Strategy

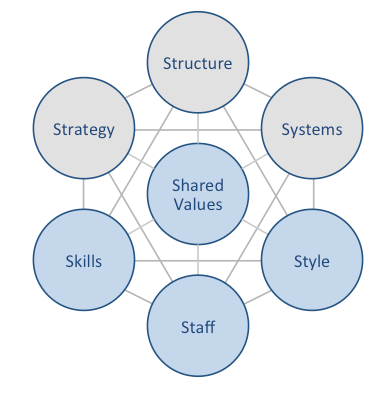

Starbucks McKinsey 7S model is used to highlight the ways in which seven elements of businesses can be aligned to increase effectiveness. According to this model, strategy, structure and systems represent hard elements. At the same time, shared values, skills, style and staff are soft elements. McKinsey 7S model stresses the presence of strong links between elements. Specifically, a change in one element causes changes in other elements. As it is illustrated in figure below, shared values are positioned at the core of Starbucks McKinsey 7S model, since shared values guide employee behaviour with implications in their performance. McKinsey 7S model Hard Elements in McKinsey 7S Model Strategy Starbucks business strategy is based on product differentiation with the focus on the quality of products and services. Moreover, the coffee chain giant effectively positions Starbucks stores as a ‘third place’ away from home and work, where customers can meet friends, relatives or spent time alone. Currently Seattle-based international coffee chain is positioning itself as a digital third place as well. Technological innovations and intensive integration of technology into various business processes in general and ordering process in particular represent another important aspect of Starbucks business strategy. The launch of Mobile Order & Pay feature, which allows customers to buy without getting in line, the launch of voice ordering app and “sending text message notifications to customers in the Seattle area when their mobile orders are ready”[1] can be mentioned to illustrate this point. Structure Starbucks Corporation has a hybrid organizational structure which combines geographic, brand-based and functional hierarchy structures. Operations are divided into North America (USA and Canada) and International (China, Japan, Asia Pacific, Europe, Middle East, Africa, Latin America and Caribbean) divisions. Brand-based divisions, on the other hand, consist of Starbucks, Teavana®, La Boulange®,, Evolution Fresh™, Seattle’s…

Howard Schultz has been at the helm of Starbucks leadership for more than two decades in total. He is rightly credited for making the business the world’s largest coffee retailer with 17133 company-operated stores and 16700 licensed stores in 84 markets employing 254,000 people.[1] On June 2000 Howard Schultz stepped down and assumed a new position as chief global strategist to focus on international expansion in general and expansion in China in particular. New internally promoted CEO Orin Smith oversaw store count to increase to 10000 locations with more than USD 5 billion annual sales. However, at the same time Starbucks market share at US decreased due to increased competition from McDonald’s, Dunkin’ Donuts and other competitors. Schultz returned at the helm of Starbucks leadership as CEO on January 2008 in the middle of global financial crisis to replace Jim Donald, who had succeeded Orin Smith in 2005. After a series of massive changes such as closing many underperforming stores, re-training employee and enforcing fair trade in coffee supply-chain, Schultz stepped down as CEO for the second time and became executive chairman. Kevin Johnson was appointed as a new Starbucks CEO effective from April 2017. Kevin Johnson admitted having ‘venti-sized shoes to fill” referring to successful leadership by Howard Schultz. At the same time, the new CEO stated “I’m not going to fall into the trap of trying to be Howard. I’m going to be authentic to who I am as a person and who I am as a leader”[2]. Howard Schultz returned for his third stint as CEO on April 4, 2022. This time the role was interim CEO until more suitable person is found. The main reason for his latest return was to actively block attempts by baristas to form unions. In September 2022, former CEO of Reckitt Benckiser…

Starbucks business strategy is based on the following four pillars: 1. Offering ‘third-place’ experience. Starbucks stores are effectively positioned as a ‘third place’ away from home and work, where people can spend time in a relaxed and comfortable environment with their friends or alone. Customers are even welcome to get their work done in a Starbucks store. All company-owned stores in the US and most company-owned stores abroad offer free wi-fi. “Starbucks stores are meticulously designed to make customers stay longer, buy more, and return for another visit.”[1] After returning as CEO for the third time in April 2022, Howard Schultz announced his plans for the company. Plans include building drive-through in 90% of new locations and machinery that will allow baristas to handle increasingly complex customer orders more quickly. Some analysts note that while drive through may increase profit martin, at the same time they may compromise the essence of third place experience for customers. Furthermore, according to Starbucks Chief Marketing Officer Mr. Brady Brewer the Seattle-based coffee chain is also creating digital third place. Mr. Brewer shares his vision the global coffeehouse chain creating a new global digital community on the basis of Web3 in general and NFTs (non-fungible tokens) in particular.[2] 2. Selling coffee of the highest quality. Starbucks business strategy can be classified as product differentiation. Accordingly, the coffee chain giant focuses on the quality of its products and customers pay premium prices for high quality. Excellent customer services as one of the solid sources of Starbucks competitive advantage further increases the attractiveness of the coffee retailer. The multinational chain of coffeehouses duly recognizes the paramount role of its employees in customer-facing positions to sustain high level of customer service. Accordingly, the company refers to its employees as partners and offers them a wide…

Starbucks organizational culture is based on values and principles of its former long-term CEO Howard Schultz. It has been noted that “Starbucks’ culture is powerful because it is tightly linked to the company’s distinctive capabilities[1].” Starbucks organizational culture integrates the following four key elements: 1. Valuing employees and their contribution. At Starbucks employees are referred to as partners and they are taken care of by the company via competitive compensation packages. For example, the coffee chain offers stock options and health insurance even to part-time employees in the US. Moreover, “at the height of the global financial crisis, when other companies were cutting HR costs wherever they could, Starbucks invested in staff training, including coffee tastings and courses that ultimately qualified for credit at higher education institutions”[2] 2. Presence of close bonds among employees. The company firmly believes in relationship-driven approach to the business and encourages the formation of close bonds between employees in its stores. One can easily witness the presence of close bonds among employees by simply observing their interaction in any store belonging to the Seattle-based international coffee chain. This contributes to the formation of relaxing and comfortable environment in Starbucks store, effectively strengthening its role as ‘third place’ away from work and home, where customers can spend good time alone or with their friends. 3. Culture of inclusion and diversity. Embracing inclusion and diversity is placed at the core of Starbucks corporate culture. The world’s largest coffee retailer runs 12 diverse Partner Networks, representing the broad spectrum of employee backgrounds. These include Armed Forces Network, Black Partner Network, Disability Advocacy Network and others. The multinational chain of coffeehouses received 100% score on the Disability Equality Index. The principles of inclusion and diversity prevail not only among the workforce, but also have reflections on customer…

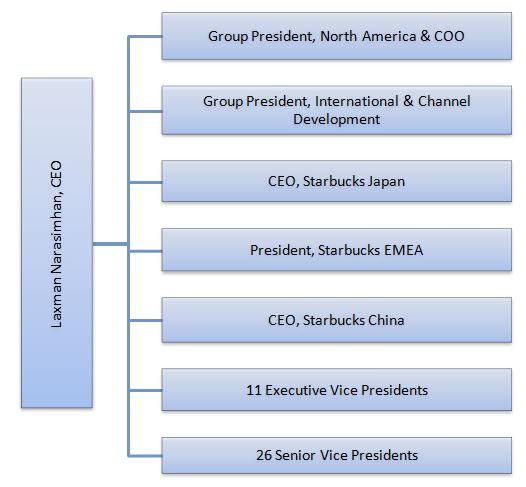

Starbucks corporate structure sustains international scope of its business operations that encompasses more than 34000 stores in 84 markets. Starbucks organizational structure is hybrid and integrates geographic, brand-based and functional hierarchy structures. Organizational structure of Starbucks can be divided into the following divisions: 1. Geographic divisions. Starbucks operations are divided into the following geographic divisions or segments: a) North America division. This division consists of USA and Canada b) International division consisting of China, Japan, Asia Pacific, Europe, Middle East, Africa, Latin America and Caribbean 2. Brand-based divisions. Each brand within Starbucks Corporation portfolio represents a separate division led by the head of division. The world’s largest coffeehouse chain has brand-based divisions as illustrated in table below: Brand Founded Products Starbucks 1971 Coffee, non-alcoholic beverages, food Teavana® 1997 Variety of teas La Boulange® 1999 French pastries and breads Evolution Fresh™ 1992 Nourishment juices and foods Seattle’s Best Coffee 1991 Coffee, non-alcoholic beverages, food Tazo Tea 1994 Teas, herbs, roots and spices Brand-based divisions within Starbucks organizational structure Starbucks corporate structure is functional hierarchy and accordingly, groups are formed according to business functions on Executive Vice President (EVP) and Senior Vice President (SVP) levels. Specifically, as illustrated in figure below organizational structure of Starbucks includes 11 Executive Vice Presidents each leading a separate function below: Chief Financial Officer Chief Marketing Officer Chief Strategy & Transformation Officer Global Coffee, Tea and Cocoa Global Supply Chain Chief Technology Officer Public Affairs Chief Partner Officer Global Channel Development Starbucks North America General Counsel Starbucks Organizational Structure Similarly, there are 24 functions headed by 26 executives at Senior Vice Presidents level: Store Development Ethics and Compliance officer Chief Procurement Officer, Global Sourcing Product Experience Global Chief Inclusion and Diversity Officer Starbucks Canada Americas Finance Latin America & Caribbean Partner…

Increasing popularity of ecosystem thinking in business has not gone unnoticed by the Swedish furniture chain as well. Currently, IKEA ecosystem is cantered around the notion of smart home. The Swedish furniture chain is investing in the new unit and expanding the range of products “which currently includes smart light bulbs, smart plugs, and other connected devices to automate home control.”[1] Named as Home Smart, the new full-fledged business unit is dedicated to smart home products. In other words, increasing numbers of smart home devices are being added into IKEA ecosystem. It can be forecasted that IKEA ecosystem is going to be aggressively expanded with hardware products that can be effectively paired with smart home technologies such as Google’s Nest and Amazon’s Alexa. James F. Moore, economist who coined the term business ecosystem defines the following four evolutionary stages of business ecosystem: birth, expansion, leadership and self-renewal. The evolution of IKEA ecosystem according to this concept is taking place in the following manner: 1. Birth. The world’s largest furniture retailer has already identified smart homes as the basis of its ecosystem. The choice of smart home as a basis of ecosystem is strategically appropriate taking into account increasing integration of internet into various aspects of daily life and chores. 2. Expansion. The company has developed a wide range of innovative products such as Symfonisk WiFi bookshelf speakers and lamps, Riggard LED lamp with wireless charging, Tradfi remote control and others that are considered as smart home products. Furthermore, the latest IKEA additions to smart home concept include electric blinds that go up and down at pre-programmed times and smart air purifiers. 3. Leadership. The furniture retailer is communicating its vision to internal and external stakeholders to strengthen its leadership position in home improvement industry with the focus on innovative products.…

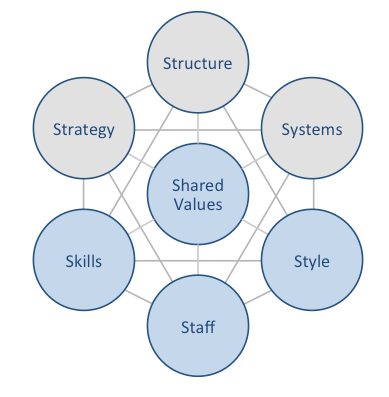

IKEA McKinsey 7S model explains how individual elements of businesses can be aligned to increase the overall effectiveness. McKinsey 7S framework considers strategy, structure and systems as hard elements, whereas shared values, skills, style and staff are accepted as soft elements. The framework stresses the presence of strong links between elements in a way that a change in one element causes changes in others. As it is illustrated in figure below, shared values represent the core of IKEA McKinsey 7S framework. This is because shared values guide employee behaviour with effects on their performance and ultimately on the bottom line for the business. McKinsey 7S model Hard Elements in IKEA 7S Model Strategy IKEA business strategy is based on the IKEA Concept, which is built upon the combination of function, quality, design and value – always with sustainability in mind. Moreover, the Swedish furniture chain offers cost advantage value for customers. Accordingly, IKEA business strategy involves offering increasing variety of products for the lowest prices. Regular engagement in new market development and benefiting from strategic alliances constitute additional pillars of IKEA business strategy. Structure IKEA organizational structure is unique and highly complex. The home improvement and furnishing chain maintains uniqueness and complexity its corporate structure in order to pay less taxes. The company can be divided into three large groups: franchise, range and supply and industry. Large scale of the business that integrates 11 franchisees operating in more than 500 locations in 63 countries[1] necessitates hierarchical organizational structure. Nevertheless, the Swedish furniture chain has proved to be successful in overcoming common weaknesses of hierarchical organizational structure such as high level of bureaucracy and lack of flexibility of the business. Systems IKEA business relies on a set of systems. These include employee recruitment and selection system, team development and orientation…

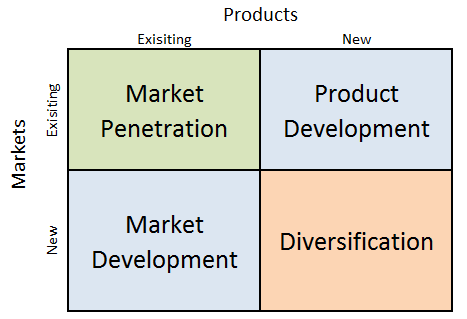

IKEA Ansoff Matrix is a marketing planning model that helps the Swedish furniture chain to determine its product and market strategy. According to Ansoff Matrix, there are four different strategy options available for businesses. These consist of market penetration, product development, market development and diversification. IKEA Ansoff Growth Matrix Within the scope of Ansoff Matrix, IKEA uses all four growth strategies in an integrated manner: 1. Market penetration. Market penetration implies selling existing products to existing markets. IKEA uses market penetration strategy aggressively. Effective marketing strategy plays an important role in increasing the efficiency of market penetration for the furniture retailer. Traditionally the world’s largest furniture retailer had relied on its famous catalogue printed in large quantities as a time-tested instrument to pursue market penetration strategy. However, in 2020 the company announced that it will stop producing catalogues starting from 2022 due to the decline of demand. 2. Product development. This involves developing new products to sell to existing markets. Product development is one of the main growth strategies for IKEA. The home improvement and furnishing chain has more than 12000 types of products in its range and it launches about 2000 new products every year.[1] The company makes some of its products in-house, as well as, purchases from suppliers. 3. Market development. Market development strategy is associated with finding new markets for existing products. The world’s largest furniture retailer engages in market development extensively. IKEA has 11 franchisees operating in more than 500 locations in 63 countries.[2] The company is forecasted to enter into more developing markets in short and medium term perspective. 4. Diversification. Diversification involves developing new products to sell to new markets and this is considered to be the riskiest strategy. IKEA experiments with diversification business strategy occasionally. IKEA restaurants within furniture retail shops can…

IKEA business strategy is built upon the IKEA concept. The IKEA Concept starts with the idea of providing a range of home furnishing products that are affordable to the many people, not just the few. It is achieved by combining function, quality, design and value – always with sustainability in mind. The IKEA Concept exists in every part of the company, from design, sourcing, packing and distributing through to business model.[1] The following points constitute integral elements of IKEA business strategy. 1. Offering the lowest prices. Cost effectiveness is one of the solid bases of IKEA competitive advantage. The global furniture retailer is able to offer low prices thanks to a combination of economies of scale and technological integration into various business processes. 2. Increasing variety of products. Great range of products also belongs to the list of IKEA competitive advantages. There are 12000 products across in IKEA portfolio and the company renews its product range launching approximately 2000 new products every year.[2] The company is also increasing its presence in food and catering industries. 3. International market expansion strategy. The home improvement and furnishing chain has traditionally engaged in new market development in an aggressive manner. IKEA has11 franchisees operating in more than 500 locations in 63 countries.[3] Furthermore, The Swedish furniture chain has long-term plans to establish its firm presence in many developing countries. 4. Benefiting from strategic alliances. The global furniture retailer benefits from strategic alliances to a maximum extent. The formation of strategic alliances is placed at the core of IKEA business strategy. The list of the most successful collaborations include partnership with Apple to explore the possibilities of Augmented Realityas a tool for home-furnishing, partnership with LEGO for new product development and partnership with Adidas in knowledge sharing about customer behaviour. Experience and competency…

McDonald’s ecosystem, also referred to as McEcosystem comprises 40,031 restaurants in in 119 countries.[1] As of December 2021 in total 37,295 stores, or 93%, were franchised. The company provides a global brand, operating system, and financial tools to help these franchisees become successful. It has been noted that “franchisees are to McDonald’s as developers are to Facebook or Salesforce”[2]. In other words, franchisees help the fast food chain to develop new products thanks to their experience of dealing with customers on a daily basis on their respective local markets. For example, the most popular items in McDonald’s menu such as Big Mac, Filet-O-Fish, or McMuffin were invented by franchisees. It can be argued that there is a great potential for McDonald’s to further develop an effective ecosystem with positive implications on the bottom line. In order for Macdonald’s ecosystem to be efficient the following points need to be taken into account: 1. Facilitating collaboration. Back in time it cost franchisee-inventors of Big Mac, Filet-O-Fish and McMuffin considerable efforts to convince then CEO Ray Kroc to add their inventions on McDonald’s menu. Once added new meals proved to be hugely successful and they are among best selling items to this day. The fast food chain has expanded multiple times since that time. Accordingly, the potential for additions on the menu invented by franchisees has expanded as well. It is critically important to establish and maintain collaboration with all stakeholders in general and franchisees in particular in order to realize this potential in practice. 2. Promoting knowledge sharing. In order to achieve franchisee contribution to strengthen its ecosystem, McDonald’s needs to ensure knowledge sharing among franchisees efficiently. Such initiatives may include organizing online and offline forums aimed at new product development and rewarding franchisees who contribute to knowledge sharing the most. 3. Effectively using the…