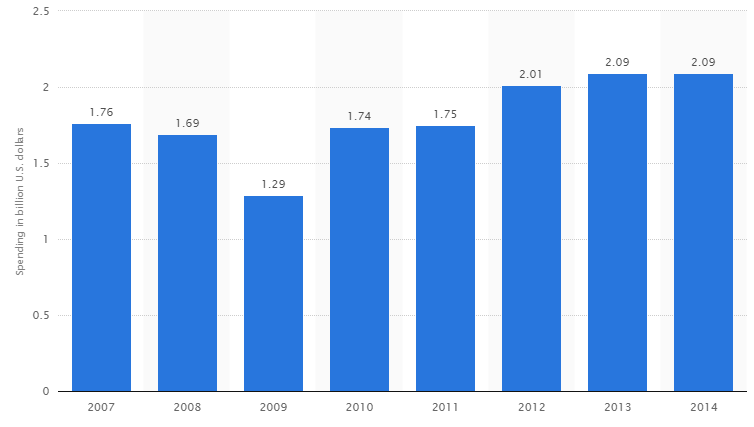

Toyota’s marketing budget has been consistently increasing after the global economic and financial crisis of 2007 – 2009 in line with overall tendency in automobile industry. Toyota marketing strategy succeeds in closely associating the brand with the best practices of Japanese ways of doing things. Specifically, Toyota marketing strategy focusses on the communication of marketing message based on the efficiency of manufacturing and use of superb vehicles. A set of marketing communication channels such as print and media advertising, sales promotion, events and experiences, public relations and direct marketing techniques are used an integrated way in order to this message to the target customer segment. Advertising Print and media advertising is one of the core elements of Toyota marketing strategy. The company uses newspapers, magazines, TV and radio ads, as well as, billboards and posters to reach its target customer segment. As it is illustrated in Figure 7 below, in the US alone the volume of advertising spending of the company reached USD 2.09 billion in 2014 and the largest proportion of this amount, USD 959 million was spent to produce and broadcast TV ads.[1] Toyota’s advertising spending in the US (in USD billions)[2] Toyota employs lifestyle-focused branding activities to promote Lexus brand. The global brand campaign slogan “Amazing in Motion” has proved to be a highly successful marketing move. As a continuation of this campaign, Toyota has partnered with rapper will.i. am to “challenge conventional notions of technology, design and music in a unique experience”[3]. The remix of the rapper’s famous hit #thatPOWER was created to feature Lexus NX highlighted by complex laser technology. Toyota viral marketing also plays an important role in increasing the level of brand awareness and promoting specific products of the company. The list of the most successful Toyota viral marketing campaigns include ‘Jungle…

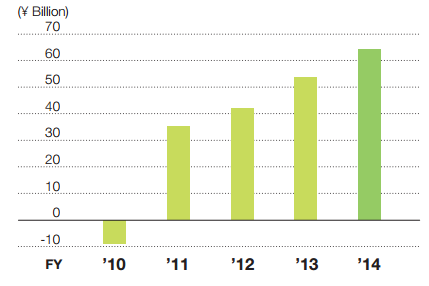

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. You can learn the theory of SWOT analysis here. The following table illustrates Toyota SWOT analysis: Strengths 1. Solid financial position 2. Toyota Production System (TPS) 3. Advanced technological features and capabilities 4. Leadership position and brand value Weaknesses 1. Extensive dependence on Japan and North American markets 2. Passenger safety issues in the past and product recalls 3. Weak presence in emerging markets 4. Lack of flexibility due to large size Opportunities 1. Investments in automated driving technology 2. Business diversification 3. Focus on developing countries 4. Further concentration on electric cars Threats 1. Passenger health and safety issues 2. Fluctuations in the prices of fuel 3. Emergence of innovative competitors 4. Increase in the prices of raw materials Toyota SWOT analysis Strengths 1. Generating revenues of ¥25.6919 trillion, which is an increase of ¥3,627.7 billion, or 16.4%, compared with the prior fiscal year,[1] Toyota possesses massive financial resources. As it is illustrated in Figure below, amid intensifying competition and increasing global economic uncertainly, the net operating income of Toyota has been consistently increasing for the last five years. The current solid financial position of the company contributes to its competitive advantage via granting opportunities to engage in research and development to a greater extent. Changes in Toyota’s net operating income[2] 2. Toyota Production System (TPS) is a widely recognized system for its efficiency in elimination of waste, irregularities, and overburdening from the production process. Based on two fundamental concepts of jidoka (automation with a human touch) and Just-in-Time principle, this system has enabled Toyota to adopt a proactive approach in dealing with manufacturing issues, at the same time saving significant manufacturing costs. Additionally, Toyota has introduced and perfected manufacturing concepts of Kaizen (continuous improvement) and…

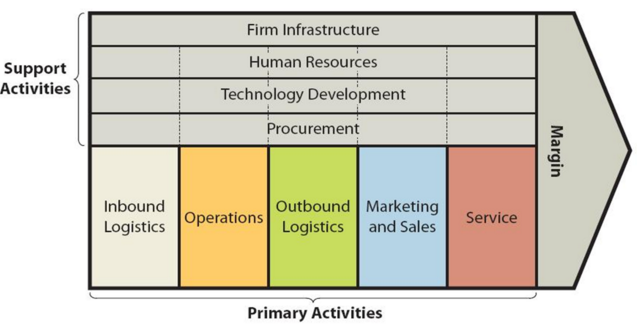

Value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the business. Figure 1 below illustrates the essence of value chain analysis. You can learn the theory of value chain analysis here. Figure 1 Value chain analysis Primary Activities Inbound logistics Inbound logistics for Toyota comprises two separate operations. The first is the operation “that transports parts from local suppliers to the local plants; the second is a separate operation, global inbound logistics, to transport parts from Japan to the North American and European plant”.[1] Localization of production is one of the core strategies pursued by Toyota and accordingly, 75.4% and 76.3% of non-domestic sales were produced outside of Japan for the calendar years of 2012 and 2013 respectively.[2] Thanks to localization of production, Toyota is able to achieve better match of local currency revenues with local currency expenses. Moreover, Toyota has developed and perfected Just-In-Time (JIT) system of manufacturing that eliminates the need for inventory and inventory management, thus saving considerable costs. To summarize, inbound logistics is a primary activity that creates an immense value for Toyota due to the localization of production and efficiency application of JIT supply chain system. Operations In 2013 Toyota automotive operations were reorganized into the following four units: The Lexus International. The business unit is assigned the role of the global head office for Lexus brand development, sales, marketing and advertising. Toyota No.1. This unit is in charge of North America, Europe, and Japan. Toyota No.2 unit caters for emerging markets of China, Asia & the Middle East, East Asia & Oceania; Africa, Latin America & the Caribbean Unit Cellar. This unit deals with unit-related technological development, manufacturing technology development and production Toyota promotes a spirit of monozukuri i.e. conscientious…

Toyota Motor Corporation is a global automobile manufacturing company that employs about 330,000 people. The company celebrated its 75th anniversary in 2012 and adherence to its mission statement “contributing to society by making ever-better cars” has taken the company to the global leadership in the industry in terms of sales. During the fiscal year of 2014, Toyota sold 9.116 million units of vehicles and generated revenues of ¥25.6919 trillion, which is an increase of ¥3,627.7 billion, or 16.4%, compared with the prior fiscal year. At the same time, it is important to clarify that revenues reported above were positively affected from a ¥900.0 billion boost due to exchange-rate fluctuations. Also, during the fiscal year of 2014, company expenses increased by ¥480.0 billion compared to the previous period. Senior management introduced massive changes to the business since 2009 immediately after the global financial and economic crisis. These include the reorganization of operations into four business units in 2013 and an extensive promotion of ‘One Toyota’ concept. The company has identified growth, efficiency and stability as three key priorities in its financial strategy. This report contains application of SWOT, PESTEL, Porter’s Five Forces and Value-Chain analytical frameworks towards the case study of Toyota Motor Corporation. The report also comprises analysis of Toyota’s marketing strategy and company’s approach towards Corporate Social Responsibility (CSR). 1. Introduction 2. Value-Chain Analysis 2.1 Primary Activities 2.2 Support Activities 3. SWOT Analysis 3.1 Strengths 3.2 Weaknesses 3.3 Opportunities 3.4 Threats 4. Marketing Strategy 4.1 Advertising 4.2 Sales Promotion 4.3 Events & Experiences 4.4 Public Relations 4.5 Direct Marketing 4.6 Personal Selling 5. PESTEL Analysis 5.1 Political Factors 5.2 Economic Factors 5.3 Social Factors 5.4 Technological Factors 5.5 Environmental Factors 5.6 Legal Factors 6. Porter’s Five Forces Analysis 7. Corporate Social Responsibility (CSR) 7.1 CSR Programs and Initiatives 7.2…

Dell acknowledges the importance of being perceived as socially responsible and unlike many other companies of its size and the sphere of operations, the company maintains a positon of Vice President for Corporate Responsibility. Dell has been acknowledged as the most ethical company for 2014 and 2015 by Ethisphere Institute. The company developed The Legacy of Goods 2020 Plan and its annual CSR report is update on the achievement of this plan. The Legacy of Goods 2020 comprises 21 ambitious long-term goals. Dell releases Supplier Responsibility Progress Report annually and it includes the details of CSR programs and initiatives engaged by the company. Table 3 below illustrates highlights from the latest report for 2014: Categories of CSR activities DELL Performance Educating and empowering workers Dell has been included in the list of ‘100 Best Companies To Work For’ by Working Mother AwardThe level of employee satisfaction assessed within the scope of Tell Dell global survey reached 80% in FY2015. This is an increase of 2% compared to the previous year Dell gained more than 33 awards globally during FY2015 for being an employer of choice The volume of hiring from university by Dell amounted to 24% of all external hires during the FY2015 By the end of FY2015 about 25% of eligible employees entered Dell’s flexible work programs Engagement in employee resource groups was increased from 14% in FY2014 to 18% in FY2015 In FY15, 86% of newly promoted people leaders enrolled Dell’s Foundations of Leadership training program Environmenta) energy consumption b) water consumption c) recycling d) CO2 emissions Within the scope of its Plant a Tree program, Dell has planted 678,000 trees. An estimated 463,180 tons of carbon has been sequestered thanks to this programAccording to Dell, its products consume 30% less energy compared to industry average…

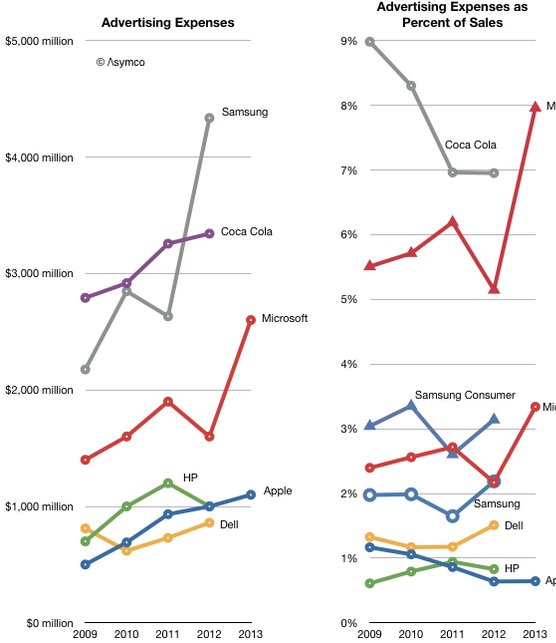

Dell is no longer under any legal obligations to reveal the details of its marketing and other expenses because the company became private as effective from September 2013. Nevertheless, data for the previous periods indicates that the company has been consistently increasing its advertising budget aftermath the global economic and financial crisis of 2007 – 2010. As it is illustrated in figure below, the same strategy has been followed by Dell’s major competitors such as Samsung and Apple, whereas marketing expenses were reduced in 2012 by Dell’s close competitor HP. Changes in Dell advertising expenses[1] Dell marketing message emphasizes low price of its products and the highest level of customization of design and experiences. The marketing message is transmitted to the target customer segment in an integrated manner via advertising, sales promotions, events and experiences, public relations, direct marketing and personal selling elements of the marketing mix. Advertising Dell relies on print and media advertising as one of its main marketing techniques. One of the latest media campaigns named “Future Ready” is a multi-million dollar attempt by Dell to promote its technology solutions for enterprise space makes an emotional appeal by illustrating the role of Dell technology in assisting a little girl receiving a new heart from a donor.[2] “Beginnings” is another noteworthy print and media marketing campaign launched by Dell and the campaign attempts to associate the brand with an entrepreneurial spirit, following the company becoming private in 2013. It is important to note that, “Beginnings” marketing video clip has emerged into a viral video in social media platforms, thus increasing the level of brand awareness to a significant extent. Sales Promotion Sales promotion as a marketing technique is used by Dell in a frequent manner. Dell official website has a dedicated page titled “Dell Coupons, Discounts…

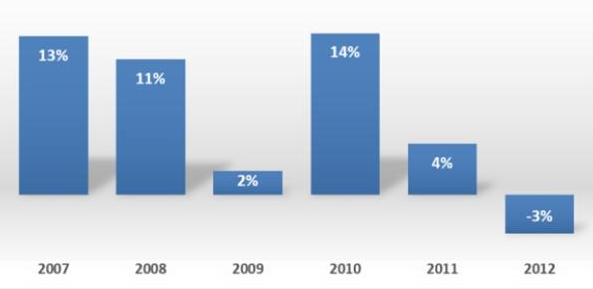

Political Factors Any corporation of a size of Dell is impacted by a set of political factors such as the level of political stability in the country, home market lobbying and international pressure groups. It is important to note that to date there is no evidence of Dell being involved in a political issue, nevertheless, the company is not immune from detrimental impact of political factors in the future. Specifically, there is a risk for Dell and other US-based computing and technology companies to become unwelcome in certain markets, particularly in Russia and China due to spying concerns sparkled mainly after the revelations of whistleblower and former CIA employee Edward Snowden. Moreover, Dell might be impacted by activities of home market lobbying and pressure groups in emerging economies advocating the interests of local computer firms, thus creating barriers for Dell in forms of trade tariffs and other instruments. Economic Factors Dell is directly impacted by a great range of economic factors that include currency exchange rates, interest rates, inflation rate, macroeconomic stability and costs of labor and raw materials. Particularly, currency exchange rate represents a major economic factor that affects Dell business performance directly and significantly because of the global scope of Dell operations. In order to address the negative impact of currency exchange rate and to gain operational efficiency, in February 2015 Dell became the biggest company that accepts bitcoins internationally[1]. Moreover, the global financial and economic crisis of 2007 – 2009 proved to have substantial detrimental impact on the growth of the global PC market, thus affecting Dell’s revenues. As it is illustrated in Figure 3 below, the growth in the global PC market amounted to 13% in 2007, however in 2009 the global PC market grew only 2% as a direct result of the crisis. It…

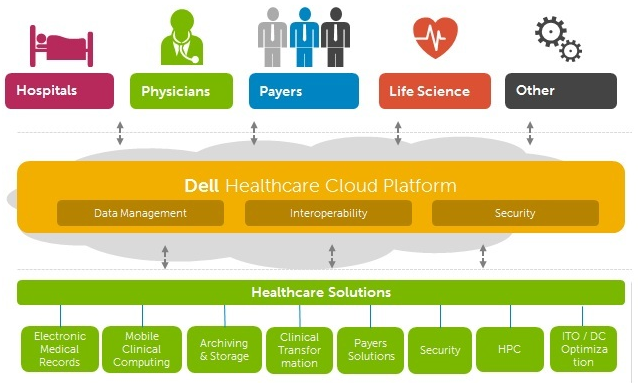

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The table below contains a brief illustration of Dell SWOT analysis: Strengths 1. Charismatic and effective leadership by Michael Dell 2. Market leadership in corporate usage. 3. Leadership in cloud 4. Leadership in healthcare sector Weaknesses 1. Lack of patents for breakthrough innovations 2. Long purchasing process 3. Extensive dependency on suppliers 4. Limited differentiation of products Opportunities 1. Investment in research and development 2. Engaging in mergers and acquisitions 3. Increasing presence in tablet and smartphone market 4. Concentrating in emerging markets Threats 1. Data security 2. Competition from emerging economies 3. Economic crisis 4. Decline of desktop and laptop market Dell SWOT Analysis Strengths 1. The company’s founder and CEO Michael Dell is a respected business leader around the globe. Michael Dell’s reputation is not constrained within consumer electronics industry and he is the first UN Global Advocate for Entrepreneurship. Starting the business in 1984 at the age of 19 from his freshman dorm room in the University of Texas, Michael Dell has been the main driving force behind the rapid growth of the business. Michael Dell stepped down as CEO in 2004 and had to return to the role in 2007 due to the decline in financial growth and the overall customer satisfaction. Michel Dell’s return has been marked with the company regaining its leadership position in the market proving his value as one of the most important assets of the business. 2. Dell products and services are popular among organizational consumers from both, private and public sectors. Dell products are used by 98% of Fortune 500 Companies[1] and 90% of Fortune 1000 companies use Dell software. It has been estimated that around 10 million small business owners function with Dell globally[2]. By…

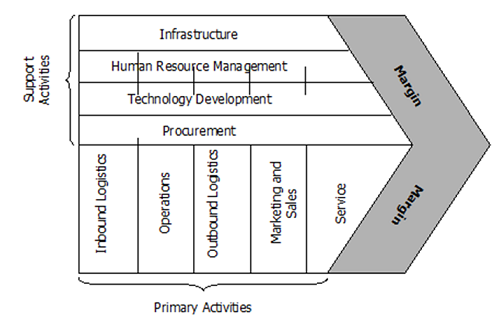

Value-chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the business. The Figure 1 below illustrates the essence of value chain analysis. It is important to note that the pattern of Dell value chain management has been extensively imitated by other companies, including companies outside of consumer technology industry due to its evident contribution to the success of the company. Figure 1 Value Chain Analysis Inbound logistics. Dell works with more than 165,000 channel partners in inbound logistics and provides USD 125 million partner incentives and investments annually[1]. The company utilizes Just-in-Time (JIT) philosophy in dealing with inbound logistics. Thanks to this strategy, Dell is able to save on huge inventory costs and sustain cost leadership for the majority of its products and services. Customer orders are registered by Dell and its vendors simultaneously by an integrated system. Then, materials are shipped by suppliers within 2 hours and shortly received at Dell’s assembly unit due to geographical proximity (see Figure 2 below). Operations. The main distinctive point between operations of Dell and its competitors relates to the fact that Dell is not a computer manufacturer; the company merely assembles parts manufactured by other companies. At the same time, high level of product customization is adapted as one of the bases of competitive advantage by the business. Therefore, operations mainly consist of three stages – assembly of stardard parts, installation of custom parts and testing product configurations (see Figure 2 below). Figure 2 Dell’s value chain[2] Outbound logistics consists of five stages as marked in red color in Figure 2 above. Thanks to the practice of mass customization, Dell is able to complete order fulfilment in a short duration of time. Generally, Dell completes customer shipments in a timely basis,…

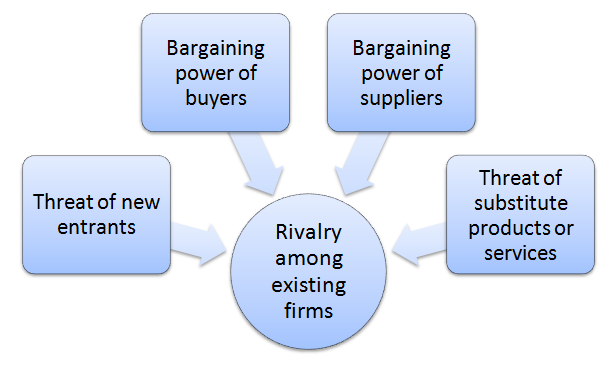

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. These forces are represented below: Threat of new entrants to consumer electronics industry is not significant due to cost and financial, knowledge and technological barriers. However, it is important to note that new businesses may overcome these barriers if they are able to introduce new products to the market based on innovative concepts. Large players such as Dell, Apple, HP, Samsung and Acer derive extensive benefits from the economies of scale and this fact represents an additional entry barrier to the consumer electronics industry. Bargaining power of buyers is immense due to the abundancy of offer and little differentiation amongst products. Moreover, there are usually no additional costs for Dell customers to switch to the competition and the majority of customers are well educated about products and services offered by Dell, another important factor that fuels buyer bargaining power. High level of price sensitivity for the type of products and services offered by Dell also increases the bargaining power of buyers. However, inability of backward integration, i.e. producing products offered by Dell by customers, can be specified as an important factor that diminishes buyer bargaining power. Bargaining power of suppliers is significant. Dell is extensively dependent on suppliers because it does not manufacture, but simply assembles its products from parts delivered by external vendors. Although there is a large number of companies that can potentially supply parts for Dell, there are only few reputable suppliers located close to Dell’s assembling units and this fact increases supplier bargaining power. Presence of supplier switching costs also contributes to their bargaining power. For Dell, the cost of supplies relative to selling price of products is high and it increases…