Co-founder Reed Hastings had the helm of Netflix leadership as the CEO for a quarter century until he stepped down early in 2023. Hastings practiced unconventional and effective leadership practices such as providing context instead of directions, offering straightforward feedback and paying people more than they expect. Under Reed Hastings, leadership at Netfix largely boiled down to hiring and retaining top talent and remaining innovative largely because of the company’s commitment to hiring high performers, giving them lots of transparency and freedom, and avoiding imposing rules that might get in their way. Currently, there are two Co-Chief Executive Officers – Ted Sarandos and Greg Peters. Sarandos had led Netflix’s Hollywood business for many years and Peters has managed advertising business of the the streaming service. The rationale behind having two CEOs relates to benefiting from the shared expertise of the two executives. There are cases such as Oracle, Salesforce and Atlassian where companies thrived under joint CEOs. At the same time, having two CEOs managing a company can involve certain challenges such as blurring the line of responsibility, lack of speed of decision making and high potential of ego issues and others. These are valid reasons why majority of companies have lone leaders. Moreover, many business analysts and practitioners argue that joint CEOs are only temporary measure mostly suitable only for start-ups. However, to the credit of Netflix, co-founder and former CEO Reed Hastings has not left the company and he is serving as executive chairman. In case if major disagreements occur between Sarandos and Peters regarding strategic issues Hastings can always jump in with the final voice regarding the issue. An interesting aspect of leadership at Netflix refers to the depth of information provided to board members and the level of engagement of the board members with…

Fundamental Analysis of Netflix Stock Fundamental analysis refers to the practice of using financial activity to forecast stock prices. Revenue: Netflix’s revenue has been growing steadily in recent years, reaching USD30.9 billion in 2022. Earnings per share: Netflix’s earnings per share have also been growing steadily, reaching USD9.36 in 2022. Free cash flow: Netflix’s free cash flow has been positive in recent years, reaching USD10.7 billion in 2022. Debt: Netflix has a moderate amount of debt, with a debt-to-equity ratio of 1.3. Margins: Netflix’s margins are high, with a gross margin of 73% and an operating margin of 22%. Valuation As of September 11, 2023 Netflix’s stock is trading at a price-to-earnings (P/E) ratio of 37.05. This is higher than the P/E ratio of the S&P 500, which is currently at 21.08. However, Netflix’s P/E ratio is lower than its historical average of 50. Technical Analysis of Netflix Stock Technical analysis is the reliance of historical stock price activity to predict future price activity. As of September 11, 2023 Netflix stock (NFLX) is trading at USD442.80. The stock has been on a downward trend since January 2023, but it has been consolidating in recent weeks. The 50-day moving average is at USD432.97, and the 200-day moving average is at USD352.07. The relative strength index (RSI) is at 57.74, which is in the neutral zone. Technical indicators The moving average convergence divergence (MACD) indicator is positive, which is bullish. The MACD line is above the signal line, and the histogram is rising. The stochastic oscillator is also positive, and it is rising towards the overbought level. Support and resistance levels The nearest support level is at USD419.81, followed by USD402.99. The nearest resistance level is at USD453.45, followed by USD472.70. Sentiment Analysis of Netflix Stock Sentiment analysis is the process of determining the emotional…

Netflix business strategy is to continuously improve its members’ experience by offering compelling content that delights them and attracts new members. Netflix pioneered subscription streaming in 2007 and retains the first mover competitive advantage in this segment. Moreover, the largest streaming service in the world is pursuing the following strategies: 1. Focusing on revenues maximization over membership growth. Internet-based technology companies such as Netflix often have to choose between growing members or revenues. On one hand, brand recognition at a broad scale requires scaling of the business. On the other hand, scaling requires massive financial investments at the same time when you cannot increase the cost. If you increase the cost, you cannot scale because people will not purchase. This is why internet-based companies such as Uber and Airbnb traded revenues for membership growth and stayed unprofitable for a long time. For Netfix, on the other hand, membership growth is important, but revenue maximization per member is their primary concern. The on-demand media provider regularly increases prices. In the latest move it eliminated its cheapest USD 9,99 add-free plan for its US-based subscribers and the cheapest ad-free tier for new members is because USD15.49 per month in summer 2023.[1] 2.Investing in original content. Netflix is the first company to invest in original content starting with award-winning House of Cards series in 2011. This was followed by a series of quality original content such as BoJack Horseman (2020), Squid Game (2021), Kipo and The Age of Wonderbeasts (2020), Arecane (2021) and many others. Quality original content is one of the main competitive advantages for the on-demand media provider. 3. Staying focused on movies, series and documentaries. Netflix stays within its niche of movies, series and documentaries and the company is planning to continue with this strategy for the foreseeable future. The…

Netflix Inc., the largest streaming service in the world, was incorporated on August 29, 1997 and began operations on April 14, 1998. The entertainment services provider has 231 million paid memberships in over 190 countries. The company employs about 12,800 people in more than 25 countries. Consolidated revenues for the year ended December 31, 2022 increased 6% as compared to the year ended December 31, 2021, due to the 6% growth in average paying memberships and a 1% increase in average monthly revenue per paying membership. Netflix business strategy involves prioritizing revenues maximization over membership growth and increasing investments on original content. Moreover, the streaming service has decided to stay focused on movies, series and documentaries not entering news and live sports segments. The on-demand media provider had change of leadership in 2023 with co-founder Reed Hastings stepping down from the role of co-CEO and Ted Sarandos and Greg Peters becoming new co-CEOs. The largest streaming service in the world has flat organizational culture and its organizational culture has been a subject of case studies in business schools for its unconventionality and effectiveness. Specifically, Netflix organizational culture effectively encourages decision making by employees at all levels and the company has taken information sharing to a whole new level. The popular streaming platform despises rules and communication practices there are candid and direct. Along with its obvious strengths such as first mover advantage, quality original content and global presence, the entertainment services provider has certain weaknesses as well. Namely, Netflix has high level of indebtedness and its business model depends on other companies. Furthermore, the company is over-dependent on North American home market and there is a room for improvement on its customer services. Netflix Inc. Report contains the application of the major analytical strategic frameworks in business studies such as…

Apple corporate social responsibility (CSR) programs and initiatives are led by Lisa Jackson, Vice President for Environment, Policy and Social Initiatives, reporting directly to CEO Tim Cook. More than 1 million people work in Apple supplier facilities and as such, the company’s operations have considerable implications on the society. It has to be noted that “Steve Jobs wasn’t known for philanthropy. Some wondered if he made anonymous donations to charity, some criticized him for his lack of public giving, while others defended him”[1]. However, with Tim Cook assuming Apple leadership in 2011, the focus on CSR aspect of the business has increased to a considerable extent. Tim Cook is a member of Paulson Institute’s CEO Council for Sustainable Urbanization, working with other CEOs of top Chinese and Western companies to advance sustainability in China. Apple Supporting Local Communities In Oregon, USA, Apple partners with Bluestone Natural Farms to transform compostable materials generated onsite into rich organic material for use on the farm. The tech giant launched a 100-kilowatt rooftop solar project at an educational premise for disadvantaged children in Philippines. The company added 50-kilowatt solar power system and a 260-kilowatt-hour battery to supply clean electricity to off-grid fishing community in Thailand. Apple Educating and Empowering Workers The multinational technology company provided training courses to about 4 million people since 2008. The tech giant has competitive employee benefits practices. For example, expectant mothers can take up to four weeks before a delivery and up to 14 weeks after a birth, while fathers and other non-birth parents are eligible for up to six weeks of parental leave. Apple suppliers paid back USD 32.2 million recruitment fees to their 36,599 employees since 2008. The iPhone maker taught employees organized 185,000 hours of inclusion and diversity training in 2021[2] The company organized 80,000 hours of management…

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Apple SWOT analysis: Strengths 1. High quality, design and performance of Apple products and services 2. Brand value of more than USD 3 trillion 3. High profit margin 4. Solid financial position of the business 5. Sophisticated supply-chain infrastructure Weaknesses 1. Lack of innovation 2. Decreasing sales of iPhones 3. Higher prices than competition 4. Incompatibility of Apple products and services with other products and services for users 5. Limited customazation options of products Opportunities 1. Further increasing concentration on Services business segment 2. Increasing focus in research and development 3. Product diversification 4. Formation of strategic partnerships 5. Increasing focus on green technology Threats 1. Quality problems with negative effects on sales and Apple brand image 2. Intensifying competition from China and India 3. Being found to have infringed on intellectual property rights 4. Reputation damage due to the tax scandal 5. Disruptive innovation by competitors Apple SWOT analysis Strengths in Apple SWOT Analysis 1. High quality of Apple products and services in terms of design and performance is the main strength of the company. Co-founder and late CEO Steve Jobs never compromised design and functionality because of the cost of raw materials and manufacturing. The same principle persists to this day. The tech giant pursues differentiation business strategy and effectively differentiates its products and services with high quality, design and performance. Moreover, highly sophisticated Apple ecosystem plays an instrumental role in maintaining brand loyalty and consequently sustaining market share in the global scale. Specifically, third-party products are not usually compatible with Apple products and all products belonging to Apple portfolio work well with each-other. Thanks to services such as iCloud, airplay, and airdrop, you can start a task in on…

PESTEL is a strategic analytical tool and the acronym stands for political, economic, social, technological, environmental and legal factors. Apple PESTEL analysis (or Apple PESTLE analysis) involves the analysis of potential impact of these factors on the bottom line and long-term growth prospects for the tech giant. Political Factors in Apple PESTEL Analysis The extent to which Apple is able to achieve its primary objective of profit maximization depends on a wide range of political factors. These include government stability, level of bureaucracy, corruption, freedom of press, home market lobbying groups etc. Additionally, activities of trade unions can be mentioned as important external political factors for Apple. Tax Payments The payment of taxes is a noteworthy political factor affecting Apple. The multinational technology company uses complex legal means to keep its tax payments as low as possible globally, especially in the US and Ireland. In the US, the tech giant holds the majority of its cash offshore so that it can avoid paying corporate income taxes in the US.[1] Any changes in government taxation policies may affect the bottom line for the iPhone maker. In Europe, European Commission concluded that Apple should have paid the Irish state at least €14 billion (USD 16.2 billion) in corporate tax for 2004-2014. However, in 2020 the General Court of the European Union ruled that European Commission was wrong, a decision that was welcomed by the Irish government.[2] Changes in taxation policies in general and the stance of governments and government agencies towards the iPhone maker in particular are external political factors that have implications for the business. Dispute with US Federal Bureau of Investigations The most significant case that illustrates the potential impact of a political factor relates to Apple’s battle with US Federal Bureau of Investigations (FBI). Specifically, the…

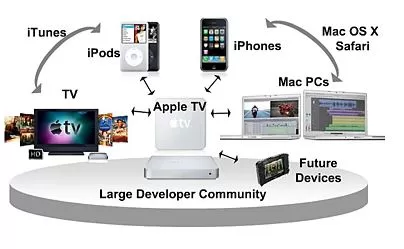

Ecosystem in its essence is “a biological community of interacting organisms”[1]. In technology terms, ecosystem refers to a group of devices and software that represent a single collaborative network. In other words, it is how well each product or service belonging to a company work individually and if end-users will get better experience when all of these products and services work together. It is the question if the whole is greater than sum of all parts. Apple ecosystem is one of the main competitive advantages associated with the brand. In fact, the iPhone maker is one of the earliest technology companies globally to purposefully form an ecosystem. Third-party products are not usually compatible with Apple products and all products belonging to Apple portfolio work well with each-other. At the same time, the ecosystem of Apple is much more than just a collection of more than 2 billion active devices[2] or services that work seamlessly. Apple ecosystem integrates the following key elements: Company image of creativity that motivates customers to upgrade their devices frequently. Perception of status and effectiveness that is associated with using Apple products Efficient devices and services that perform best with other Apple products and services Apple ID is the cornerstone of the ecosystem. It is used to register all Apple devices. Advantages of Apple Ecosystem Thanks to services such as iCloud, airplay, and airdrop, one can start a task in on one Apple device and continue it on another and there is no need to download or install anything. Moreover, Apple ecosystem offers features like AirDrop, iMessage, and FaceTime on macOS; unlocking a Mac laptop with an Apple Watch; or auto-pairing and finding lost AirPods, and the list goes on. Today, Apple ecosystem is widely considered to be the best in the industry, and arguably in…

Corporate culture of Apple plays an important role in efficiently maintaining its operations in the global scale with 164,000 full-time equivalent employees.[1] Apple organizational culture used to have a reputation of being harsh, demanding and intimidating under the leadership of founder and late CEO Steve Jobs. However, it can be argued that since assuming the top leadership in 2011, Tim Cook has invested considerable efforts towards ‘humanising’ the brand. Specifically, unlike his predecessor, Tim Cook has spoken out about human rights, privacy, immigration reform and environmental issues.[2] Apple corporate culture integrates the following important features: 1. Creativity and innovativeness. Apple pursues the business strategy of product differentiation with the focus on the design and functionality of products and services. An effective implementation of this strategy in practice requires a high level of creativity and innovativeness from employees at all levels. Accordingly, in order to encourage their employees to be more creative and innovative, the company attempts to develop relevant working environment. Creative design of Apple Campus, informal dress codes and creatively designed working space can be mentioned to illustrate this point. 2. Working under pressure. Ability to work under pressure is a must-have skill for Apple employees at all levels. In fact, it is challenging to work for the first company ever to be valued at $3 trillion. Most projects have strict and short deadlines and working long hours is a norm in the company. CEO Tim Cook sets example in terms of his loyalty to the company and working long hours. He is known for sending emails to employees at 4:30 am. Moreover, Sunday is a work night for many managers at Apple because of the executive meeting the next day. Not everyone can sustain to work at such an intense rate. But employees who survive within the first…

Apple business strategy can be classified as product differentiation. Specifically, the multinational technology company differentiates its products and services on the basis of simple, yet attractive design and advanced functionality. Apple business strategy consists of the following four elements: 1. Focus on design and functionality of products. According to its business strategy, Apple has adapted advanced features and capabilities of its products and services as bases of its competitive advantage. The list of innovations introduced by Apple include, but not limited to the introduction of iPad, the first device of its kind that stored thousands of songs with a simple shuffle capabilities through songs, development Macintosh, the first computer to use a graphical user interface and the launch of iMac that “ripped up the computer design rule book, doing away with dull beige boxes and instead replacing them with fun, translucent machines in shades such as “Bondi Blue” that hinted at the aesthetic Apple would become so well-known for.”[1] The first company ever to be valued at $1 trillion systematically improves features and capabilities of its products, setting new standards for the industry at the same time. Take photos for example. Apple single-handedly advanced global photography industry with a range of innovations illustrated in table below. Innovation Year High dynamic range imaging 2010 Panorama photos 2012 True Tone flash 2013 Optical image stabilization 2015 Dual-lens camera 2016 portrait mode 2016 portrait lighting 2017 night mode 2019 LiDar scanning 2020 Photography innovations by Apple Inc. First mover advantage is another element of Apple competitive advantage. It has to be stated that Apple competitive advantage may be challenging to be sustained for long-term perspective. Specifically, the management may fail in terms of ensuring the addition of innovative features and capabilities in new versions of its products, thus compromising…