Posts by John Dudovskiy

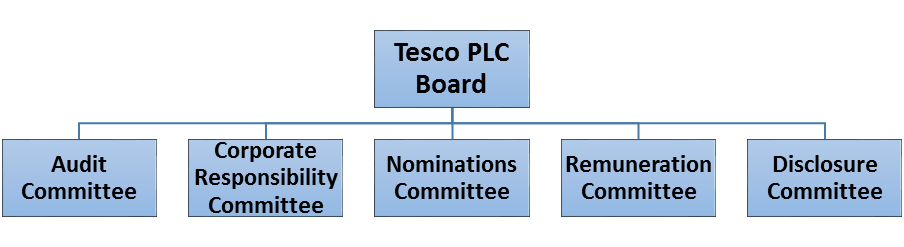

Tesco Board of Directors comprises 10 members and there were significant changes in the Board during the financial year 2014/15. These changes include the appointment of John Allan as the Chairman of the Board, the appointment of a new CEO Dave Lewis and new Chief Financial Officer Alan Steward, the retirement of four Non-Executive Directors and the appointment of three new Non-Executive Directors. In 2015, Mr. Lewis announced the reduction of costs across head office functions by 30 per cent with direct implications on the management structure. As it is illustrated in Figure 1 below, Tesco governance structure comprises five committees reporting to Tesco PLC board. There are 11 members in Tesco Executive Committee led by Group Chief Executive Dave Lewis. Figure 1 Tesco Corporate Governance Structure Tesco organizational structure is highly hierarchical reflecting the large size of the business. Even in store level, there are as many as four layers of management in some large stores. The Figure 2 below illustrates a typical organizational structure within Metro, Superstore and Extra formats. It is important to note that the structure below is not rigid for all Tesco stores and some stores operate with a slightly different structure reflecting their location, size and a range of other store-specific factors. Figure 2 Tesco organizational structure at store level It can be argued that three or four management layers within a single store may create unnecessary bureaucracy with a negative implications on the flow of information across the management layers. Therefore, the senior level management needs to consider delayering opportunities i.e. increasing the flexibility of operations and changes within store and accelerating the flow of information via reducing the layers of management. Tesco PLC Report comprises a comprehensive analysis of Tesco. The report illustrates the application of the major analytical strategic frameworks in…

Tesco leadership had to change following a major scandal in 2015 that involved the cases of supplier mistreatment and profit mis-declarations as revealed by BBC’s Panorama.[1] John Allan has been elected as a new Chairman of the Board and Dave Lewis, who once was a supplier for Tesco has been appointed as the new CEO to lead a new senior management team. Restoration of trust of stakeholders in general and consumers and suppliers in particular has been announced as the main strategic task by the new management. The new leadership has introduced a new Code of Business Conduct, supported17 by a company-wide training programme along with other measures in order to prevent wrongdoings in the future. Simplification of the business has emerged as another main priority for the new management team. Range of initiative declared by Tesco leadership also include concentrating on “availability, service and selectively on price; undertaking a significant programme of restructuring and financial discipline; and launching a programme of renewal to restore trust in every aspect of the brand”[2] The new management aims to address supplier relationship issues proactively and it has established new Supplier Helpline, designed to resolve payment and administrative issues quickly and simply.[3] The first ‘outsider’ to lead Tesco since its foundation in 1919, Dave Lewis has been able successful so far as a CEO with his drastic measures that included “selling Blinkbox entertainment arm; slashing up to 10,000 positions and shutting stores; closing down Cheshunt and putting its GBP1bn Clubcard data business Dunnhumby and its South Korean arm up for sale. A new deal is reportedly on the table with staff to end its costly defined-benefit pension scheme, worth GBP3bn.”[4] Tesco PLC Report constitutes a comprehensive analysis of Tesco business strategy. The report illustrates the application of the major analytical strategic frameworks in business…

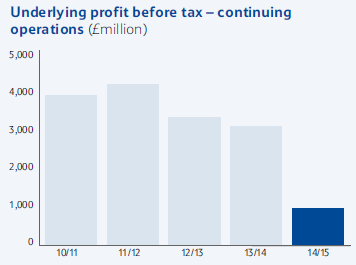

Tesco business strategy can be described as cost leadership and its motto ‘Every Little Helps’ guides its business strategy to a considerable extent. Economies of scale is one of the main competitive advantage extensively exploited by Tesco due to the vast scale of its operations. Tesco business strategy has traditionally involved experimentation with various aspects of the business and this strategy changed the overall retail industry in the UK to a certain extent. For example, Tesco was the first retailer to introduce 24-hour shopping experience and today it has thousands of Click & Collect points across the country.[1] Tesco business strategy for the short-term is aimed at regaining stakeholder trust in general and customer trust in particular following commercial income reporting scandal in 2015. The senior level management has announced that this objective will be achieved via the following set of initiatives: Focusing on availability, service and selectively on price Undertaking a significant programme of restructuring and financial discipline Launching a programme of renewal to restore trust in every aspect of the brand Moreover, as an outcome of income reporting scandal combined with a set of other factors, Tesco is currently in a difficult financial position with a total leverage debt of GBP 22 billion and the net debt of GBP 8.5 billion.[2] The following initiatives have been introduced by the senior level management in order to reduce the volume of debt: Not paying final dividends to shareholders for the financial year 2014/15 Reducing the amount of capital expenditure to GBP 1 billion Replacing defined benefit pension scheme for all employees Reviewing Tesco’s property portfolio, including leases that amount to GBP 1.5 billion annual rent bill The sale or closure of all three Blinkbox businesses (movies, music and books) and Tesco Broadband Tesco PLC Report contains more detailed discussion of…

There is a set of macro and micro environmental factors that affect marketing decisions of Tesco marketing management in direct and indirect manners. Macro-environmental factors impacting Tesco marketing decisions are identified through the process of environmental scanning and they include political, economic, social, cultural, technological and legal factors. Micro-environmental factors, on the other hand, relate to the impact of internal and external organisational stakeholders, and the extent of competition in supermarket industry in general. Products and services offered by Tesco and other businesses cannot be attractive to all people in equal terms, because differences in needs and wants among people. Therefore businesses do engage in market segmentation and targeting practices. It can be specified that “market segmentation is based on the generally true concept that the market for a product is not homogenous to its needs and wants”[1]. In simple terms, market segmentation is dividing population members into groups according to their needs, wants and other criteria and developing products and services that aim to satisfy needs and wants of particular groups. Segmentation can be divided into geographic, demographic, psychographic, and behavioural bases. Segmentation, targeting and positioning can be implemented in relation to Tesco brand in general, as well as, its individual products. The Table 2 below specifies target customer segment for Tesco’s own brand TV – Tesco 19-230 18.5 inch Widescreen HD Ready LCD TV DVD Combi with Freeview: Segmentation bases Target customer segment for Tesco Technika 19-230 18.5 inch Widescreen HD Ready LCD TV Geographic Region UK, and 13 other countries Density Rural and urban Demographic Age All age categories Gender Males and females Income Low and middle income category Occupation Students, employees, professionals Education High school, technical, Bachelors, Social status Working class, skilled working class, lower middle class, middle class Family size Single individuals, nuclear…

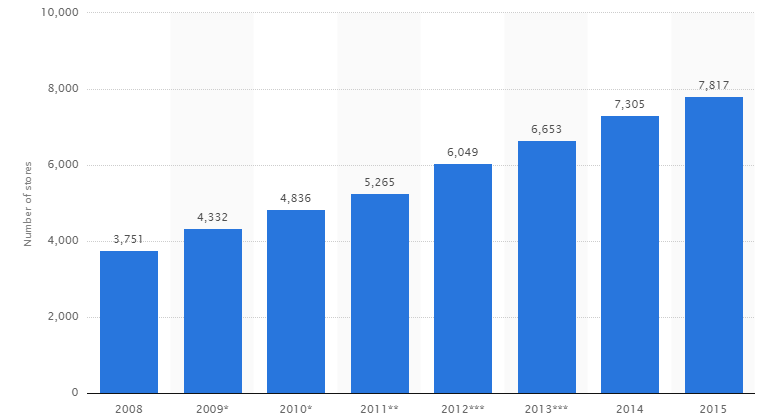

The term marketing mix “is used to describe the tools that the marketer uses to influence demand”[1]. Traditionally, marketing mix contained four elements – product, price, place, and promotion, and additional elements that have added to the concept of marketing mix consist of people, process and physical evidence. Tesco marketing mix is manipulated by the marketing and the senior management to a great extent in order to offer competitive benefits to target customer segment with positive effects on the bottom line. Product. Tesco offers a comprehensive range of products. Specifically, along with food and grocery products the following product categories can be purchased from the supermarket chain: Clothing & jewelry Technology & gaming Health & beauty Home electrical Entertainment & books Home appliances Baby & toddler Garden Toys DIY & Car accessories The range of product categories sold in Tesco stores depend on the type of store with Express stores having the least variety of products and Extra stores offering the widest choice. Moreover, Tesco Bank offers a range of popular banking products such as mortgages, credit cards, personal loans and savings. Place. Place element of the marketing mix relates to locations where customers purchase products and services and the distribution of products to those locations. Tesco utilises two channels to sell its products and services: online and offline. As it is illustrated in figure below, despite the global financial and economic crisis of 2007 – 2009 and other challenges faced by the company, the number of Tesco stores have been consistently increasing for the last eight years to reach 7817 stores in 11 countries by the end of 2015. More than two-thirds of total Tesco sales are made in the UK.[2] Stores are operated in the following format: Metro Express Extra Superstore Changes in the number of Tesco stores worldwide[3] Online sales…

Tesco PLC is a UK-based global supermarket chain and it has 7817 shops and 517,802 employees around the world. Founded in 1919 by Jack Cohen, Tesco has emerged to become the biggest retailer in the UK and more than 80 million shopping trips are made to Tesco stores each week (Annual Report, 2015). Tesco’s mission statement is “to be the champion for customers – to help everyone who shops with us enjoy a better quality of life and an easier way of living”. Tesco business strategy can be described as cost leadership with a focus on availability, range and customer service. During the financial year of 2015, the group sales amounted to GBP 69.7 billion with the group trading profit of GBP 1.4 billion, however, the company made a net loss of GBP 6.4 billion during the same period (Annual Report, 2015). Along with market saturation, such a poor financial performance has been caused by a series of scandals that include an overstatement of commercial income by GBP 208 million (Rigby, 2015) and the cases of supplier mistreatment. It has been revealed that the supermarket chain demanded a payment of GBP 1 million from one of its suppliers, L’Oreal (Ahmed, 2015) and the company has been found to delay payment to suppliers in order to improve its operational profit margins in 2014 (Simpson, 2016). These scandals caused a severe damage to Tesco’s brand image and replacement of the leadership at the top level. The new leadership headed by a new Chairman of the Board John Allan and new CEO Dave Lewis pledged to restore the trust towards the brand via focusing on the core values that had made Tesco popular in the first place. Tesco PLC Report contains the application of the major analytical strategic frameworks in business studies such…

SWOT is an abbreviation that is interpreted as strengths, weaknesses, opportunities and threats related to businesses. The table below illustrates the main points of Tesco SWOT analysis: Strengths 1. Leadership position in the UK 2. Effective online operations 3. Clubcard as an effective consumer information tool 4. Strong property portfolio Weaknesses 1. Weak financial performance 2. Serious damage to the brand image due to commercial income scandal in 2015 3. Reliance on the UK market 4. Diminished employee morale Opportunities 1. Pursuing international market expansion strategy 2. Increasing presence in financial services industry 3. Increasing non-food retail range 4. Enhancing the effectiveness of the marketing strategy Threats 1. Inability of the new leadership to turn over the business 2. Inability to sustain cost leadership competitive advantage 3. Currency fluctuations 4. Emergence of new ethics-related problems Tesco SWOT analysis Strengths 1. Tesco is the biggest retailer in the UK with a grocery market share of 27.9 per cent. Its closest competitor Sainsbury’s has the market share of only 16.6 per cent and the market share of Walmart-owned ASDA is equal to 16.4 per cent.[1] Possessing the largest market share is an important strength regardless of the industry and this position allows Tesco to generate substantial revenues, given it addresses 7Ps of marketing mix in an appropriate manner. 2. The company utilizes online sales channel with a high level of efficiency. Tesco was among the first retailers in the UK to successfully implement online sales channel and currently, revenues generated via online sales account for a solid share of the total revenues. Specifically, in 2015 Tesco online grocery market grew ahead of the market at 20 per cent although the company posted pre-tax loss of GBP 6.37 billion during the same year.[2] The growth of online sales ahead of the market despite…

PepsiCo segmentation, targeting and positioning decisions can be specified as the essence of overall marketing efforts. Segmentation involves dividing population into groups according to certain characteristics, whereas targeting implies choosing specific groups identified as a result of segmentation to sell products. Positioning refers to the selection of the marketing mix the most suitable for the target customer segment. PepsiCo uses multi-segment type of positioning and accordingly, it targets more than one customer segment at the same time with different products or service packages. For example, Pepsi-Cola is positioned as soft drink that tastes good and has a pleasantly refreshing impact. However, Pepsi-Cola contains a high amount of sugar and it is not positioned for customers that are concerned about health implications of consuming carbonated soft drinks. For this specific customer segment PepsiCo offers Diet Pepsi, which is positioned as a soft carbonated drink that contains less among of sugar compared to Pepsi-Cola and other soft drinks. The following table illustrates PepsiCo segmentation, targeting and positioning: Type of segmentation Segmentation criteria PepsiCo target segment Geographic Region Domestic/international Density Urban/rural Demographic Age 15-45 Gender Males & Females Life-cycle stage Bachelor Stage young, single people not living at home Newly Married Couples young, no children Full Nest I youngest child under six Full Nest II youngest child six or over Income Average, above average and high earners Occupation Students, employees, professionals Behavioral Degree of loyalty ‘Hard core loyals’ and ‘Soft core loyals’ Benefits sought Refreshment, enjoying good taste, satisfaction of a habit, spending time Personality Easygoing/determined/ambitious User status Regular users Psychographic Social class Working class, middle class and upper class Lifestyle[1] Aspirer, Succeeder, Explorer PepsiCo segmentation, targeting and positioning It is important to specify that PepsiCo portfolio comprises 22 brands including Pepsi-Cola, Lay’s, Mountain Dew, Gatorade, Tropicana and others[2], and the Table 2 above specifies PepsiCo target…

PepsiCo CSR strategy focuses on three pillars of sustainability: human, environmental and talent. The company releases Global Responsibility Report annually and it includes the details of CSR programs and initiatives engaged by the company. The table below illustrates highlights from the latest report for 2015: Categories of CSR activities PepsiCo Performance Supporting local communities Since 2006, PepsiCo invested USD 850 million to support communities where it operates Through its partnership programs PepsiCo provided access to save water to 6 million people during the period of 2008-2014 Educating and empowering workers Implementation of Lean Six Sigma Training has been increased from 3 to 30 countries during 2010 – 2015. Labor and human rights In 2014, PepsiCo trained 1900 suppliers on Supplier Code of Conduct that focuses on the protection and promotion of human rights The company as Human Rights Operating Committee (HROC) consisting of cross-functional leaders across PepsiCo with the aim of building awareness around promotion of human rights across the company and suppliers Employee health and safety Lost time incident rate in was reduced by 23 per cent in 2014 compared to the previous year Gender equality and minorities In 2015, the company spent USD 1.4 billion with minority-and-women-owned businesses Environment a) energy consumption b) water consumption c) recycling d) CO2 emissions An improvement of 16% energy efficiency was achieved in 2015 Operational water usage per unit of production was reduced by 23 per cent in 2015. The amount of absolute water usage was reduced by 1 billion liters during the same period About 93 per cent of PepsiCo’s waste is diverted from landfill, i.e. 93 per cent of water recycled and re-used More than 130 million pounds of foodgrade recycled polyethylene terephthalate (rPET) was used by PepsiCo in 2014, an increase of about 25% compared to the…

PepsiCo McKinsey 7S framework explains how important elements of businesses can be aligned to increase the overall effectiveness. According to McKinsey 7S framework, strategy, structure and systems are hard elements, whereas shared values, skills, style and staff represent soft elements of businesses. The essence of the framework can be explained in a way that a change in one element causes changes in others. As it is illustrated in Figure 1 below, shared values are positioned at the core of PepsiCo McKinsey 7S framework, since shared values guide employee behavior with implications in their performance. Figure 1 McKinsey 7S Framework Hard Elements Strategy. PepsiCo business strategy integrates the following six principles: Achieving growth through mergers and acquisitions (M&A) Forming strategic alliances in global scale Focusing on emerging markets Focusing on organizational culture Developing and promoting the idea of One PepsiCo Innovation in marketing initiatives Moreover, as it is illustrated in Figure 2 below, the level of consumption of carbonated drinks in the US has been consistently declining for the last ten years and this tendency is expected to continue for the foreseeable future. PepsiCo strategy reflects this important tendency and accordingly, the company has been increasing its portfolio to include food and snacks product categories to decrease the dependency of the business on sodas and carbonated drinks. Figure 2 The decline of millions of liters of soda sold in the US[1] Along with strong financial performance, numerous customer awards is a convincing indicator of appropriateness and effectiveness of PepsiCo business strategy. The list of awards won during the year of 2015 alone include Innovation Supplier of the Year from 7-Eleven, Vendor of the Year from Dollar General, the Think Customer Award from CVS, Supplier of the Year from Target, and Food & Beverage Supplier of the Year from Walmart.[2] Structure. PepsiCo has…