands – Aer Lingus, Iberia and Vueling. The Group also owns 13.55 per cent of the equity of IB OpCo Holding S.L. (“Iberia”) and 86.26 per cent of the equity of Avios Group (AGL) Limited (“AGL”). IAG made a record profit of GBP 1,264 million in 2015. By the end of 2015, British Airways had 39,304 employees globally (Annual Report, 2015). British Airways pursues service differentiation business strategy and differentiates its services via an extensive reliance on digitalization and information technology and high level of customization of service provision. These points represent solid sources of British Airways’ competitive advantage. Major weaknesses related to British Airways include an overdependence on the UK market and low profitability of business operations. At the same time, the airline is presented with the opportunities of forming strategic cooperation with other businesses in airline and catering industries, further engaging in international market expansion and benefiting from synergy via closer integration between IAG’s operating airlines. British Airways Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on British Airways. Moreover, the report contains analyses of British Airways’ business strategy, leadership and organizational structure and its marketing strategy. The report also discusses the issues of corporate social responsibility. 1. Introduction 2. Business Strategy 3. Leadership 4. Organizational Structure 5. SWOT Analysis 5.1 Strengths 5.2 Weaknesses 5.3 Opportunities 5.4 Threats 6. PESTEL Analysis 6.1 Political Factors 6.2 Economic Factors 6.3 Social Factors 6.4 Technological Factors 6.5 Environmental Factors 6.6…

Tesco CSR programs and initiatives are developed and implemented by Corporate Responsibility Committee led by Chairman John Allan. The importance of CSR for Tesco maybe greater nowadays than ever before due to a series of ethics-related scandals the supermarket chain had to deal with recently such as inappropriate profit reporting and poor supplier treatment cases. In other words, it is important for the supermarket chain to restore the trust of its towards the brand and engagement in CSR programs and initiatives is an effective tool to achieve this objective. The company releases Corporate Responsibility Update regularly and it includes the details of CSR programs and initiatives engaged by the company. The table below illustrates the highlights from the latest report for the financial year of 2014/15: Categories of CSR activities Tesco Performance Supporting local communities The company donated GBP 55 million, which accounts to 3.96 per cent of its pre-tax profit to various charities and good causesIn total, GBP 37.9 million has been raised from Tesco employees and via customer fundraising Educating and empowering workers 70% of employees stated they would recommend Tesco as a great place to workAs much as 77 per cent of managers, directors and business leaders within the company made career progresses Labor and human rights The supermarket chain declares its commitment to UN Universal Declaration of Human Rights and the International Labour Organization Core ConventionsIn 2010, Tesco’s USA stores, Fresh & Easy was accused by Human Rights Watch for allegedly exploiting weak labour laws in the US and bullying employees to prevent them from joining unions[1] Employee health and safety In 2015 a total of 1539 employees in retail and distribution were injured at work that resulted in fractures or lost time of more than three days Gender equality and minorities The percentage gap in payment…

Tesco McKinsey 7S model illustrates the linkage between seven separate elements of the business to increase the overall effectiveness. According to this model, businesses have hard and soft elements and shared values as soft element are the result of interaction of all elements with direct and huge effects on employee behavior and performance. Tesco McKinsey 7S Framework Hard Elements Strategy. Tesco pursues cost leadership business strategy according to its marketing communication message Every Little Helps. The supermarket chain has been able to sustain this strategy due to the extensive exploitation of the economies of scale and the exercise of bargaining power in dealing with suppliers to secure low purchasing costs. Currently, Tesco is dealing with a set of complex challenges such as restoring customer trust following profit accounts scandal, supplier payment delays scandal and dramatic decline of sales as a result of these incidents. Tesco strategy to deal with these issues as announced by its new CEO Dave Lewis include the reduction of capital expenditure to GBP 1 billion, replacement of the benefit pension scheme for all employees and the review of property portfolio with the aim of cost reduction. Moreover, a focus on availability, service and selectively on price emerged as a strategic priority for the new management. Structure. Tesco’s organizational structure is highly hierarchical and comprises many layers of management from store sales assistant to the CEO. The new CEO Dave Lewis eliminated the roles of deputy store managers in 2015 as part of attempts to simplify the organizational structure. There are 10 members in The Board of Directors and the company’s Executive Committee comprises 11 members. Systems. The supermarket chain relies on a wide range of systems on a daily basis to sustain its operations. New management led by CEO Dave Lewis announced plans to simplify organizational…

Value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the business. The figure below illustrates the essence of value chain analysis. Tesco value chain analysis Primary Activities Inbound logistics Tesco inbound logistics operations are complex and involve the supply of hundreds of product categories to 7817 Tesco stores around the world[1]. Economies of scale due to the large scope of its operations is a major source of value creation for Tesco. The company makes regular investments to increase the capacity of logistics so that the economies of scales can be exploited to a greater extent. For example, in 2013 as a part of a government-backed trial program testing the efficacy of longer trailers, Tesco received 25 new 51-foot Gray & Adams refrigerated units. New trailers can carry 51 cages (UK shipping units), six more than a standard 45-foot trailer. This change resulted in 13 per cent increase in logistics productivity[2]. The company has a history of poor supplier treatment under the previous leadership that involved the cases of payment delays to improve Tesco’s operational profit margins[3] and unnecessary and unjustified fines being imposed to suppliers[4] with negative implications on various aspects of supply chain practices. However, the new management led by new CEO Dave Lewis announced its commitment to form strategic relationships with suppliers. Operations Tesco operations can be divided into three large segments: 1. Retail. This segment represents the core business of Tesco PLC. With more than 80 million shopping trips made thousands of Tesco shops in 11 countries around the world[5], the scope of Tesco’s retail operations is extensive. The company operates stores in the following format: Metro. Metro stores sell wide range of food and a smaller selection of general items such as cook ware…

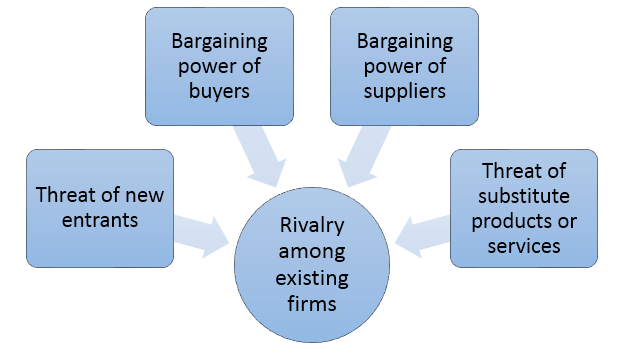

Tesco Porter’s five forces attempts to analyze five separate forces that determine the extent of overall competition in the grocery retail industry. These forces are represented in Figure 1 below: Figure 1 Tesco Porter’s Five Forces Threat of substitute products or services for Tesco is irrelevant. Tesco sells a wide range of products belonging to the following categories: Clothing & jewelry Technology & gaming Health & beauty Home electrical Entertainment & books Home appliances Baby & toddler Garden Toys DIY & Car The range of products sold by Tesco is highly comprehensive. The supermarket chain sells a wide range of products, as well as, substitutes of the majority of these products. Therefore, it can be argued that the threat of substitute products and services for Tesco is irrelevant. Rivalry among existing firms in supermarket chain sector is fierce. The amount of advertising expenditure and the extent of differentiation of products and services are major factors impacting the competitiveness of companies operating in food and grocery retail industry. There are no switching costs for consumers and this fact also increases the intensity of competition in the industry. As it is illustrated in Figure 2 below, although there are many major market players in the grocery retail industry in the UK, Tesco maintains a clear leadership position despite challenges the company currently faces. Figure 2 Market share of grocery retail chains in the UK from January 2015 to April 2016[1] Bargaining power of Tesco suppliers is low. Tesco has hundreds of suppliers and there is a minimum or no supplier switching cost for the supermarket chain. The company has the history of using its barraging power to delay payment to suppliers in order to improve its operational profit margins under the previous leadership in 2014.[2] After this and other incidents of poor…

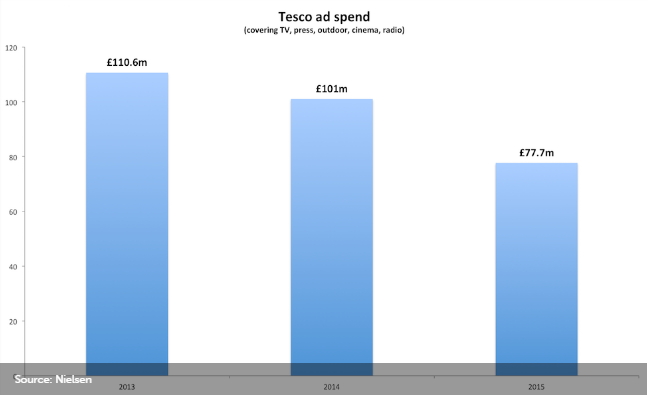

Currently, Tesco marketing strategy aims to regain the trust of stakeholders to the brand. The company is refocusing on “Every Little Helps” strapline to strengthen its core traditional competitive advantage in the marketplace. Certain elements of the marketing communication mix such as print and media advertising, sales promotions, events and experiences and public relations are used by the retail chain to communicate this message to customers. Advertising Tesco marketing strategy makes an extensive use of print and media advertising systematically as a tested channel to send marketing communicate message to current and potential consumers. It is important to note that although Tesco has decreased its advertising budget in 2015 compared to previous years as a part of its massive cost-saving initiatives (see figure below), the efficiency of its print and media advertising has increased. This has been achieved via application of marketing differentiation. For example, during Christmas period, the retail chain eschewed an emotional campaign for humour using the family of characters, played by Ruth Jones and Ben Miller, it had introduced earlier in the year.[1] Changes in Tesco advertising budget Occasionally, Tesco print and media advertising contains valuable advises on cooking or home styling. For example, company recently “released reactive print ads around the Great British Bake Off, with a “bake it or fake it” theme. One page shows what ingredients someone can buy to make the creations shown on TV, the other page shows what they can buy instead.”[2] Sales Promotion Various forms of sales promotions play an integral role within Tesco marketing strategy. The supermarket chain facilitates sales promotions in the following formats: Clubcard. Customers collect 1 point for each GBP 1 spent in Tesco. Several times a year customers receive statements and and vouchers equal to the value of points they have saved. Free gifts. The supermarket chain offers free…

PESTEL is a strategic analytical tool used to evaluate external environment for the business. Specifically, Tesco PESTEL analysis involves an evaluation of political, economic, social, technological, environmental and legal factors affecting the retail chain. Political Factors A range of political factors can affect Tesco in direct and indirect ways. The list of political factors that may affect Tesco include but not limited to political stability in the UK and abroad, bureaucracy and the extent of corruption in Tesco’s home market in international markets. Moreover, activities of trade unions and home market lobbying initiatives in international markets are important political factors that affect the retail chain. Tesco’s new Chairman, John Allan has proved himself as an outspoken business leader to express his views about impacts of political factors on the business. For example he has stated that “the prospect of an EU referendum is causing uncertainty for investors, and this represents a “heavy pebble” placed in the scales of the British economy”[1]. Certain political factors can potentially have negative implications on Tesco’s bottom line. For example, in 2014 a group of local councils in the UK formally asked the government to for new powers to tax large supermarkets, an initiative that became known as ‘Tesco Tax’.[2] Although, this specific initiative was refused by the UK government to avoid price increases, similar political initiatives may succeed in the future with negative implications for Tesco. Economic Factors Various macroeconomic factors affect Tesco to a great extent. The cost of labor is one of the major economic factors greatly impacting the revenues of the supermarket chain. The company’s annual wage bill accounts to GBP 4.5 billion. Accordingly, increase of 1 per cent in the cost of labor costs the company about GBP 45 million. An increase of the national minimum wage to GBP 7.20…