Posts by John Dudovskiy

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Walmart SWOT analysis: Strengths 1. Efficient utilization of online sales channels 2. Huge financial resources 3. Leadership position in the US 4. Sophisticated supply chain operations 5. High brand value Weaknesses 1. Low profit margin 2. Brand image damaged by a series of scandals 3. Lack of flexibility due to its large size 4. Business model easy to replicate Opportunities 1. Further international market expansion 2. Formation of strategic alliances 3. Vitalizing CSR programs and initiatives 4. Exploring diversification opportunities Threats 1. Failure to sustain cost advantage 2. Eruption of quality-related or ethics-related scandals 3. Negative impact to revenues from currency fluctuations 4. Risk of a new global economic crisis Walmart SWOT Analysis Strengths 1. Walmart has an impressive online presence. There are 11 countries with a dedicated Walmart e-commerce websites and the total e-commerce sales increased by 22 per cent in 2015, and about 75 percent of walmart.com sales come from non-store inventory[1]. Moreover, in Brazil, Walmart’s online assortment, including from marketplace partners grew 10 times and in China, Yihaodian saw traffic increase more than 60 percent in 2015[2]. Such a solid presence in online platform and an efficient utilization of online sale channel is a significant strengths that immensely contributes to Walmart’s core competitive advantage of cost leadership. 2. Walmart’s consolidated revenues during the fiscal year of 2015 equaled to USD 486 billion and free cash flow of more than USD 16 billion was generated during the same period[3]. This amount is more than the revenues of the following four companies combined—Costco, Kroger, Tesco in the United Kingdom, and Carrefour SA in France. Walmart’ AA credit rating, which is rare in retail further contributes to the financial strengths of the company. In other…

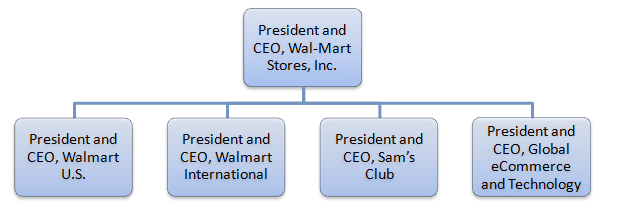

Traditionally, Walmart leadership attempts to integrate the values of its founder Sam Walton into the organizational culture in order to improve employee morale with positive implications on the bottom line. In 1988 the roles of Chairman and CEO were separated and today these roles are performed by Gregory B. Penner and Doug McMillion respectively. Doug McMillion has assumed Walmart leadership position in February 2014 and a range of initiatives introduce by the new CEO include enhancing the priority for customer services via employee training and development and increasing wages of floor-level employees and focusing on improving nutritional aspects of foods. Walmart leadership academy, instituted in 2009 aims to accelerate the preparedness of leaders and is modelled after the Royal Military Academy Sandhurst[1] Walmartorganizational structure is highly hierarchical due to the massive size of the company. In other words, the company employs about 2.2 million people globally[2] and therefore, there is no alternative organizational structure for Walmart to ensure effective management of such a large number of employees.The Board of Directors consists 16 members and it includes two members of Walton family, as well as, young, but proven business executives such as Kevin Systrom, CEO and Co-Founder, Instagram and Marissa A. MayerPresident and CEO of Yahoo!, Inc. Walmart organizational structure at the very top executive has a pattern as illustrated in Figure 1 below: One step down the hierarchy form the above, Walmart executive team comprises 29 senior managers for the following roles: Executive Vice President and Treasurer Executive Vice President, Softlines and General Merchandise, Walmart U.S. Executive Vice President, Corporate Affairs Chief Operating Officer, Global eCommerce Executive Vice President and Chief Financial Officer Chief Merchandising Officer, Walmart U.S. Executive Vice President, Global People Division Executive Vice President and Chief Financial Officer, Walmart U.S. Executive Vice President, Chief Administrative Officer Executive…

Walmart business strategy is based on ‘everyday low prices’ philosophy of the company. In other words, Walmart pursues cost leadership business strategy enabled by the economies of scale derived by the company in a significant extent. An efficient utilization of online sales channel contributes to the level of cost-efficiency of retail operations and about 75 percent of walmart.com sales come from non-store inventory[1]. Constant improvements of assortment, price and access are basis of Walmart business strategy. In simple terms, Walmart strives to offer the widest choice of products for the cheapest price, along with giving customers the opportunity of choosing the most convenient channel to facilitate the purchase. Wall Mart competitive advantage relies on cost leadership. Moreover, the strategic level management consistently aim to associate Wall Mart competitive advantage with price, access, assortment and experience. Since his appointment as CEO in February 2014, Doug McMillion introduced important changes in Walmart business strategy in the following three directions:[2] Increasing focus on customer services. In February 2015, the company announced a USD1 billion investment in U.S. hourly associates to provide higher wages, more training and increased opportunities to build a career with Walmart.[3] Improving groceries. Due to increasing level of health-consciousness of consumers, Walmart is attempting to increase its range of organic options and fresh produce. This change is more evident in the US market and it is being actively integrated into marketing communication message of the brand. Enhancing the flexibility of the shopping experience. It has been noted that “Wal-Mart is working to integrate its physical stores with the digital business”[4]. For example, thanks to the latest changes, customers are able to collect their online orders from stores and they can also get text reminders from the pharmacy. Generally, Walmart competitive advantage can be sustained in the global marketplace in long-term…

Walmart Stores Inc. is a US-based global discount supermarket chain that has more than 11,000 stores in 27 countries and serves nearly 260 million customers each week under 72 banners (Annual Report, 2015). Founded in 1962 by Sam Walton, today Walmart employs 2.2 million people globally and it is the world’s largest retailer. Walmart U.S. delivered net sales of USD 288 billion, a more than 3 percent increase in the fiscal year of 2015 and consolidated fiscal revenues equaled to USD 486 billion (Annual Report, 2015). During the fiscal year of 2015 Walmart revenues grew by more than USD9 billion to nearly USD 486 billion and earnings per share were USD 4.99, a nearly 3 percent increase from the previous year . On a constant currency basis, net sales surpassed USD 141 billion, while operating income increased to more than USD6 billion (Annual Report, 2015). ‘Everyday low prices’ is Walmart’s marketing communication message and this message serves as a guiding principle for Walmart business strategy. Specifically, Walmart strives to achieve cost leadership by the use of economies of scale to a great extent, exercising its huge bargaining power in dealing with suppliers and paying low wages to employees. Walmart Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on Walmart. Moreover, the report contains analyses of Walmart’s business strategy, leadership and organizational structure and its marketing strategy. The report also discusses the issues of corporate social responsibility. 1. Introduction 2. Business Strategy 3. Leadership and Organizational Structure 4. SWOT Analysis 4.1 Strengths 4.2 Weaknesses 4.3 Opportunities 4.4 Threats 5. PESTEL Analysis 5.1 Political Factors 5.2 Economic Factors 5.3 Social Factors 5.4 Technological Factors 5.5 Environmental Factors 5.6 Legal Factors 6. Marketing Strategy…

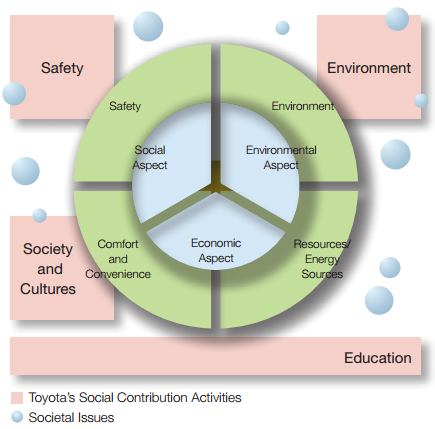

CSR programs and initiatives are launched as a part of Toyota Global Vision that was formulated in March 2011. Toyota Global Vision is represented in the form of a tree where Toyota values represent the roots of the tree, stable base of the business is the trunk of the tree. The concepts of ‘Always Better Cars’ and ‘Enriching Lives of Communities’ are positioned as fruits of the tree. In other words, Toyota Global Vision places an equal emphasis on the primary objective of profit maximization (Always Better Cars) and CSR (Enriching Lives of Communities). Overview of Toyota’s CSR activities[1] The company releases Global Responsibility Report annually and it includes the details of Toyota CSR programs and initiatives engaged by the company. Table 3 below illustrates highlights from the latest report for 2014: Categories of CSR activities Toyota Performance Labor and human rights 2.14% of all workforce are disabled people Health and safety Quality Control (QC) circles have been instituted at Toyota to increase the vitality of people and workplaces. As of March 2015, approximately 4,100 circles involving approximately 36,000 members were active in Japan, and approximately 13,000 circles involving approximately 99,000 members were active abroadToyota conducts genchi genbutsu safety inspections regularly to ensure the safety of employees and visitors to the company. Environmentb) water consumption c) recycling d) CO2 emissions Rainwater collection has been implemented by Toyota to reduce the amount of water usage in its plants Toyota engages in recycling in the following four directions: (1) utilization of eco-friendly materials; (2) making use of parts longer; (3) development of recycling technology; (4) making vehicles from the materials of end-of-life vehicles. The company aims to improve the global average fuel efficiency by 25% by FY2015, compared to FY2005 As of December 31,…

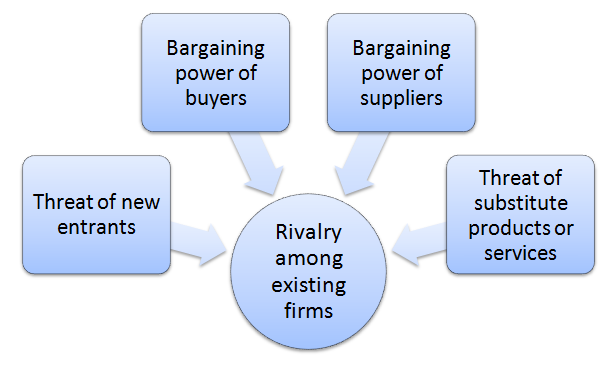

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. These forces are represented in Figure 1 below. You can learn the theory of Porter’s five forces analysis here. Figure 1 Porter’s Five Forces Threat of new entrants into automobile manufacturing industry is low. This is because of a set of industry entry barriers such as huge amount of capital requirements and access to distribution channels. Extensive economies of scale enjoyed by current automobile brands is another factor that creates a substantial barriers for new entrants. In case of Toyota in particular, due to its size and the global scope of its operations, the company immensely benefits from the economies of scale and this benefit is passed to consumers to reduce the prices of vehicles and stay competitive. Moreover, an immense role of product differentiation, expected retaliation from existing auto manufacturers and certain regulatory barriers in most markets are additional range of factors that reduce the threat of new entrances to the market. Bargaining power of suppliers in vehicle manufacturing industry is insignificant. This is because there is a great numbers of suppliers of various parts and the importance of volume for most suppliers is paramount. Supplier switching cost for an auto manufacturer varies depending on the type of supplier and the nature of the product delivered by the supplier. In case of Toyota, due to its reliance on lean manufacturing and just-in-time supply chain management, suppliers that are located closely to manufacturing units have greater bargaining power. Rivalry among existing firms is aggressive. In the global marketplace Toyota competes with General Motors, Volkswagen, Daimler, BMW Group, Honda Motor, Ford Motor Company, Nissan, Hyundai Motor, SAIC Motor and others. As it is illustrated in Figure…

PESTEL is a strategic analytical tool and the acronym stands for political, economic, social, technological, environmental and legal factors. Toyota PESTEL analysis involves the analysis of potential impact of these factors on the bottom line and long-term growth prospects. You can learn the theory of PESTEL analysis here. Political Factors The global automobile industry is subject to a range of political factors such as political stability, the impact of home lobbying groups, major geopolitical tendencies and others. Toyota Motor Corporation in particular has experienced the direct impact of political factors in many instances. A stark example of an impact of political factor on Toyota performance relates to poor relationships between Japan and China. Specifically, “anything related to Japan — and the products it peddles – is off-the-charts out of favour. This is because the two countries are in dispute over the possession of a set of small, uninhabited, privately owned islands in the East China Sea”[1]. This situation has a potentially negative impact on the volume of Toyota revenues in China. In another instance, Toyota found itself involved in a political battle in Australia in 2014. The controversy is related to ‘royal commission’ policies introduced by the Prime Minister Tony Abbot which was criticized to target big businesses such as Toyota manufacturing in Australia. The incident has resulted in an announcement by Toyota that it will cease the manufacturing in Australia in 2017.[2] Economic Factors There is a set of economic factors such as the rate of inflation, currency exchange rate, macro-economic climate in the country and in the industry, cost of labor and tax rates that have direct or indirect implications on Toyota revenues. Particularly, currency exchange rate fluctuations is a major macro-economic factor that directly affects Toyota reported revenues. For example, company’s operating income for the fiscal…

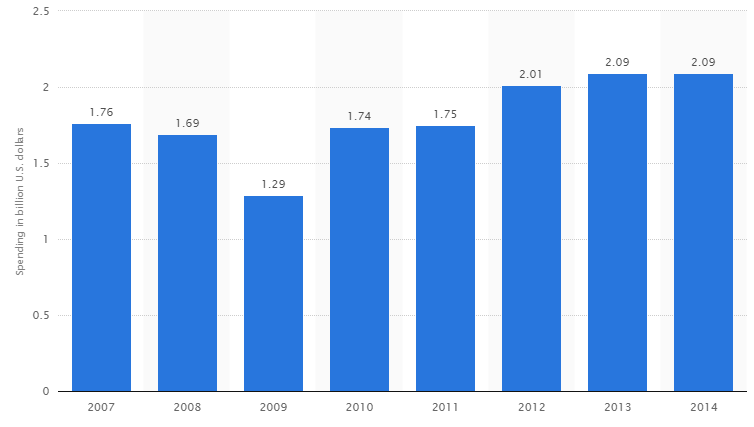

Toyota’s marketing budget has been consistently increasing after the global economic and financial crisis of 2007 – 2009 in line with overall tendency in automobile industry. Toyota marketing strategy succeeds in closely associating the brand with the best practices of Japanese ways of doing things. Specifically, Toyota marketing strategy focusses on the communication of marketing message based on the efficiency of manufacturing and use of superb vehicles. A set of marketing communication channels such as print and media advertising, sales promotion, events and experiences, public relations and direct marketing techniques are used an integrated way in order to this message to the target customer segment. Advertising Print and media advertising is one of the core elements of Toyota marketing strategy. The company uses newspapers, magazines, TV and radio ads, as well as, billboards and posters to reach its target customer segment. As it is illustrated in Figure 7 below, in the US alone the volume of advertising spending of the company reached USD 2.09 billion in 2014 and the largest proportion of this amount, USD 959 million was spent to produce and broadcast TV ads.[1] Toyota’s advertising spending in the US (in USD billions)[2] Toyota employs lifestyle-focused branding activities to promote Lexus brand. The global brand campaign slogan “Amazing in Motion” has proved to be a highly successful marketing move. As a continuation of this campaign, Toyota has partnered with rapper will.i. am to “challenge conventional notions of technology, design and music in a unique experience”[3]. The remix of the rapper’s famous hit #thatPOWER was created to feature Lexus NX highlighted by complex laser technology. Toyota viral marketing also plays an important role in increasing the level of brand awareness and promoting specific products of the company. The list of the most successful Toyota viral marketing campaigns include ‘Jungle…

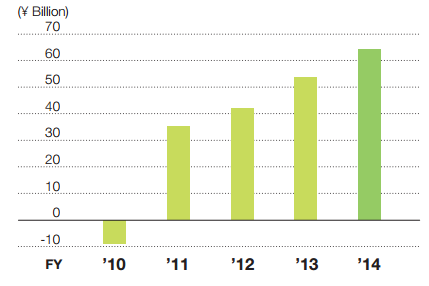

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. You can learn the theory of SWOT analysis here. The following table illustrates Toyota SWOT analysis: Strengths 1. Solid financial position 2. Toyota Production System (TPS) 3. Advanced technological features and capabilities 4. Leadership position and brand value Weaknesses 1. Extensive dependence on Japan and North American markets 2. Passenger safety issues in the past and product recalls 3. Weak presence in emerging markets 4. Lack of flexibility due to large size Opportunities 1. Investments in automated driving technology 2. Business diversification 3. Focus on developing countries 4. Further concentration on electric cars Threats 1. Passenger health and safety issues 2. Fluctuations in the prices of fuel 3. Emergence of innovative competitors 4. Increase in the prices of raw materials Toyota SWOT analysis Strengths 1. Generating revenues of ¥25.6919 trillion, which is an increase of ¥3,627.7 billion, or 16.4%, compared with the prior fiscal year,[1] Toyota possesses massive financial resources. As it is illustrated in Figure below, amid intensifying competition and increasing global economic uncertainly, the net operating income of Toyota has been consistently increasing for the last five years. The current solid financial position of the company contributes to its competitive advantage via granting opportunities to engage in research and development to a greater extent. Changes in Toyota’s net operating income[2] 2. Toyota Production System (TPS) is a widely recognized system for its efficiency in elimination of waste, irregularities, and overburdening from the production process. Based on two fundamental concepts of jidoka (automation with a human touch) and Just-in-Time principle, this system has enabled Toyota to adopt a proactive approach in dealing with manufacturing issues, at the same time saving significant manufacturing costs. Additionally, Toyota has introduced and perfected manufacturing concepts of Kaizen (continuous improvement) and…

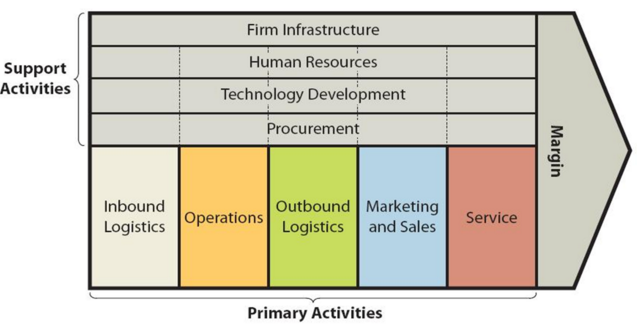

Value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the business. Figure 1 below illustrates the essence of value chain analysis. You can learn the theory of value chain analysis here. Figure 1 Value chain analysis Primary Activities Inbound logistics Inbound logistics for Toyota comprises two separate operations. The first is the operation “that transports parts from local suppliers to the local plants; the second is a separate operation, global inbound logistics, to transport parts from Japan to the North American and European plant”.[1] Localization of production is one of the core strategies pursued by Toyota and accordingly, 75.4% and 76.3% of non-domestic sales were produced outside of Japan for the calendar years of 2012 and 2013 respectively.[2] Thanks to localization of production, Toyota is able to achieve better match of local currency revenues with local currency expenses. Moreover, Toyota has developed and perfected Just-In-Time (JIT) system of manufacturing that eliminates the need for inventory and inventory management, thus saving considerable costs. To summarize, inbound logistics is a primary activity that creates an immense value for Toyota due to the localization of production and efficiency application of JIT supply chain system. Operations In 2013 Toyota automotive operations were reorganized into the following four units: The Lexus International. The business unit is assigned the role of the global head office for Lexus brand development, sales, marketing and advertising. Toyota No.1. This unit is in charge of North America, Europe, and Japan. Toyota No.2 unit caters for emerging markets of China, Asia & the Middle East, East Asia & Oceania; Africa, Latin America & the Caribbean Unit Cellar. This unit deals with unit-related technological development, manufacturing technology development and production Toyota promotes a spirit of monozukuri i.e. conscientious…