BMW segmentation, targeting and positioning can be specified as the base of the marketing efforts of the company. BMW, as well as, any other business entity has to divide population into different categories according to a set of certain criteria and develop products and services that are particularly attractive to this specific group. This marketing process is known as segmentation, targeting and positioning. Segmentation, targeting and positioning is important because businesses cannot offer products and services that are attractive to all members of population in an equal manner. Segmentation implies dividing potential customers into different groups according to certain criteria such as age, social class, lifestyle etc. Segmentation can be divided into four types: demographic, behavioral, and psycho-graphic. Segmentation stage is followed by targeting and this stage is associated with selection of specific group(s) as a target customer segment. Positioning is the last stage in segmentation, targeting and positioning and this stage involves selection of the marketing mix that is relevant to the chosen target customer segment in the best possible manner. BMW Group uses mono-segment type of positioning and accordingly, the company makes an appeal to a single customer segment. In other words, BMW Group product portfolio only comprises expensive vehicles at a premium level and the company does not have budget vehicles in its portfolio to target individuals and households with a smaller budget. The following table illustrates BMW segmentation, targeting and positioning: Type of segmentation Segmentation criteria BMW Group target segment BMW MINI Rolls-Royce Geog-raphic Region Domestic/international Domestic/international Domestic/international Density Urban/rural Urban Urban Demog-raphic Age 20-65 25-45 40+ Gender Males & Females Males & Females Males & Females Life-cycle stage Bachelor StageNewly MarriedCouples Full Nest I Full Nest II Full Nest III Empty Nest I Empty Nest II Solitary Survivor I Solitary Survivor II Bachelor StageNewly MarriedCouples Full Nest I…

PESTEL is a strategic analytical tool and the acronym stands for political, economic, social, technological, environmental and legal factors. BMW PESTEL analysis involves the analysis of potential impact of these factors on the bottom line and long-term growth prospects Political Factors There is a wide range of political factors that affect BMW Group in various ways. For example, enforcement of new laws related to CO2 emission and change in EU legislation related to end-of-life vehicle (ELV) recycling are major political factors that affect BMW manufacturing processes. Level of political stability in emerging markets such as Russia, China, and Brazil can be highlighted as additional political factors impacting BMW in a way that political instability in these countries can have negative implications on local consumer spending patterns. Additionally, in case of political instability BMW investments in respective countries may be subjected to risks. There are also instances where BMW has attempted to influence external political factors to create a favourable political climate for its business operations. The opposition of the company to European commission proposals for a tougher limit on carbon emissions in 2012 can be mentioned to justify this claim. Specifically, it was noted that BMW was lobbying to water down European plans to improve the fuel efficiency of cars at the same time as trumpeting its green credentials as the official car sponsor of the Olympic Games, according to internal documents seen by the Guardian[1]. Economic Factors Impacts of a wide range of economic factors on BMW performance are evident and significant. Namely, vast GDP fluctuations in EU countries during the last few years with direct implications on consumer spending in EU countries is a substantial economic factor that affects BMW Group performance to a considerable extent. Currency exchange rate can be named as another important economic factor that has…

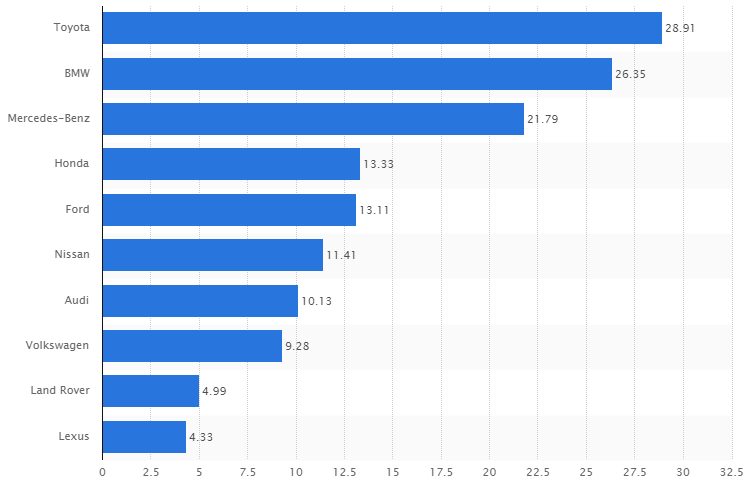

SWOT analysis can be described as “a technique for focusing an individual’s or group’s attention on strengths, weaknesses, opportunities and threats. It is useful particularly because strengths and weaknesses can be the cause of potential future risks – both opportunities and/or threats” (Murray-Webster, 2010, p.88). The following table illustrates BMW SWOT analysis: Strengths 1. Strong brand image 2. Highly automated driving experience and advanced features and capabilities 3. Strong performance of Financial Services Segment 4. Strong CSR performance 5. Reliability of vehicle Weaknesses 1. High level of vulnerability to the future economic crises due to premium pricing strategy 2. Lack of strategic partnerships compared to the competition 3. Weak BMW brand portfolio with only three brands: BMW, MINI, and Rolls Royce 4. Lack of operational cost efficiency 5. Damage to the brand image due to air bag issue Opportunities 1. Increasing revenues through more emphasis on electromobility 2. Formation of strategic alliances with other automobile companies 3. Launch of BMW 9 Series generation 4. Increasing presence in Chinese market 5. Engaging in product diversification Threats 1. Further increases on the prices of raw materials 2. Emergence of new competition from emerging economies 3. Negative impacts from exchange rate fluctuations 4. Damage to the brand image due to malfunctions 5. Loss of talent and key personnel to competitors BMW SWOT analysis Strengths 1. BMW is a highly reputable brand with strong brand image with is associated with efficiency and prestige. As it is illustrated in Figure 1 below, BMW is the second most valuable brand in automobile industry after Toyota with an estimated brand value of USD 6.35 billion. High brand value is a considerable strength for any business as it is a convincing indicator of a high level of consumer loyalty. Figure 1 Automobile brand values in billion…

BMW business strategy can be characterized as product differentiation with a particular focus on design and digitization. Electromobility represents the latest direction for BMW Group product differentiation and the company introduced its fully electric BMW i3 in 2013. This has been followed by plug-in hybrid vehicle BMW i8 in 2014. Moreover, BMW business strategy focuses on individual mobility in the premium segment – combined with attractive mobility services.[1] The company stays loyal to Strategy Number One which strives to align high levels of profitability in short-term perspective with increasing the levels of long-term value of the company in times of change. Four strategic areas for BMW have been specified as “Growth”, “Shaping the Future”, “Profitability” and “Access to technology and customers” BMW Group competitive advantage is based on the following points: 1. Representation of status and achievement. BMW belongs to premium car categories, and accordingly, possession of a BMW model car can be interpreted as a sign of achievement and social status in a society. 2. Effective design and features integrated to each model of the brand. These common design and effective features include, but not limited to the two-section, rounded radiator grille, attractive aesthetics, sophisticated style, and Hofmeister kink, i.e. the counter curve in the window-outline at the base of the rear roof pillar. 3. Competitive post-sales service. BMW received positive acclaim for superior after-the-sales customer service and this fact is greatly valued by customers. Research and development (R&D) plays an integral role in sustainability of BMW competitive advantage and this fact is duly recognized by the senior management. In 2015, R&D investments were increased by EUR 136 million to more than EUR 4.2 billion[2]. It has to be noted that BMW competitive advantage is challenging to sustain in the long-term perspective because sustainability of competitive advantage depends on the…

Bayerische Motoren Werke Aktiengesellschaft (BMW AG) is the parent company of the BMW Group, a global automobile manufacturer and seller based in Munich Germany. Originally founded as Bayerische Flugzeugwerke AG (BFW) in 1916 the company has emerged as one of the leading brands in the global market of luxury cars. BMW Group owns famous BMW, MINI and Rolls-Royce Motor Car Limited brands. In 2015 the company sold its products to more than 2.2 million people in more than 150 countries, an increase of 6.1 per cent compared to the previous year. BMW Group generated more than 93 billion EUR revenues in 2015, a significant increase of 14.6 per cent compared to the previous year. BMW net profit in 2015 increased by 10 per cent to around 6.4 billion EUR. The company employs 122,244 people globally and it has a hierarchical organizational structure. BMW Group operations are divided into four business segments: automotive, motorcycles, financial services and other entities. The company has 30 manufacturing sites in 14 countries and robotic technology plays an instrumental role in BMW manufacturing process. BMW Group pursues product differentiation business strategy and differentiates its vehicles on the basis of design, performance and advanced features and functionalities. Moreover, high level of integration of information technology and internet, as well as, electromobility represent solid grounds of BMW Group competitive advantage. At the same time, BMW Group has certain weaknesses that include a lack of portfolio diversification with only three brands, a high level of vulnerability to economic crises due to the premium pricing strategy and the lack of strategic partnerships with other businesses within and outside of automobile industry. BMW Group Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model…

Corporate Social Responsibility (CSR) is a critically important aspect of the business for any company of a large size, including Walmart. Walmart CSR strategy rely on the following three principles[1]: Creating economic opportunity for our employees, suppliers and people who work in retail and retail supply chains beyond Walmart Enhancing the sustainability of operations and product supply chains for people and the planet Building strong communities where the retailer operates Walmart’s aims to achieve the following 3 aspirational goals formulated in 2005 by Lee Scott, who was Walmart CEO at the time: Supply the company with 100 per cent renewable energy Create zero waste Sell products that sustain people and the environment The company releases Global Responsibility Report annually and it includes the details of Walmart CSR programs and initiatives engaged by the company. The table below illustrates highlights from the latest report for 2015: Categories of CSR activities Walmart Performance Supporting local communities In UK, Asda donated more than 10,000 grants as part of the Chosen By You, Given By Us program in 2014More than USD 100 million awarded in state and neighbourhood grants by Walmart and Walmart foundation in the US Walmart employees in the US volunteered over 1.5 million hours in their local communities in 2015 USD 14 million was donated by Walmart to the causes in “dollar-for-doer” grants Educating and empowering workers Results if a survey involving more than 2 million employees worldwide indicate that 4 or 5 are proud to work at WamartIn February 2015, the company announced a USD1 billion investment in U.S. hourly associates to provide higher wages, more training and increased opportunities to build a career with Walmart.[2] More than USD 100 million grants will be funded by Walmart foundation to accelerate mobility of retail workers from entry- to middleskills jobs, Labor and human…

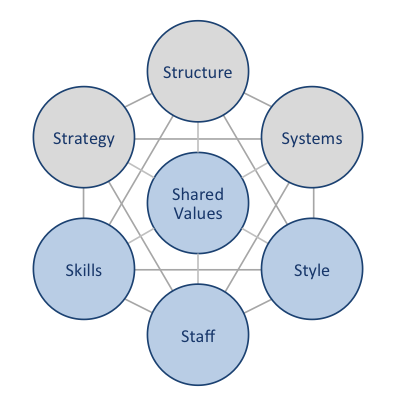

Walmart McKinsey 7S framework illustrates the ways in which seven elements of businesses can be aligned to increase effectiveness. According to the framework strategy, structure and systems represent hard elements, whereas shared values, skills, style and staff are soft elements. McKinsey 7S framework stresses the presence of strong links between elements in a way that a change in one element causes changes in others. As it is illustrated in Figure 10 below, shared values are positioned at the core of Walmart McKinsey 7S framework, since shared values guide employee behavior with implications in their performance. Hard Elements Strategy. Walmart pursues cost leadership business strategy according to its brand promise of ‘everyday low prices’. The company has been able to sustain this strategy thanks to the economies of scale, exercise of its vast bargaining power to secure low prices from suppliers and paying employees low wages. Three important pillars in Walmart business strategy can be specified as – assortment, price and access. Due to its aggressive pursuit of cost leadership strategy, Walmart has attracted criticism for paying its employees low wages with a consequent negative impact on the quality of customer services. CEO Doug McMillion had to address this issue via introducing certain changes in Walmart business strategy. Specifically, in February 2015, the company announced a USD1 billion investment in U.S. hourly associates to provide higher wages, more training and increased opportunities to build a career with Walmart.[1] Structure. Traditionally, Walmart organizational structure has been highly hierarchical due to the massive size and scope its business that comprises more than 11,000 stores in 27 countries and serves nearly 260 million customers each week under 72 banners.[2] However, new CEO Doug McMillion introduced initiatives to delayer the organizational structure. Specifically, in 2015 Walmart announced that “it will eliminate a layer of management…

Value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the business. The figure below illustrates the essence of value chain analysis. Walmart Value chain analysis Primary Activities Inbound logistics It has been estimated that more than 50 per cent of Walmart products in the US come from overseas suppliers[1] and about 75 percent of walmart.com sales come from non-store inventory [2]. Generally, Walmart inbound logistic practices are based on the following three principles: Using the minimum amount of links in the supply chain. Starting from 1980s, Walmart began to ruthlessly eliminate traders in its supply chain opting to work with manufacturers directly. Such a strategic decision proved to have a positive impact on the bottom line after a few years. Specifically, “in 1989, Wal-Mart was named Retailer of the Decade, with distribution costs estimated at a mere 1.7% of its cost of sales – far superior to competitors like Kmart (3.5%) and Sears (5%)”[3]. The efficiency of Walmart supply chain practices has further improved since in a consistent manner. Forming strategic partnerships with vendors. Walmart imposes strict conditions on various aspects of the business when negotiating with potential suppliers. The company also attempts to purchase for the lowest prices applying its huge bargaining power in order to be able to maintain cost leadership competitive advantage. However, once a potential vendor is contracted as a supplier, Walmart offers a strategic partnership for long-term perspective and engages in high volume purchases, although for lower prices. Using cross docking as an inventory tactic. Cross docking implies “the direct transfer of products from inbound or outbound truck trailers without extra storage, by unloading items from an incoming semi-trailer truck or railroad car and loading these materials directly into outbound trucks, trailers, or…

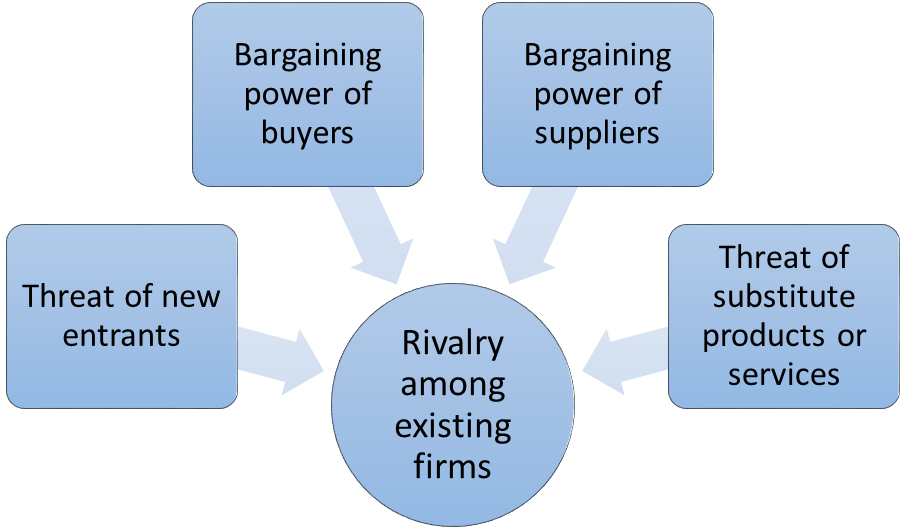

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. Walmart Porter’s Five Forces are represented in Figure 1 below: Figure 1. Walmart Porter’s Five Forces Rivalry among existing firms is intense. Walmart is engaged in cut throat competition with many other grocery retail chains and supermarkets such as Costco Wholesale Corporation, Dollar General Corporation, Dollar Tree, Inc., Kohl’s Corporation, Macy’s Inc, Sears Holdings Corporation, Target Corporation and others. At the same time, as it is illustrated in Figure 2 below, the pattern of changes of grocery industry concentration for more than two decades has been in favor of major market players such as Walmart, Kroger, Costco and Safeway. Market share of these large companies have been consistently increasing compared to grocery stores of smaller sizes partially due to the cost advantage gained via economies of scale. Figure 2. Changes in industry concentration in the US grocery market[2] Threat of substitute products or services. Walmart sells thousands of products belonging to the following categories: groceries entertainment health and wellness – including pharmacy hardlines – including stationery, auto spares, and accessories hardware apparel home furnishings household appliances It can be argued that the threat of substitute products is irrelevant for Walmart due to the abundant range of products sold by the retailer. In other words, Walmart sells a wide range of products, as well as, substitutes to this products, therefore, the impact of this particular threat to Walmart can be stated to be irrelevant. Bargaining power of Walmart suppliers is insubstantial. Due to the size and the scope of its business, Walmart secures the lowest prices from its suppliers to sustain its cost leadership competitive advantage. Walmart paid its suppliers USD 13.5 billion in total in 2015 alone.[3] Along with…

Walmart marketing budget equaled to USD2.4 billion for both fiscal 2015 and fiscal 2014 and USD2.3 billion for the fiscal year of 2013[1]. These funds are invested in Walmart marketing communication mix that include print and media advertisements, viral marketing, sales promotions, events and experiences, public relations and direct marketing components of the marketing communication mix. Advertising Traditionally, print and media advertising has represented the core of Walmart marketing strategy for many years. However, in 2015, Walmart Vice President Wanda Young announced planned shift of the main focus from the print advertising to the mobile marketing campaigns.[2] Such a change in Walmart marketing strategy is expected to target young people in general and Millenials in particular. Viral marketing is another direction that is being extensively utilized by Walmart with varying levels of success. For example, Walmart marketing video ‘Work is a Beautiful Thing: Meet Patrick’ released in 2014 has attracted more than 1.2 million views in just six days with thousands of positive comments and with evident positive implications on the brand image.[3] Nevertheless, Walmart still uses print and media advertising to a considerable extent and the company places advertisements on newspapers, magazines and TV channels popular with the target customer segment. Sales Promotion Sales promotion is used by Walmart in an extensive manner. The retailer launches seasonal sales promotions in a regular manner along with sales promotions in before and during public holidays and other memorable days. Particularly, Black Friday is a massive sales promotion day for Walmart each year eagerly anticipated by millions of customers. Walmart maintains Daily Savings Center section in its official website where online and offline sales promotion offers are announced. Sales promotion also has been adapted as an effective tool to increase the sales of Sam’s Club segment of the business. Specifically, the emphasis of…